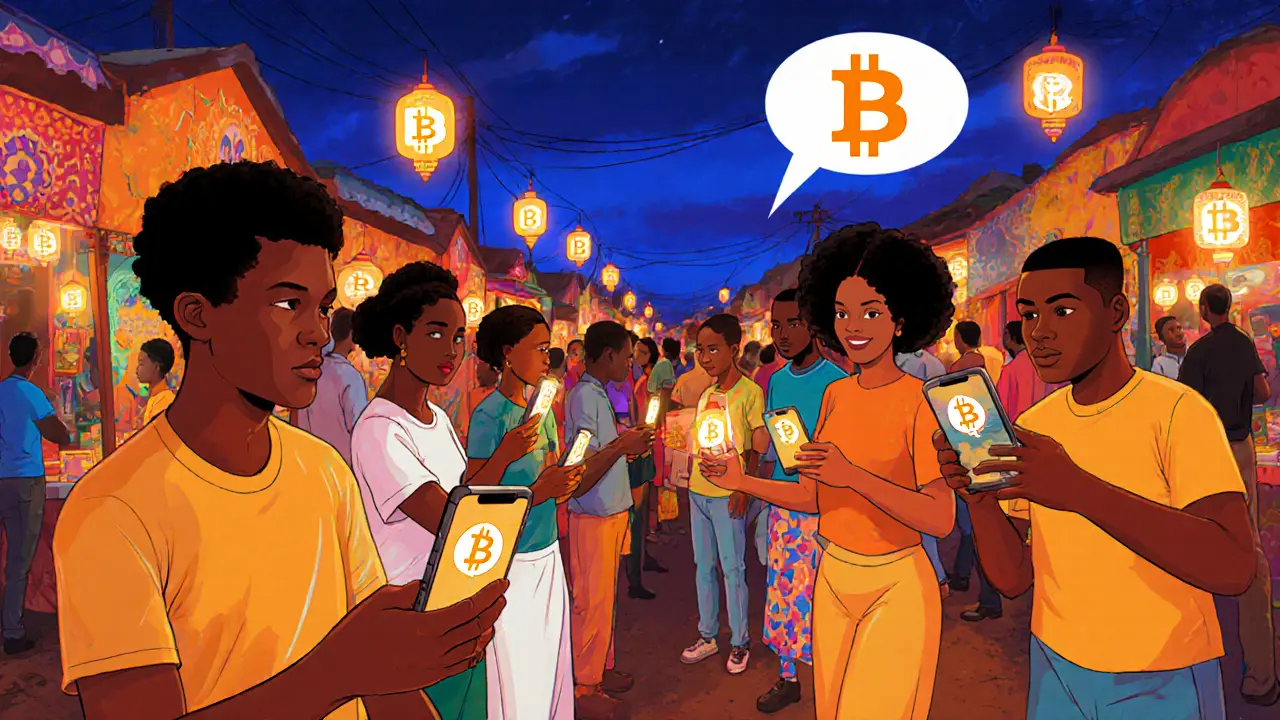

When talking about Nigeria, the West African powerhouse with a youthful, mobile‑first population. Also known as Naija, it has become a hotbed for digital finance experiments. The country’s large unbanked segment, combined with high mobile penetration, creates a perfect storm for crypto adoption. Nigeria now hosts thousands of daily traders, dozens of local startups, and a growing community that watches every regulatory hint like a pulse.

One of the biggest forces is cryptocurrency regulation, the set of rules the Central Bank of Nigeria and other agencies are drafting to govern digital assets. Clear rules can boost investor confidence, while vague guidelines often stall projects. At the same time, DeFi, decentralized finance platforms that let users lend, borrow, and earn yield without a traditional bank is exploding, offering higher returns than local savings accounts. The rise of crypto airdrops, free token distributions used to kick‑start new projects and reward early supporters adds another layer of buzz, especially for students and freelancers looking for extra income. Together these entities create a feedback loop: regulation encourages responsible projects, DeFi provides real‑world use cases, and airdrops draw fresh participants into the ecosystem.

What you’ll discover below is a curated mix of deep‑dive reviews, how‑to guides, and market analyses that reflect each of these pillars. From a detailed look at Firebird Finance on Polygon to step‑by‑step yield‑farming tutorials, the articles cover practical tools, risk considerations, and the latest policy updates affecting Nigerian users. Whether you’re a trader, developer, or regulator, the collection gives you actionable insights to navigate the fast‑moving Nigerian crypto scene. Let’s jump into the posts and see how these trends play out on the ground.

Explore why Nigeria leads global peer-to-peer crypto adoption, the economic forces behind it, key platforms, risks, and future outlook in this detailed 2025 guide.