When you hear DePIN, a model that blends real‑world assets with blockchain technology to create shared, token‑driven infrastructure, also known as Decentralized Physical Infrastructure Networks, you’re looking at a new layer of the crypto economy. DePIN lets anyone own a slice of something physical—like a wireless hotspot, a solar panel, or a storage unit—and earn tokens when the asset is used. This approach flips the traditional “build‑and‑sell” model into a community‑run network where usage translates directly into crypto rewards.

At the heart of any DePIN project lies smart contracts, self‑executing code that enforces rules, distributes earnings, and manages ownership on the blockchain. Smart contracts act as the digital backbone, ensuring that when your hotspot serves data, the agreed‑upon token payout happens automatically. Pair that with tokenomics, the economic design that defines how tokens are minted, allocated, and burned, and you get a transparent incentive system that keeps participants honest and motivated. Without solid tokenomics, a DePIN can suffer from oversupply or wrong incentives, which is why most successful projects publish detailed token‑distribution charts and inflation schedules.

Another piece of the puzzle is blockchain interoperability, the ability for different chains to talk to each other and share data or assets. DePIN assets often live on one chain but need to be accessed by users on another, so protocols like IBC, LayerZero, or CCIP become essential. Interoperability lets a DePIN‑powered storage node on Polygon be paid in a BSC‑based token, expanding the user base and liquidity options. In practice, this means developers must choose cross‑chain bridges that balance security, speed, and cost.

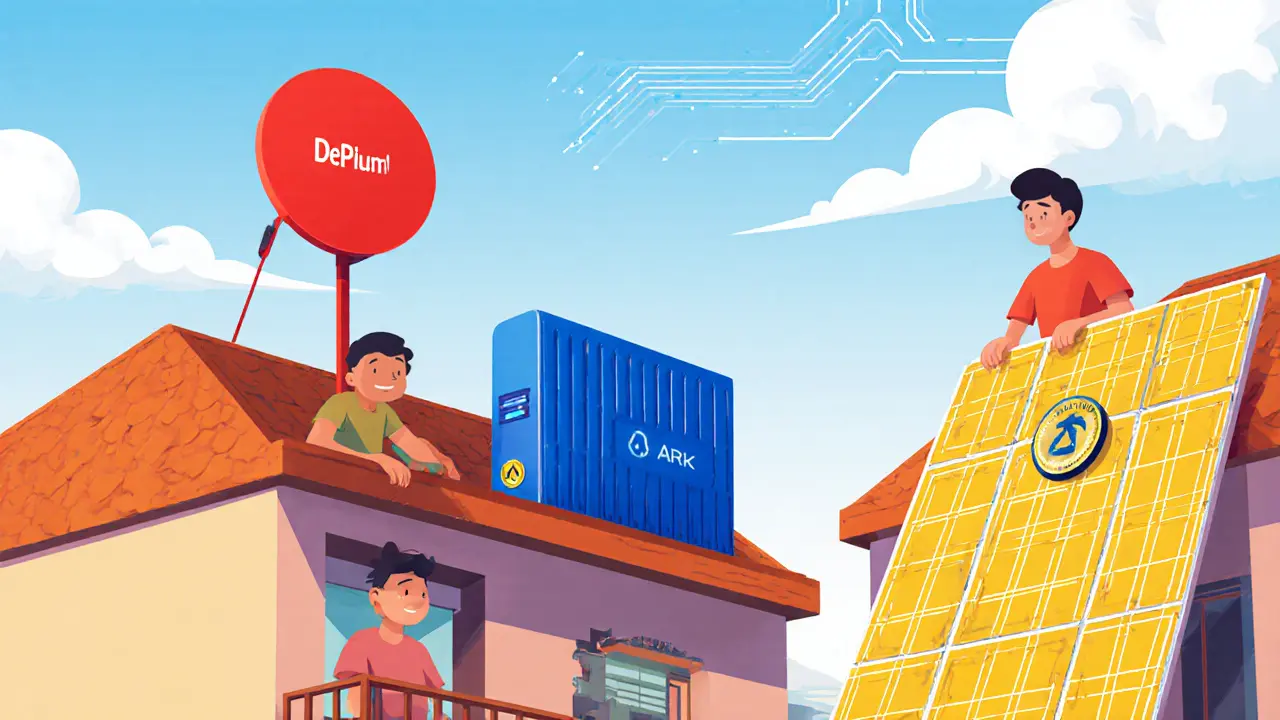

Today you can see DePIN in action across several sectors. Wireless providers are deploying community‑owned 5G nodes that reward owners with tokens each time a device connects. Energy projects tokenize solar panel output, letting investors earn a share of the generated kilowatt‑hours. Even logistics firms are tokenizing cargo containers, turning idle space into a tradable asset. These examples illustrate the semantic triple “DePIN enables tokenized physical assets”, “Tokenized assets drive new revenue streams”, and “Revenue streams fuel network growth”. As more industries recognize the upside, we’re seeing a surge in pilot programs and venture funding aimed at scaling these networks.

Of course, building a DePIN isn’t without hurdles. Developers must contend with regulatory gray zones, especially when the physical asset touches telecom or energy law. Security is another concern—if a sensor is compromised, the smart contract could still reward malicious actors unless proper safeguards are coded. That’s where thorough audits and community governance models come into play, providing layers of oversight before tokens flow. When these pieces line up—clear tokenomics, robust smart contracts, and seamless interoperability—DePIN can deliver genuinely decentralized services that rival traditional monopolies.

Community governance rounds out the DePIN stack. Token holders typically vote on network upgrades, fee structures, and expansion plans through on‑chain proposals. This democratic layer ensures that the network evolves in line with participant interests rather than a single corporate agenda. For example, a DePIN‑run mesh Wi‑Fi network might allocate a portion of its token treasury to subsidize new node deployments in underserved regions, directly reflecting the community’s desire for broader coverage. Such participatory budgeting creates a feedback loop where improved service drives token demand, which in turn funds further improvements.

Looking ahead, the convergence of DePIN with emerging trends like Web3, the Internet of Things (IoT), and edge computing promises even richer ecosystems. Imagine a city where streetlights, parking meters, and air‑quality sensors all report data to a shared blockchain, rewarding owners for contributing reliable information. As hardware costs drop and low‑power chips become ubiquitous, the barrier to entry for hosting physical nodes shrinks, opening the door for millions of micro‑operators. In that scenario, DePIN becomes the glue that binds physical infrastructure to decentralized finance, creating a truly tokenized world.

Below you’ll find a curated set of articles that dive deeper into each of these building blocks: reviews of DeFi‑friendly DEXes that power token swaps for DePIN, step‑by‑step guides on token vesting, and analyses of regulatory frameworks that affect physical‑infrastructure projects. Whether you’re hunting a new yield farm, scouting a token‑backed real‑world asset, or just curious about how blockchain can power everyday services, the collection offers practical insights to help you navigate the DePIN landscape.

Explore how decentralized physical infrastructure (DePIN) works, its leading projects, benefits, challenges, and future outlook for participants and regulators.