When we talk about Token Incentives, the mechanisms that motivate participants to hold, use, or promote a cryptocurrency. Also known as crypto rewards, they bridge user interest and project success. Token incentives typically include Token Vesting, a schedule that releases tokens over time to prevent sudden supply spikes, Airdrops, free token distributions aimed at bootstrapping community adoption, Yield Farming, earning extra tokens by providing liquidity or staking assets, and broader Tokenomics, the economic design that defines supply, demand, and utility. Together, they form a web of incentives that keeps a blockchain alive.

Token vesting is more than a lock‑up period; it shapes market psychology. By gradually releasing tokens to founders, team members, or early investors, a project signals commitment to stability. This schedule reduces the risk of a "sell‑off" after a big launch, which can scar price charts. In practice, a well‑designed vesting plan aligns the interests of developers with token holders, because everyone benefits from a rising price floor. Vesting also works hand‑in‑hand with token incentives: when a user sees that the team’s supply is controlled, they’re more likely to participate in airdrops or liquidity pools, trusting that the token won’t be dumped.

Airdrops act as the entry point for many newcomers. By handing out a modest amount of tokens to a wide audience, projects spark curiosity and create a base of users ready to explore other incentives. The success of an airdrop often hinges on how it ties back to tokenomics – if the dropped token has clear utility, holders will seek ways to use or stake it, leading naturally into yield farming opportunities.

Yield farming builds on that momentum. Users lock their tokens in smart contracts, earning extra rewards that are usually paid in the same or a related token. This creates a feedback loop: the more participants farm, the higher the liquidity, the more appealing the token becomes for traders and developers alike. Yield farming therefore amplifies token incentives by turning passive holding into active earnings, reinforcing the token’s economic model.

All these pieces – vesting, airdrops, yield farming, and tokenomics – intersect to form a cohesive incentive structure. Projects that master this balance often see stronger community engagement, steadier price growth, and more resilient ecosystems. Below you’ll find a curated list of articles that break down each element, compare real‑world examples, and show how token incentives are applied across DeFi, GameFi, and beyond.

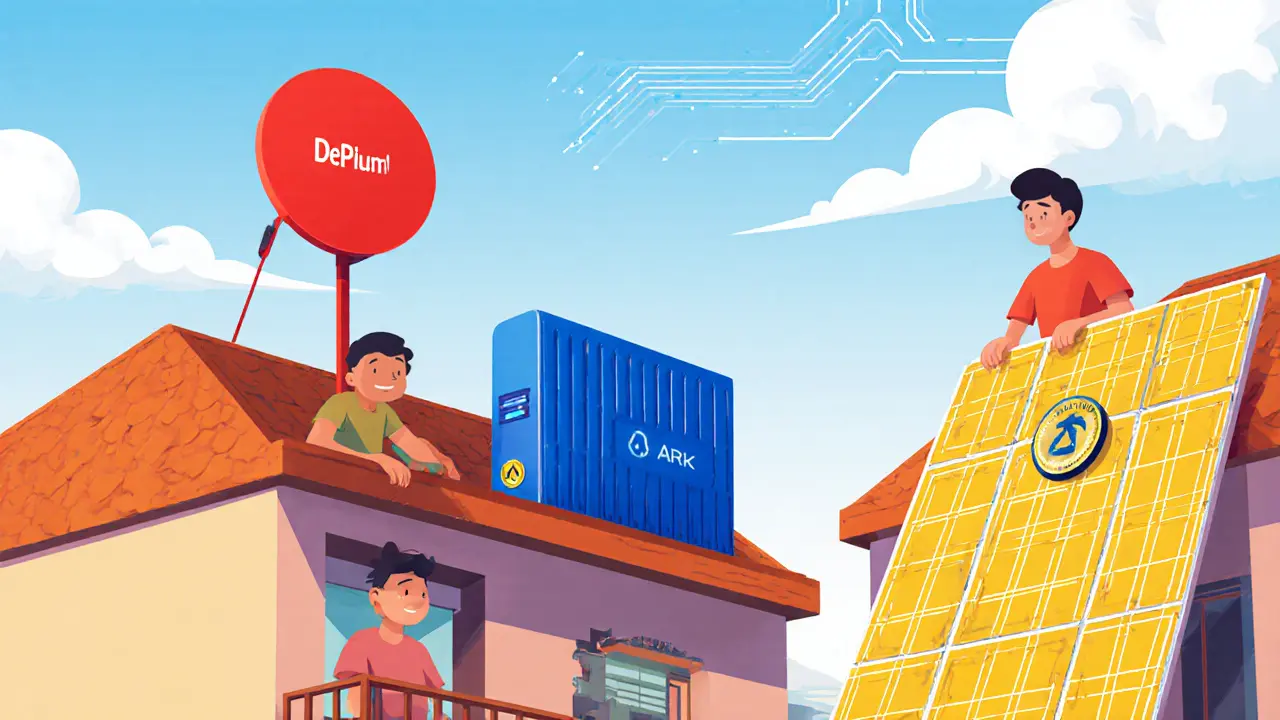

Explore how decentralized physical infrastructure (DePIN) works, its leading projects, benefits, challenges, and future outlook for participants and regulators.