DePIN Project Comparison Tool

Helium

HNTDecentralized telecom network

1.2M nodes

Filecoin

FILDecentralized storage network

450K nodes

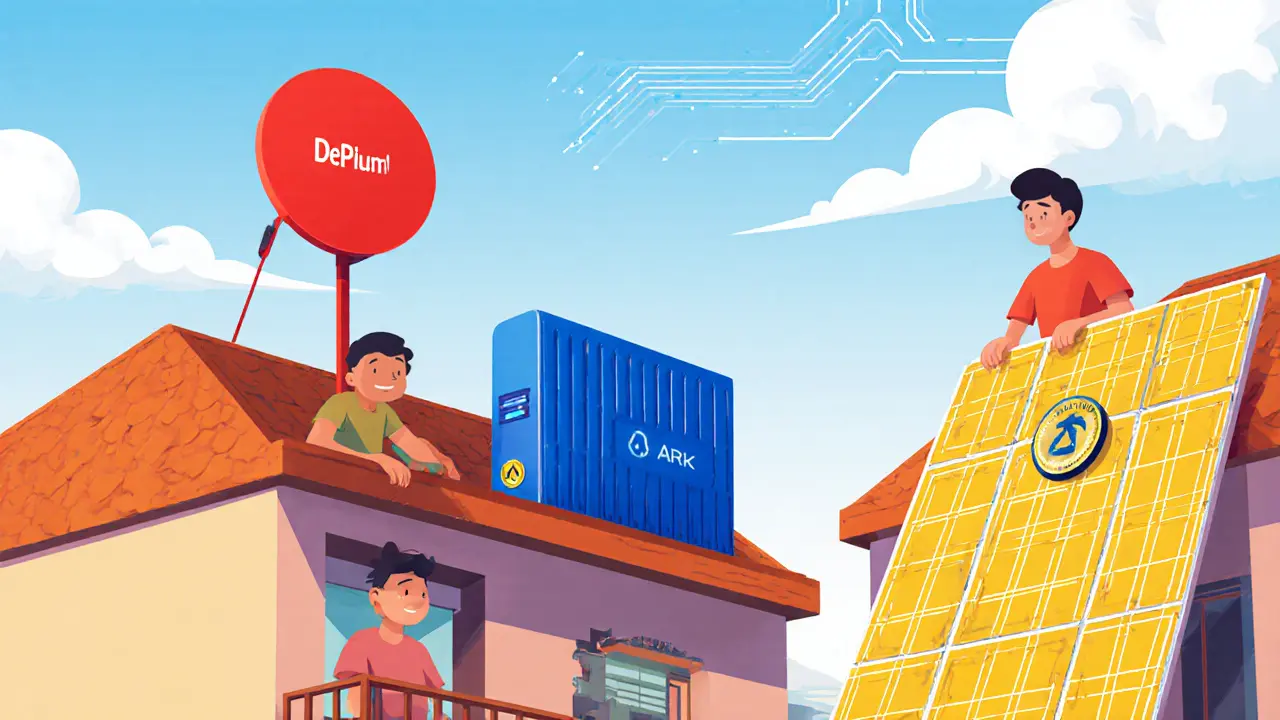

Arkreen

ARKRenewable energy sharing

80K nodes

Key Features Comparison

- Primary Service Telecom

- Hardware Type Hotspots

- Token Incentive HNT

- Network Scale 1.2M Nodes

Storage Network Details

- Primary Service Storage

- Hardware Type Drives

- Token Incentive FIL

- Network Scale 450K Nodes

Energy Sharing Overview

- Primary Service Energy

- Hardware Type Solar Panels

- Token Incentive ARK

- Network Scale 80K Nodes

How DePIN Works

DePIN networks combine blockchain technology with real-world hardware to create decentralized services. Participants contribute physical assets (antennas, storage drives, solar panels) and earn tokens for their contribution.

Smart contracts automatically distribute rewards based on network participation and service quality.

Imagine a world where anyone can own a slice of the network that powers your phone, stores your files, or even feeds the grid. That vision is what decentralized physical infrastructure promises, and it’s moving from niche experiments to mainstream reality. Below we break down how these networks work, why they matter, and what the next few years could look like for participants, investors, and regulators.

What DePIN Really Is

Decentralized Physical Infrastructure Networks is a blockchain‑enabled system where real‑world assets-like antennas, solar panels, or storage drives-are owned and operated by a distributed community. Participants earn tokens for providing those assets, and smart contracts enforce payment and governance.

This model flips the traditional playbook. Instead of a single company pouring billions into towers or data centers, thousands of individuals host modest hardware in homes, cars, or small businesses. The combined footprint creates a service that can rival, and sometimes beat, the coverage and cost of legacy networks.

Core Building Blocks

- Blockchain provides an immutable ledger for tracking who contributed what and when.

- Token incentives align economic rewards with network health.

- Smart contracts automate payouts, governance votes, and quality checks.

- Physical hardware-antennas, routers, solar inverters, storage drives-acts as the tangible layer.

- Community tools (Discord, Telegram, forums) enable peer support and collective troubleshooting.

Leading Projects and What Sets Them Apart

| Project | Primary Service | Token | Typical Hardware | Nodes Deployed (2025) | Main Use Case |

|---|---|---|---|---|---|

| Helium | Decentralized telecom | HNT | Hotspot antennas, LoRaWAN gateways | 1.2 million | IoT connectivity for sensors, low‑bandwidth devices |

| Filecoin | Decentralized storage | FIL | Hard‑drive arrays, NAS units | 450,000 | Secure, low‑cost archival storage for developers and enterprises |

| Arkreen | Renewable energy sharing | ARK | Solar panels, smart meters | 80,000 | Peer‑to‑peer energy trading and grid balancing |

These three illustrate the breadth of DePIN: telecommunications, storage, and green energy. Each uses the same blockchain foundation but tailors hardware and token economics to its niche.

Why Decentralized Networks Beat Traditional Models

Cost reduction is the headline. Building a cell tower can cost $250,000 or more; a Helium hotspot costs under $200. When hundreds of thousands of participants deploy cheap hotspots, the aggregate coverage rivals that of a few big operators, yet the capital burden is split among many.

Accessibility follows. Anyone with a modest internet connection and a bit of technical curiosity can join. That democratizes ownership and spreads economic upside. In contrast, legacy utilities often require regulated licenses, massive upfront CAPEX, and a monopoly to lock in customers.

Transparency is baked in. All token flows and hardware registrations sit on a public ledger, so participants can audit earnings, verify network health, and vote on upgrades. Traditional firms keep financials hidden and decisions behind closed doors.

Challenges on the Road Ahead

Despite the upside, DePIN faces real hurdles.

- Coordination complexity: With thousands of independent operators, ensuring consistent coverage and service quality demands sophisticated incentive designs.

- Regulatory gray zones: Governments are still figuring out how to treat token rewards for tangible services. Some jurisdictions may tax rewards as income, while others might issue licensing requirements for telecom‑grade equipment.

- Technical learning curve: Setting up a hotspot, configuring a storage node, or wiring a solar inverter isn’t plug‑and‑play for most people. Community support varies, and early adopters often spend weeks mastering the stack.

- Token volatility: Earnings are paid in cryptographic tokens whose market price can swing wildly. A node that once generated $10 a month in HNT might drop to $2 if the token dips.

Projects that invest in better documentation, on‑boarding tools, and stable‑coin reward layers are likely to survive the next wave.

Economic Incentives: How Tokens Keep the Network Healthy

At the heart of every DePIN is a reward curve. Nodes that provide higher uptime, better coverage, or more storage capacity earn more tokens. This model mirrors traditional utility pricing-pay for actual service-while removing the middleman.

Two popular designs have emerged:

- Proof‑of‑Coverage (PoC): Used by Helium, nodes prove they are physically present and broadcasting by submitting cryptographic proofs to the blockchain.

- Proof‑of‑Replication (PoRep): Used by Filecoin, storage providers demonstrate they truly hold a unique copy of data.

Both mechanisms rely on auditors-either other nodes or dedicated verify bots-to challenge participants and confirm honest behavior. The token reward then compensates the verified work.

Regulatory Landscape in 2025

Policymakers worldwide are catching up. The Coinbase Institute recently published a whitepaper urging regulators to create a “Token‑Based Service Framework” that clarifies tax treatment and licensing for DePIN operators. In the EU, the Digital Services Act is being amended to recognize blockchain‑verified service provision as a distinct category, potentially easing cross‑border deployment.

Australia’s Securities and Investments Commission (ASIC) has issued guidance stating that tokens earned from providing physical infrastructure are considered “revenue” rather than securities, provided the project does not promise financial returns on token speculation. This nuance opens the door for Australian hobbyists to join projects like Helium without a separate licensing process.

Roadmap: Where DePIN Could Be by 2030

Industry analysts at a16z crypto anticipate three major trends:

- Inter‑network composability: Future protocols will let a Helium hotspot also serve as a Filecoin storage node, sharing hardware and token rewards across services.

- Layer‑2 scaling: As blockchain throughput improves, real‑time pricing and micro‑transactions for IoT data will become feasible, unlocking new business models.

- Enterprise adoption: Large logistics firms and renewable energy cooperatives are piloting private DePINs to cut costs and gain data sovereignty.

If these trends hold, a typical homeowner could earn a modest side income while contributing to national‑wide telecom, cloud, and energy grids-all coordinated by open‑source smart contracts.

Getting Started: A Quick‑Start Checklist

- Choose a network that matches your interests (e.g., Helium for IoT, Filecoin for storage).

- Buy or repurpose compatible hardware. For Helium, a hotspot kit; for Filecoin, a NAS with at least 4TB usable space.

- Create a blockchain wallet that supports the network’s token (e.g., MetaMask for HNT, Ledger for FIL).

- Follow the project’s onboarding guide to register your device on the chain.

- Monitor performance dashboards; adjust antenna placement or storage redundancy to maximize rewards.

- Stay active in community channels for firmware updates and troubleshooting tips.

Most newcomers report that the first month feels like a steep learning curve, but after the initial setup the process becomes routine.

Frequently Asked Questions

Do I need a technical degree to run a DePIN node?

No. Most projects provide step‑by‑step guides that assume basic networking knowledge. Communities are usually willing to help troubleshoot hardware issues.

What are the biggest cost factors?

Upfront hardware purchase (hotspot kit or storage drives) and electricity for running the device. Some projects also charge a small transaction fee on the blockchain.

Can I earn a reliable income?

Earnings fluctuate with token price and network demand. Many participants treat rewards as a supplemental income rather than a full‑time salary.

How does governance work?

Token holders can vote on protocol upgrades, reward adjustments, and fee structures. Voting power typically scales with the amount of token you own or stake.

What happens if my hardware fails?

Rewards pause until the device is back online. Some networks penalize prolonged downtime, so quick replacement or redundancy is advisable.

carol williams

The DePIN paradigm fundamentally reconfigures asset ownership and network economics, and any deviation from the token‑incentive model is simply suboptimal. While many tout the decentralization narrative, the real driver is the immutable ledger that guarantees transparent reward distribution.

Moreover, the hardware heterogeneity-ranging from low‑cost LoRaWAN hotspots to high‑capacity storage arrays-creates a synergistic ecosystem that scales with user participation.

In short, the future belongs to those who embrace both the blockchain and the physical layer with equal fervor.