When you hear Peer-to-Peer Trading, the direct exchange of crypto assets between individuals without a centralized intermediary. Also known as P2P Trading, it relies on trust‑less mechanisms that let anyone swap tokens from a wallet to another.

One of the core ways this happens today is through a Decentralized Exchange (DEX), a platform that enables peer-to-peer swaps of tokens using smart contracts. A DEX removes the need for a middleman, so you keep control of your private keys and avoid deposit limits. Behind every trade on a DEX sits a Smart Contract, self‑executing code that enforces trade terms on the blockchain. These contracts automatically match buyers and sellers, calculate rates, and settle the transaction in a single step. Because the logic is transparent, anyone can audit the code before trusting it with funds. That transparency is why many traders prefer peer-to-peer routes over centralized order books when they want full custody and lower counter‑party risk.

Even with DEXes and smart contracts, the cost of moving assets can bite into your profits. That's where Transaction Fee Estimation Tools, software services that predict how much gas or network fee a trade will require become essential. Accurate estimates let you time swaps for cheaper blocks, avoid failed transactions, and set realistic slippage limits. Many tools scrape real‑time network data, apply machine‑learning models, and even factor in upcoming protocol upgrades to give you the most reliable numbers.

Security doesn’t end at the contract level either. Validator Networks, the groups of nodes that secure a blockchain by confirming blocks and enforcing consensus provide the backbone that keeps peer-to-peer trades honest. A robust validator set reduces the chance of double‑spending attacks and ensures that trade confirmations are final. When you choose a blockchain with strong validator participation, you’re essentially adding a layer of insurance to every swap you execute. Together, fee tools and validator health shape the overall experience of peer-to-peer trading, making it faster, cheaper, and safer.

Now that you understand the building blocks—DEX platforms, smart contract automation, fee‑prediction services, and validator security—you’re ready to explore the wide range of articles below. Whether you’re looking for step‑by‑step guides, deep‑dive reviews, or the latest regulatory updates, this collection gives you practical insight to sharpen your peer-to-peer trading game.

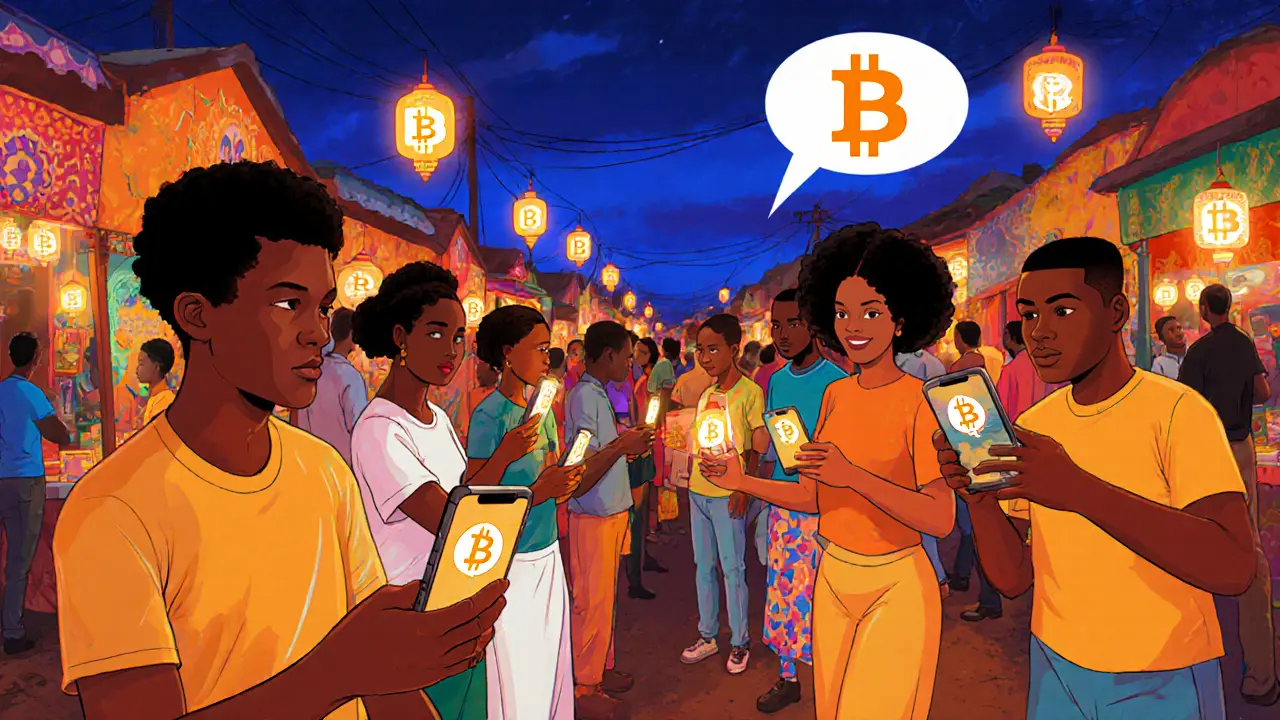

Explore why Nigeria leads global peer-to-peer crypto adoption, the economic forces behind it, key platforms, risks, and future outlook in this detailed 2025 guide.