When navigating Crypto Market, the global arena where digital assets are bought, sold, and valued. Also known as digital asset market, it brings together investors, developers, and regulators in a fast‑moving ecosystem. Understanding the Blockchain, the distributed ledger that records every transaction is the first step, because every token, every trade, and every smart contract lives on a chain. From there, you quickly see that the crypto market requires a solid grasp of cryptocurrency regulation, which varies country by country and can reshape price action overnight. Finally, Token Airdrop, free distribution of new tokens to eligible wallets acts like a marketing splash that can spike demand and reshape market sentiment.

One major sub‑topic is DeFi, decentralized finance platforms that let you lend, borrow, and earn without a bank. DeFi protocols create fresh liquidity pools, which in turn affect price discovery across the market. Another crucial piece is Cryptocurrency Regulation, the set of legal rules that govern how digital assets can be issued, traded, and taxed. Recent moves in India, Australia, and the UAE show how regulation can trigger both panic selling and new opportunities, depending on how clear the guidelines are. Finally, the rise of Yield Farming, the practice of locking tokens in DeFi pools to earn rewards adds another layer: it attracts capital looking for higher returns, which pushes up token prices and creates new market cycles.

All these pieces interact in predictable ways. The crypto market encompasses DeFi projects, which require smart contracts on a blockchain, while regulators influence how easily users can access these services. Token airdrops impact market dynamics by bringing new participants into the ecosystem, often boosting demand for the underlying blockchain. Validator networks, the backbone of proof‑of‑stake chains, shape the security and speed of transactions, indirectly steering trader confidence. When you connect the dots—block time, staking rewards, and regulatory clarity—you get a clearer picture of why prices move the way they do.

Below you’ll find a hand‑picked collection of articles that dive deeper into each of these areas. Whether you’re tracking the latest Firebird Finance review on Polygon, decoding India’s crypto tax rules, or learning how to claim a Phala Network airdrop, the posts cover practical steps, risk checks, and real‑world examples. Use this resource as your quick reference guide to stay ahead of market swings, spot new opportunities, and avoid common pitfalls in the ever‑evolving crypto market.

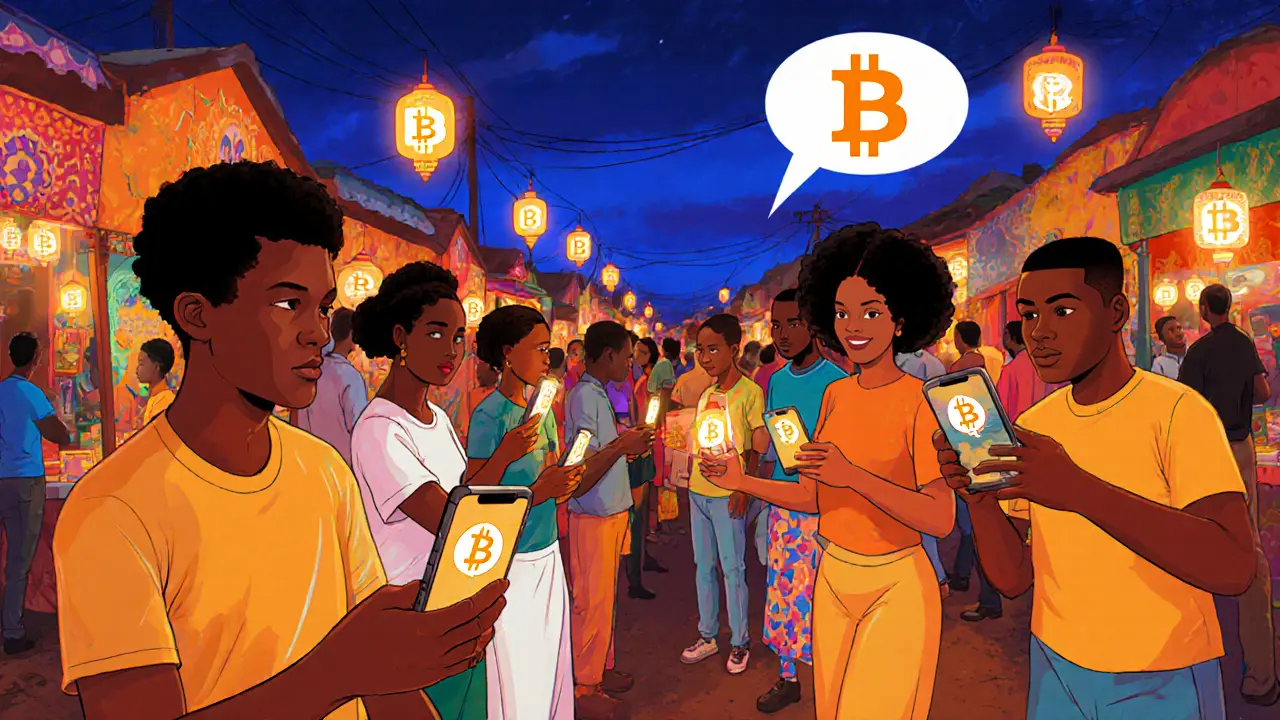

Explore why Nigeria leads global peer-to-peer crypto adoption, the economic forces behind it, key platforms, risks, and future outlook in this detailed 2025 guide.