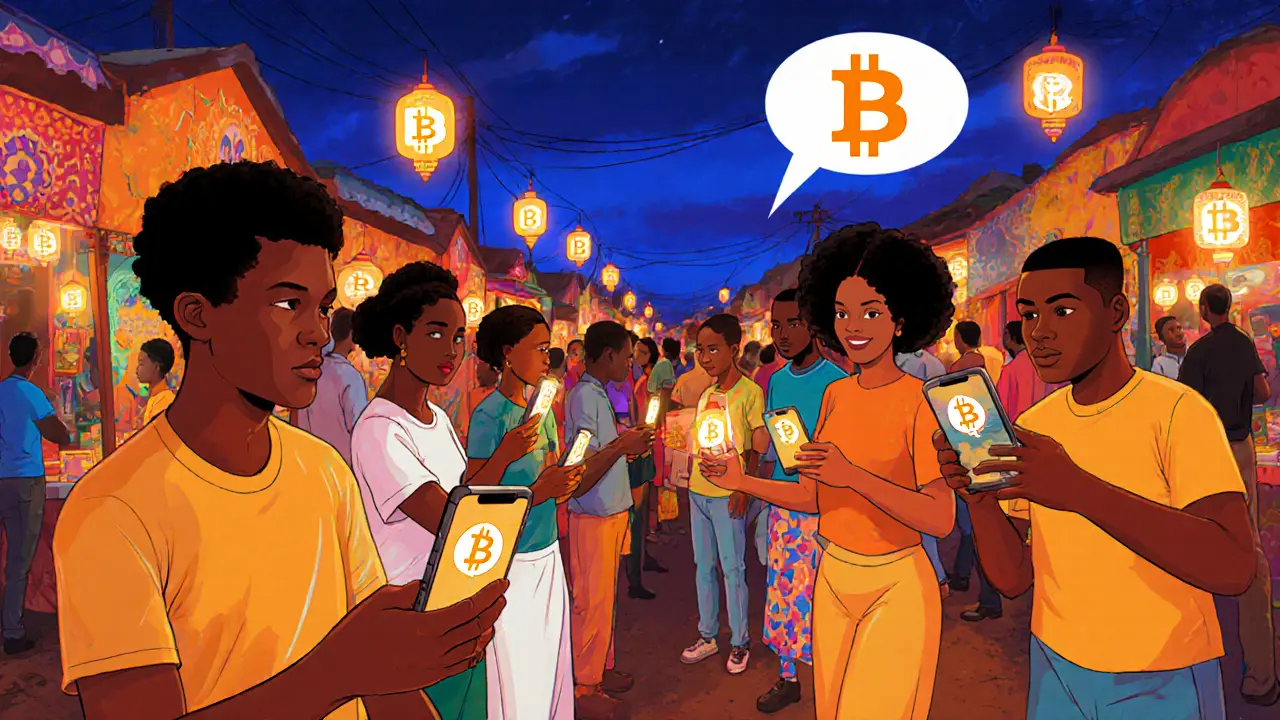

When talking about P2P crypto adoption, the growing use of direct, person‑to‑person cryptocurrency transactions worldwide. Also known as peer‑to‑peer crypto uptake, it blends technology, finance, and local culture to let anyone swap assets without a middleman.

One of the core drivers is peer-to-peer (P2P) trading, platforms where users post buy or sell offers and match directly with counterparties. These platforms cut fees, boost privacy, and often work in regions where traditional exchanges face bans. Another pillar is decentralized exchanges (DEX), on‑chain services that automate order matching through smart contracts. DEXs give P2P traders a secure, trustless environment and open the door to cross‑border swaps without local restrictions.

Regulatory frameworks act like the traffic lights of this ecosystem. Crypto regulations, laws that define how governments treat digital assets, licensing, and consumer protection, can either accelerate adoption by offering clarity or slow it down with heavy compliance burdens. Recent moves in India, Australia, and the UAE illustrate how policy shifts directly influence which P2P solutions thrive in a given market.

P2P crypto adoption encompasses peer‑to‑peer trading, DEX technology, and regulatory environments. It requires reliable identity verification tools to prevent fraud while preserving user anonymity. At the same time, interoperability protocols like cross‑chain bridges connect isolated markets, enabling assets to flow between Bitcoin, Ethereum, and emerging layer‑2 solutions.

Because P2P platforms often operate in regions with limited banking infrastructure, they lean on mobile wallets, QR‑code payments, and cash‑in/out services. This practical side shows why blockchain interoperability matters: users can move funds from a local fiat gateway into a global crypto network without needing a centralized exchange.

Adoption patterns also depend on community education. Guides that break down wallet setup, escrow mechanisms, and risk management empower newcomers to trade safely. When users understand how to protect private keys and verify counterparties, the network effect speeds up, pulling more participants into the P2P loop.

Looking ahead, the next wave will blend AI‑driven price alerts, automated escrow smart contracts, and regulatory sandboxes that let innovators test new P2P models under supervision. These trends promise tighter security, lower costs, and wider reach, especially in emerging economies where traditional finance is still catching up.

Below you’ll find a curated set of articles that dive deeper into each of these themes – from real‑world DEX reviews and regulation deep dives to hands‑on how‑to guides for P2P traders. Browse the list to see how the pieces fit together and grab actionable tips you can apply right now.

Explore why Nigeria leads global peer-to-peer crypto adoption, the economic forces behind it, key platforms, risks, and future outlook in this detailed 2025 guide.