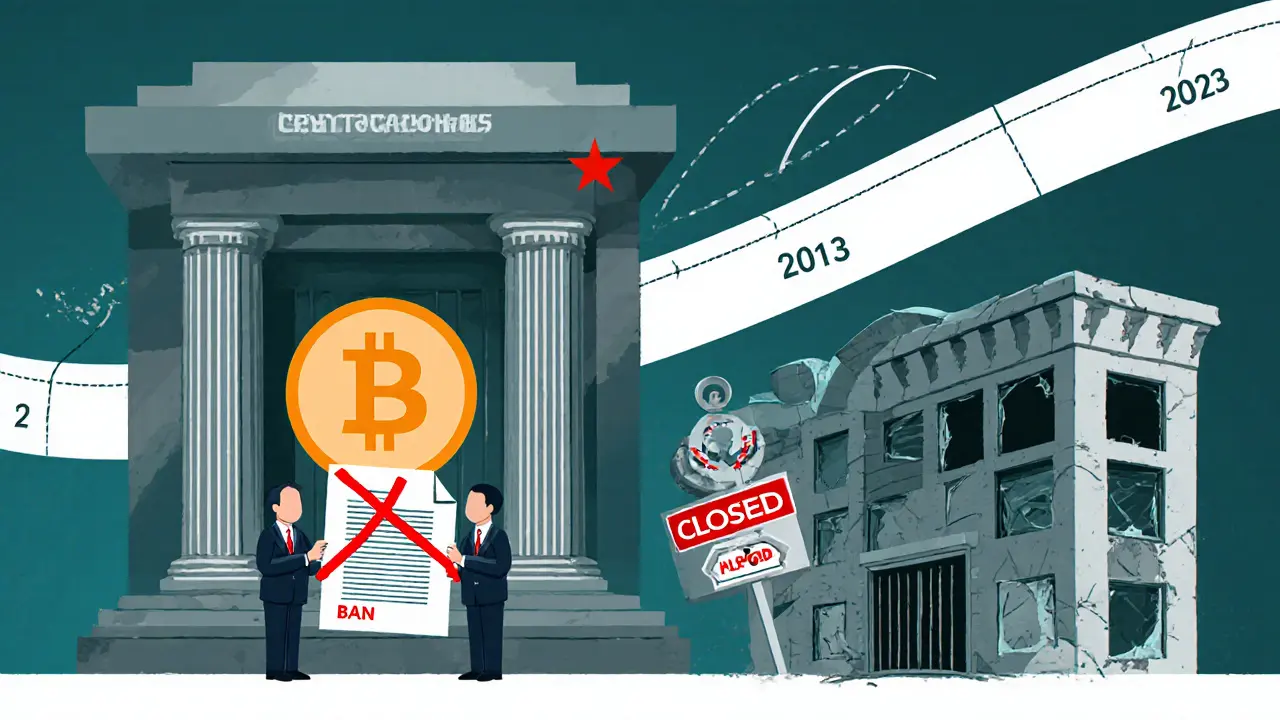

China's Crypto Ban Timeline

This interactive timeline shows the major regulatory actions taken by China against cryptocurrencies since 2009. Click on each event to learn more details.

Ban on Virtual Game Currencies

The government banned the purchase of virtual game currencies using the yuan to protect the local gaming market.

Primary Authority: State Administration of Radio, Film, and TelevisionBanking Ban on Bitcoin

The People's Bank of China declared Bitcoin a 'special virtual commodity' and ordered banks to stop handling any bitcoin-related transactions.

Primary Authority: People's Bank of China (PBoC)Exchange & ICO Ban

Domestic cryptocurrency exchanges and initial coin offerings (ICOs) were banned. ICOs were labeled an 'illegal fundraising mechanism' threatening economic stability.

Primary Authority: PBoC, Ministry of Industry & Information TechnologyFull Transaction Ban

All crypto transactions were declared illegal. Individuals can still hold assets in private wallets, but trading, payments, and fundraising are prohibited.

Primary Authority: People's Bank of China (PBoC)Mining Crackdown

Power-intensive Bitcoin mining farms were targeted due to excessive electricity consumption and carbon-reduction goals.

Primary Authority: National Energy AdministrationKey Takeaways

- China's crypto stance evolved from game currency restrictions to a complete ban on transactions

- Major crackdowns occurred in 2013, 2017, and 2021

- Mining dominance shifted overseas following the 2021 crackdown

- China promotes its digital yuan as an alternative to decentralized crypto

China's cryptocurrency ban is a series of government measures that have progressively prohibited the use, trading, and mining of decentralized digital assets within the country. The restrictions span over a decade, shaping one of the world’s toughest crypto environments.

TL;DR:

- Since 2009 China has moved from banning virtual game credits to outlawing all crypto transactions.

- Key clamp‑downs occurred in 2013 (banking ban), 2017 (exchange & ICO ban), and 2021 (total transaction ban).

- Financial firms face strict prohibitions; exchanges either shut down or relocate overseas.

- Mining was dominant until the 2021 crackdown, which pushed most hashpower abroad.

- China promotes its state‑run digital yuan while keeping decentralized crypto illegal.

From Virtual Game Tokens to a Full‑Scale Crypto Ban

China’s first encounter with digital assets came in June 2009 when the government barred the purchase of virtual game currencies using the yuan. The move was less about finance and more about protecting the local gaming market.

The real turning point arrived on December 5, 2013. The People's Bank of China (PBoC), together with the Ministry of Industry and Information Technology, declared Bitcoin a “special virtual commodity” and ordered banks to stop handling any bitcoin‑related transactions. Analysts recall how Bitcoin’s price fell more than 30% on the now‑defunct Mt.Gox exchange within hours of the announcement, just ten days after breaking the $1,000 barrier.

In September 2017, during the massive bull run that pushed Bitcoin toward $20,000, Chinese regulators escalated the crackdown. They banned domestic cryptocurrency exchanges and initial coin offerings (ICOs) in one sweeping directive. The official statement labeled ICOs an “illegal fundraising mechanism” that threatened economic stability. Within days, major platforms such as ViaBTC and BTCC were forced to shut down or move operations offshore.

The final piece fell into place on September 24, 2021. The PBoC announced that all crypto transactions were illegal, while still permitting individuals to hold assets in private wallets. This made China the strictest crypto jurisdiction globally, effectively criminalising any domestic trade, payment, or fundraising activity involving decentralized tokens.

Timeline of Major Regulatory Actions

| Year | Action | Targeted Activity | Primary Authority |

|---|---|---|---|

| 2009 | Ban on virtual game currencies | Purchasing digital game credits with yuan | State Administration of Radio, Film, and Television |

| 2013 | Banking ban on Bitcoin | Bitcoin transactions via banks | People's Bank of China (PBoC) |

| 2017 | Exchange & ICO ban | Domestic crypto exchanges, ICO fundraising | PBoC, Ministry of Industry & Information Technology |

| 2021 | Full transaction ban | All crypto trading, payments, and fundraising | PBoC |

| 2021 | Mining crackdown | Power‑intensive Bitcoin mining farms | National Energy Administration |

Who Feels the Heat? Impact on Different Stakeholders

Financial institutions have the cleanest rule‑book: they must block any crypto‑related transactions and report suspicious activity. Failure can lead to license revocation or criminal prosecution.

Crypto exchanges faced an all‑or‑nothing choice. Companies like BTCC and Huobi either shut down domestic services or re‑registered abroad, often in Singapore, Hong Kong (pre‑2021), or the United States. Relocating means securing foreign banking partners, obtaining licences in jurisdictions with clearer crypto guidance, and rebuilding user trust.

Miners enjoyed a golden era. By August 2015, four Chinese pools-F2Pool, AntPool, BTCC Pool, and BW.com-controlled roughly 50% of global Bitcoin hashrate. The 2021 energy‑policy crackdown forced them to sell equipment or move operations overseas, most notably to Texas and the Pacific Northwest of the United States.

Individual users encounter a gray area. Holding crypto in a private wallet is not illegal, yet buying, selling, or using it for payments is prohibited. Citizens typically resort to VPNs, offshore exchanges, or hardware wallets. Tax reporting adds another layer of complexity, as Chinese law still requires disclosure of foreign‑sourced income.

China vs. the Rest of the World: A Policy Contrast

While the United States operates a patchwork of permissive rules across the SEC, CFTC, and Treasury, and the European Union pushes the Markets in Crypto‑Assets (MiCA) framework, China’s stance is binary: state‑approved digital yuan or nothing.

India flips between tentative bans and tentative allowances, and Russia imposes partial restrictions. China remains the outlier with a consistent, comprehensive prohibition that spans all crypto activities.

This divergence creates a “bifurcated” global environment. Authoritative reports from Bloomberg and the Financial Times note that China’s approach is driven mainly by capital‑flow control and the desire to keep monetary policy tight, rather than by technological opposition.

Enforcement Tools and Compliance Challenges

Authorities monitor the banking system for suspicious transfers, scan internet traffic for VPN‑related crypto URLs, and employ AI‑driven social‑media analysis to flag prohibited discussions. The penalties range from heavy fines for businesses to criminal charges for repeated violations.

Compliance for crypto firms typically involves:

- Ceasing all operations that touch Chinese citizens.

- Re‑structuring the corporate entity abroad (often as a Cayman or Singapore company).

- Obtaining a licence from a jurisdiction with clear crypto regulations.

- Setting up offshore banking relationships to handle fiat conversions.

For individual traders, the practical steps include:

- Using reputable VPN services to access offshore platforms.

- Storing crypto in hardware wallets rather than exchange accounts.

- Maintaining records for potential future tax audits.

Future Outlook: Digital Yuan and Beyond

China is investing heavily in its digital yuan (e‑CNY), a central‑bank digital currency that offers the state full control over digital payments. The e‑CNY pilots in major cities show the government’s commitment to a sovereign digital cash system that co‑exists with a strict crypto ban.

Analysts at JPMorgan, Goldman Sachs, and Morgan Stanley all agree that the probability of a policy reversal is low unless there is a dramatic shift in political priorities. The digital yuan could become the dominant retail payment method, effectively sidelining decentralized alternatives.

Nevertheless, China’s influence on the global crypto market endures through three channels:

- Overseas Chinese entrepreneurs running exchanges and mining firms.

- Continued manufacturing of ASIC mining hardware in Shenzhen and surrounding regions.

- Substantial trading volume from Chinese citizens using foreign platforms.

These factors suggest that while domestic activity will stay muted, China will remain a key player in the broader crypto ecosystem.

Frequently Asked Questions

Is it illegal for a Chinese citizen to own Bitcoin?

Holding Bitcoin in a private, non‑custodial wallet is not expressly illegal, but buying, selling, or using it for payment is prohibited. The government monitors exchanges and can penalise attempts to convert crypto into yuan.

Why did China ban crypto mining in 2021?

The crackdown cited excessive electricity consumption and the need to meet carbon‑reduction targets. Authorities also feared that massive hashpower gave China undue influence over Bitcoin’s network.

Can foreign crypto exchanges serve Chinese users?

Since September 2021, providing services to Chinese residents is illegal for overseas platforms. Some exchanges attempt to bypass the rule with VPNs, but they risk being black‑listed and losing access to Chinese banking channels.

How does the digital yuan differ from Bitcoin?

The digital yuan is a centrally issued, fully traceable token that runs on a permissioned blockchain. Bitcoin is decentralized, proof‑of‑work, and pseudo‑anonymous. The state controls issuance and can freeze or reverse e‑CNY transactions, which is impossible with Bitcoin.

What should a Chinese crypto startup do to stay compliant?

The safest route is to relocate the business offshore, obtain a licence in a crypto‑friendly jurisdiction, and ensure no services are offered to mainland Chinese residents. Continuing any domestic operation risks severe penalties.

Mark Briggs

Great another timeline of the same old crackdown.