ThunderSwap vs Competitors Comparison Tool

This tool compares key metrics of three leading decentralized exchanges (DEXs): ThunderSwap, PancakeSwap, and Uniswap.

Use the sliders below to adjust the relative values and see how they compare in real-time.

ThunderSwap

BSC-based DEX

PancakeSwap

BSC-based DEX

Uniswap

Ethereum-based DEX

Adjust Values for Comparison

Note: ThunderSwap's actual TVL and volume data are currently untracked by major aggregators. These values are estimates based on industry benchmarks.

If you’ve been hunting for a low‑fee swap platform on Binance Smart Chain (BSC), you’ve probably heard the name ThunderSwap is a decentralized exchange (DEX) that forks the Uniswap AMM model onto the BSC network. In this ThunderSwap review we’ll break down how it works, who it’s built for, and whether its promises hold up against the heavy‑weight rivals PancakeSwap and Uniswap.

How ThunderSwap Works - The AMM Basics

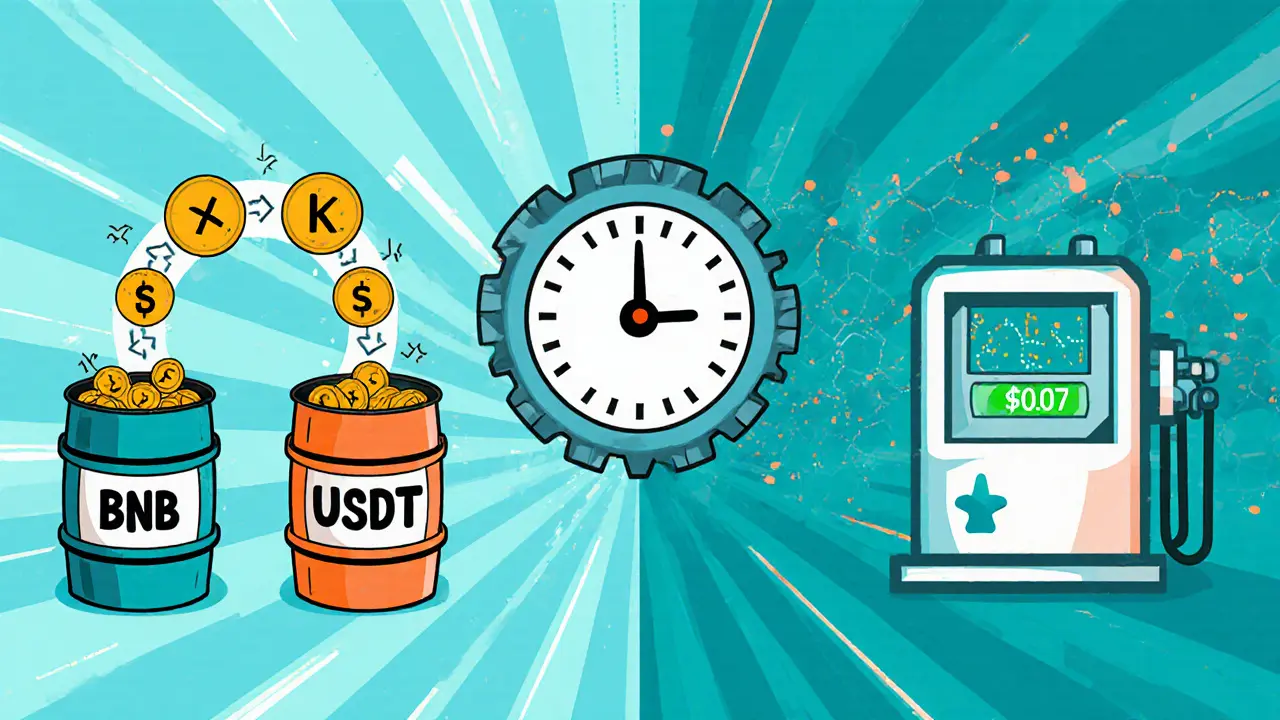

ThunderSwap follows the classic Automated Market Maker (AMM) approach, meaning it doesn’t use order books. Instead, every trading pair lives in a smart contract that balances assets via the constant‑product formula x×y=k. When you trade, you’re simply shifting the pool’s ratio, and the contract auto‑adjusts the price.

Because it runs on BSC, the underlying Binance Smart Chain is a high‑throughput, low‑cost blockchain that settles transactions in roughly three seconds and charges under $0.10 per tx as of Q32025. Those network characteristics translate into near‑instant swaps and minimal gas fees-two of the main reasons BSC‑based traders gravitate to the ecosystem.

Connecting Your Wallet - No KYC Required

Like most DEXs, ThunderSwap is non‑custodial. You’ll need a web‑compatible wallet such as MetaMask is a browser extension that lets you manage BSC, Ethereum and many other EVM‑compatible assets or Trust Wallet. The platform also supports WalletConnect, so mobile users can link directly from their phone.

There’s no KYC checkpoint, no email sign‑up, and no password to remember. You simply click “Connect Wallet,” approve the connection, and you’re ready to trade.

Fees, Speed, and Slippage

ThunderSwap charges a flat 0.30% protocol fee on every swap, the same as Uniswap’s original model. This fee is split between liquidity providers (LPs) and the platform’s treasury. Because BSC transaction fees sit below $0.10, the total cost of a $1,000 trade on ThunderSwap is typically under $5, far cheaper than Ethereum‑based swaps that can exceed $15 in gas alone.

Speed is another strong point: with average block times of three seconds, most swaps confirm in under 15 seconds. However, low liquidity can cause noticeable slippage on larger orders. Without deep pools, moving $10k+ of a thin pair may see price impact above 2%.

The Native Token - TNDR

ThunderSwap’s ecosystem is anchored by its own utility token, TNDR is the native governance and fee‑rebate token for the ThunderSwap platform. Holders can stake TNDR to earn a portion of the protocol fees and vote on future upgrades. The token’s market cap sits below $5million, and price data is sporadic because major aggregators label the exchange as “untracked.”

Because TNDR isn’t listed on most major CEXs, liquidity is primarily confined to ThunderSwap’s own pools. That setup boosts internal volume but makes external price discovery shaky.

Liquidity and Volume - The Hard Numbers

Data aggregators such as CoinMarketCap flag ThunderSwap as an “untracked listing,” meaning reliable volume metrics are unavailable. Compared with its peers:

- Uniswap (Ethereum) posted > $4billion TVL and billions in daily volume in 2025.

- PancakeSwap (BSC) held roughly $1.2billion TVL and $750million daily volume in Q32025.

- ThunderSwap’s TVL is estimated in the low‑tens of millions, and daily volume likely falls below $1million.

The lack of transparent volume data raises two red flags for traders: (1) higher slippage risk on bigger swaps, and (2) a greater chance of price manipulation in thin pools.

Security, Audits, and Regulatory Outlook

ThunderSwap’s codebase is a direct fork of Uniswap’s open‑source contracts, which have been audited many times. However, there’s no publicly announced audit specific to the ThunderSwap deployment. The platform also lacks any regulatory registration, a point highlighted by the UK FCA’s October2025 warning against unregistered DEXs.

Because the DEX is non‑custodial, users retain full control of private keys, reducing the risk of exchange hacks. Still, smart‑contract bugs remain a possible threat, especially when the code isn’t independently verified.

Pros and Cons - Quick Verdict

Pros

- Very low transaction fees thanks to BSC.

- Fast confirmation times (≈3s blocks).

- Simple, non‑custodial UI that works with MetaMask, Trust Wallet, and WalletConnect.

- TNDR staking offers fee rebates for loyal users.

Cons

- Untracked volume data signals limited liquidity.

- No public security audit specific to ThunderSwap.

- Thin pools lead to higher slippage on larger trades.

- Limited community presence and scarce user reviews.

Comparison Table - ThunderSwap vs PancakeSwap vs Uniswap

| Metric | ThunderSwap | PancakeSwap | Uniswap |

|---|---|---|---|

| Blockchain | BSC | BSC | Ethereum |

| TVL (USD) | ~$20M | ~$1.2B | ~$4B |

| Daily Volume (USD) | Untracked / <$1M | $750M | $2B+ |

| Swap Fee | 0.30% | 0.25% + 0.17% BNB | 0.30% |

| Avg. Tx Cost (USD) | ~$0.07 | ~$0.09 | ~$12.00 |

| Liquidity Pools | ~120 active | ~5,000+ active | ~15,000+ active |

Who Should Use ThunderSwap?

If you’re a small‑scale trader (<$5k per trade) looking for cheap BSC swaps and you’re comfortable accepting higher slippage risk, ThunderSwap can be a handy tool. Its TNDR staking also adds a modest incentive for frequent users.

Conversely, institutional traders, large‑volume arbitrageurs, or anyone needing audited security guarantees should gravitate toward PancakeSwap or Uniswap, where deep liquidity and transparent metrics reduce execution risk.

Future Outlook - Is ThunderSwap Here to Stay?

Without a visible roadmap, regular audit reports, or active community promotion, ThunderSwap’s long‑term viability looks shaky. The broader DEX market is consolidating around a few major players, and any platform that can’t demonstrate robust liquidity or compliance may fade into obscurity. That said, the BSC ecosystem still offers room for niche forks, so a focused community could keep the platform alive for a while.

Frequently Asked Questions

Is ThunderSwap safe to use?

ThunderSwap inherits the open‑source Uniswap AMM code, which is widely regarded as secure, but there is no dedicated audit for its BSC deployment. Because it’s non‑custodial, you keep full control of your keys, reducing exchange‑hack risk. Still, smart‑contract bugs could affect funds; use only amounts you’re comfortable risking.

How do I get TNDR tokens?

TNDR is primarily minted as liquidity rewards on ThunderSwap. You can earn it by providing assets to a TNDR‑paired pool, or you may find it on a few smaller DEXs that list the token. It’s not widely available on major centralized exchanges.

What wallet should I use?

MetaMask, Trust Wallet, and any WalletConnect‑compatible app work fine. Just make sure the network is set to Binance Smart Chain (BSC) before connecting.

Can I trade on ThunderSwap without paying KYC fees?

Yes. As a decentralized exchange, ThunderSwap does not require any identity verification. All you need is a compatible wallet.

How does ThunderSwap’s fee compare to PancakeSwap?

ThunderSwap charges a flat 0.30% fee that goes entirely to liquidity providers and the protocol treasury. PancakeSwap’s base fee is 0.25% plus a 0.17% BNB fee that is burned. In practice, the total cost on PancakeSwap is slightly lower for BNB‑based trades, but both are far cheaper than Ethereum‑based DEXes.

Hanna Regehr

ThunderSwap’s low fees are indeed attractive for traders looking to minimize costs on BSC.

However, the limited TVL means liquidity providers may face higher impermanent loss.

When assessing a DEX, one should compare not only fees but also the depth of its pools.

For users swapping small amounts, the 0.30% fee aligns with Uniswap’s original model.

For larger trades, the thin liquidity can cause slippage above 2%, eroding any fee advantage.

The native TNDR token offers staking incentives, which can partially offset fees for loyal participants.

Nevertheless, the token’s low market cap and lack of CEX listings limit its price discovery.

Security-wise, the code is a fork of Uniswap, which has been audited extensively, yet ThunderSwap lacks its own audit.

This missing audit should be a red flag for risk‑averse users.

Regulatory concerns also arise, as the UK FCA warned against unregistered DEX platforms in late 2025.

From a developer perspective, the forked contracts are well‑understood, simplifying integration for new projects.

On the other hand, the untracked volume data makes it difficult to gauge real user activity.

Community engagement appears sparse, which might affect future development and support.

In summary, ThunderSwap is suitable for low‑value, quick swaps where fee savings matter.

For high‑value trades, consider PancakeSwap or Uniswap for deeper liquidity and better price stability.

Always perform your own due diligence before committing significant capital.