Crypto Exchange Feature Checklist

Evaluate Your Crypto Exchange

Based on lessons learned from BX Thailand, check if an exchange meets minimum requirements for security, usability, and regulatory compliance.

Required Features

Your Exchange Rating

0/5Back in 2015, if you lived in Thailand and wanted to buy Bitcoin with Thai Baht, there was one name everyone trusted: BX Thailand. It wasn’t flashy. It didn’t have a mobile app. It didn’t offer futures or staking. But it worked. For over six years, it was the go-to platform for Thai crypto users who just wanted to buy, sell, and hold Bitcoin without jumping through hoops. Today, that platform is gone. The website redirects to a dead end. The servers are offline. And if you’re searching for BX Thailand now, you’re not looking for a place to trade-you’re looking for answers.

What Was BX Thailand?

BX Thailand, operating under the domain bx.in.th, was a cryptocurrency exchange founded in 2013 by Bitcoin Co. Ltd. It was one of the first platforms in Thailand to let users trade Thai Baht (THB) directly for Bitcoin and a handful of other coins. At its peak, it handled about $15 million USD in daily trading volume. Most of that volume came from BTC/THB trades-roughly 85% of all activity. It didn’t try to be Binance or Coinbase. It focused on one thing: making it easy for Thai people to turn baht into crypto and back again. The platform had a simple interface. Three main sections: recent trades, buy orders, and sell orders. No complex charts. No margin trading. Just clean order books and real-time price updates. You could view depth charts and price charts, but that was it. No indicators, no alerts, no automated strategies. It was built for people who didn’t need fancy tools-they just needed to get in and out of Bitcoin without drama.Security: One of the Strongest in Thailand at the Time

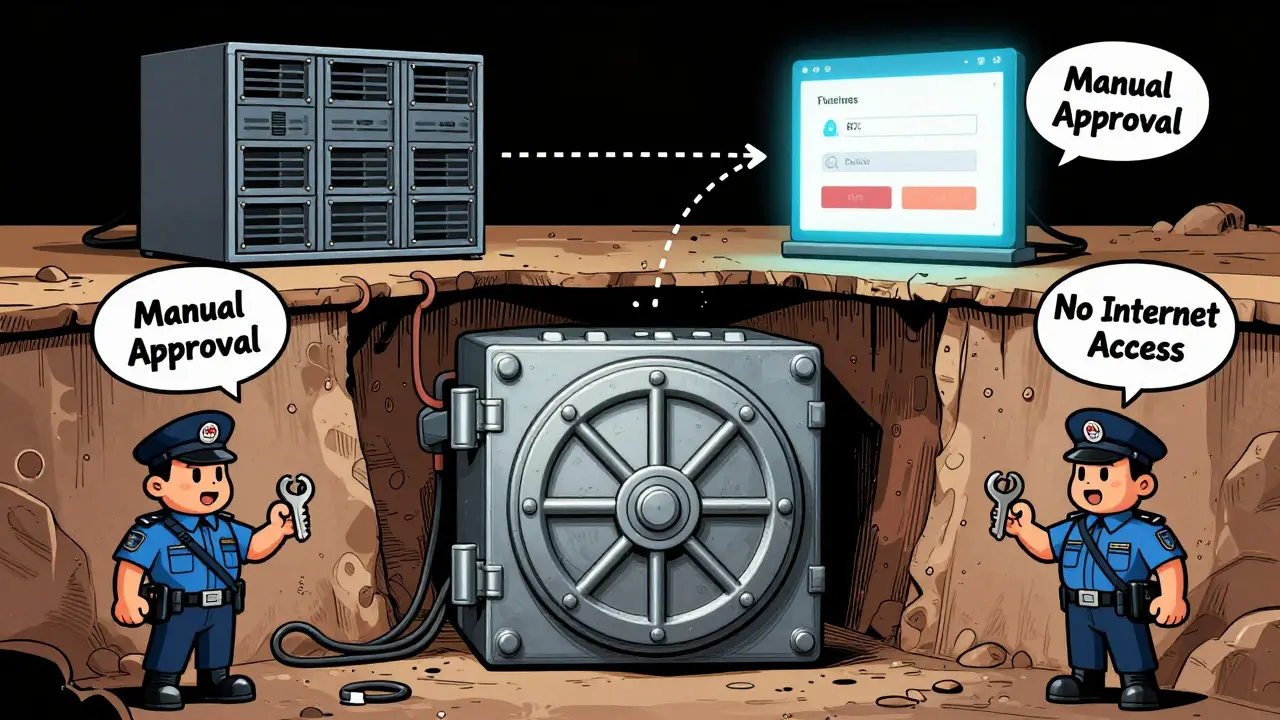

What set BX Thailand apart wasn’t its features-it was its security. In an industry full of hacks and scams, BX Thailand was unusually transparent about how it protected user funds. They kept 80-90% of all customer crypto in offline cold storage. Wallet servers were physically isolated. No internet access. Full disk encryption. Only company owners had physical access to the hardware. The website you logged into? That ran on separate servers. No connection to the wallets. Even withdrawals weren’t automatic. Every large withdrawal required manual approval by a human employee. They even claimed to have written every line of their code themselves, saying they knew their system “line by line.” They also operated as a full-reserve exchange. That meant for every Bitcoin someone deposited, they held an equal amount in their own vaults. Bitcoin Co. Ltd. publicly pledged to cover any losses from theft. In 2018, they published a security whitepaper detailing all of this. Most users believed them. Trust wasn’t just a buzzword here-it was built into the architecture.Fees: Fair, But Not Competitive Long-Term

Fees were straightforward: 0.25% for both makers and takers. No tiered discounts. No loyalty programs. Just a flat rate. That was higher than some newer Thai exchanges like BitKub, which started offering 0.15% fees in 2019. But BX Thailand didn’t compete on price. They competed on reliability. Depositing crypto? Free. Depositing Thai Baht via bank transfer? Also free. Withdrawals had small fixed fees: 0.001 BTC for Bitcoin, 0.01 ETH for Ethereum, and 0.5 XRP for Ripple. Thai Baht withdrawals cost 25 THB per transaction. These were standard for the time. Compared to international exchanges that charged extra for THB deposits, BX Thailand was actually cheaper and simpler.Why It Failed: No Mobile App, No Innovation

BX Thailand’s biggest flaw wasn’t security. It wasn’t fees. It was stagnation. While competitors like BitKub and Satang Pro rolled out mobile apps, added dozens of altcoins, introduced staking, and built modern trading dashboards, BX Thailand stayed frozen in 2016. By 2019, they only supported 12 cryptocurrencies. BitKub had over 50. BX Thailand had no mobile app at all. Users had to use a desktop browser. If you were commuting or traveling, you couldn’t check your balance or make a quick trade. Customer support was painfully slow. Reviews from 2019 show users waiting 3-5 business days just to get a reply. During market crashes, when every second counted, that delay was dangerous. One Reddit user wrote: “I tried to withdraw Bitcoin during a price dip. Took four days to get a response. Missed my chance.” The interface was also mostly in Thai. English support existed, but only about 60% of the site was translated. For non-Thai speakers, it was a barrier. Documentation was basic. Most users relied on unofficial guides posted on Thai forums to figure things out.

The Regulatory Crunch

Thailand’s government didn’t sit still. In 2018, the Securities and Exchange Commission (SEC) passed the Digital Asset Decree. All crypto exchanges had to apply for a license by 2019. BX Thailand applied. But they didn’t have the resources to rebuild their platform to meet new compliance standards. They didn’t have venture funding. They didn’t have engineers to upgrade their code. They were a small team running a platform built for a simpler time. Meanwhile, BitKub raised millions in funding. Satang Pro partnered with banks. BX Thailand? They kept doing the same thing they’d always done. And as the market exploded-from $50 million in annual Thai crypto trading in 2016 to over $2 billion by 2019-they got left behind.The Shutdown: No Warning, No Explanation

In early 2020, BX Thailand quietly shut down. No press release. No email to users. No social media announcement. The website just stopped working. The domain bx.in.th now shows a server error. All trading functions are gone. Funds were never returned publicly, and no official statement was ever issued by Bitcoin Co. Ltd. Users were left in the dark. Some reported being able to withdraw their remaining funds before the shutdown. Others couldn’t. There’s no public record of how many people lost money. No regulator stepped in to investigate. The Thai SEC didn’t label it a scam-because there was no evidence of fraud. But they didn’t protect users either.Legacy: A Pioneer That Couldn’t Keep Up

BX Thailand was never meant to be the future of crypto. It was meant to be the bridge. A safe, simple way for ordinary Thai people to enter the crypto world. And for years, it did that job well. It proved that Thai users trusted local platforms. It showed that crypto-fiat exchanges could operate securely without complex features. It laid the groundwork for today’s licensed exchanges in Thailand. But it also proved a harsh lesson: in crypto, standing still is falling behind. Security alone isn’t enough. If you don’t adapt to mobile, to new coins, to faster support, to user expectations-you become obsolete. Today, if you’re in Thailand and want to trade crypto, you have better options: BitKub, Satang Pro, Zipmex. They have apps. They have 100+ coins. They have 24/7 support. They’re regulated. They’re modern. BX Thailand? It’s a footnote now. A quiet reminder that even the most trusted platforms can vanish if they stop listening to their users.

What You Can Learn From BX Thailand

If you’re thinking about using a crypto exchange today-especially in Southeast Asia-ask yourself these questions:- Does it have a mobile app? Or are you stuck on a desktop browser?

- How many cryptocurrencies does it support? Are you locked into just Bitcoin?

- How fast is customer support? Can you get help in under 24 hours?

- Is it licensed by the local financial authority? (In Thailand, that’s the SEC.)

- Do they publish regular proof-of-reserves? Or do they just claim to be “secure”?

Where to Go Now in Thailand

If you’re in Thailand and need a reliable crypto exchange today, here are your best options:- BitKub: The market leader. 50+ coins, mobile app, Thai support, SEC licensed.

- Satang Pro: Clean interface, bank partnerships, strong security, good customer service.

- Zipmex: Offers staking and interest accounts. Good for long-term holders.

Final Thoughts

BX Thailand wasn’t a scam. It wasn’t a Ponzi scheme. It was a honest, simple exchange that served its users well-for a while. But crypto doesn’t reward loyalty. It rewards adaptation. And when the world moved faster than BX Thailand could, it didn’t survive. Its story isn’t about loss. It’s about evolution. The Thai crypto market didn’t die when BX Thailand shut down. It grew up. And if you’re trading today, you’re trading on the foundation it helped build.Is BX Thailand still operational?

No, BX Thailand ceased all operations in early 2020. The website bx.in.th no longer functions and redirects to an error page. All trading, deposits, and withdrawals have been permanently disabled. There has been no official announcement from the company explaining the shutdown.

Can I still access my funds from BX Thailand?

There is no way to recover funds from BX Thailand. The exchange shut down without a formal withdrawal process. Some users reported successfully withdrawing their assets before the platform went offline, but many others were unable to. No regulatory body has stepped in to compensate users, and there is no active customer support channel.

Was BX Thailand a scam?

No, BX Thailand was not a scam. It operated as a legitimate exchange with strong security practices, including cold storage, manual withdrawals, and full-reserve backing. The shutdown appears to have been due to financial and operational challenges-not fraud. However, the lack of transparency around its closure raises serious concerns about user protection in unregulated environments.

Why did BX Thailand shut down?

BX Thailand shut down because it couldn’t keep up with market demands. Competitors like BitKub offered mobile apps, more coins, faster support, and better user interfaces. BX Thailand’s platform was outdated, lacked investment for upgrades, and failed to adapt to Thailand’s 2018 digital asset regulations. Without funding or technical updates, it became unsustainable.

Did BX Thailand have a mobile app?

No, BX Thailand never released a mobile app. Users had to access the platform through a desktop web browser. This was a major drawback as smartphone usage surged in Thailand between 2017 and 2020. Competitors quickly filled this gap, making BX Thailand increasingly inconvenient for everyday users.

Is BX Thailand’s security still relevant today?

Yes, but only as a lesson. BX Thailand’s use of cold storage, manual withdrawals, and isolated server architecture was ahead of its time. Modern exchanges still use similar principles. However, security alone isn’t enough. Today’s users expect speed, mobile access, and responsive support. A platform can be secure and still fail if it ignores user experience.

What should I look for in a Thai crypto exchange today?

Look for these five things: 1) SEC licensing, 2) a mobile app, 3) support for at least 20+ cryptocurrencies, 4) customer service that responds within 24 hours, and 5) public proof-of-reserves. Avoid platforms that don’t clearly state their regulatory status or that rely only on vague claims like “we’re secure.”

Sammy Tam

Man, BX Thailand was the quiet hero of Thai crypto. No flashy ads, no influencer shills-just cold storage and quiet reliability. I remember using it back in 2017 when everyone else was chasing altcoins. I trusted them because they didn’t try to be something they weren’t. It’s sad when the good guys fade because they refuse to play the hype game.

Modern exchanges have apps and staking and AI alerts, but do they feel safe? I’d take BX’s simple interface over a dashboard that looks like a stock trading terminal any day.

They didn’t need to be Binance. They just needed to stay alive long enough to get acquired. Instead, they got ignored until the lights went out.