Music NFT Revenue Calculator

Streaming Revenue Calculator

NFT Revenue Calculator

Streaming Revenue Estimate

Enter stream count to see results

NFT Revenue Estimate

Enter NFT details to see results

Revenue Comparison

Streaming Revenue

NFT Revenue

Blockchain Fees

$0.00

By 2025, NFTs in the music industry are no longer just digital trading cards or hype-driven collectibles. They’ve become a real tool for artists to bypass labels, get paid faster, and build deeper connections with fans. If you’re an independent musician, a curious fan, or just someone wondering if this tech is still relevant, the answer is yes-but not in the way you might’ve heard in 2021. Today, NFTs are solving actual problems: royalty delays, unfair splits, and the disconnect between artists and listeners.

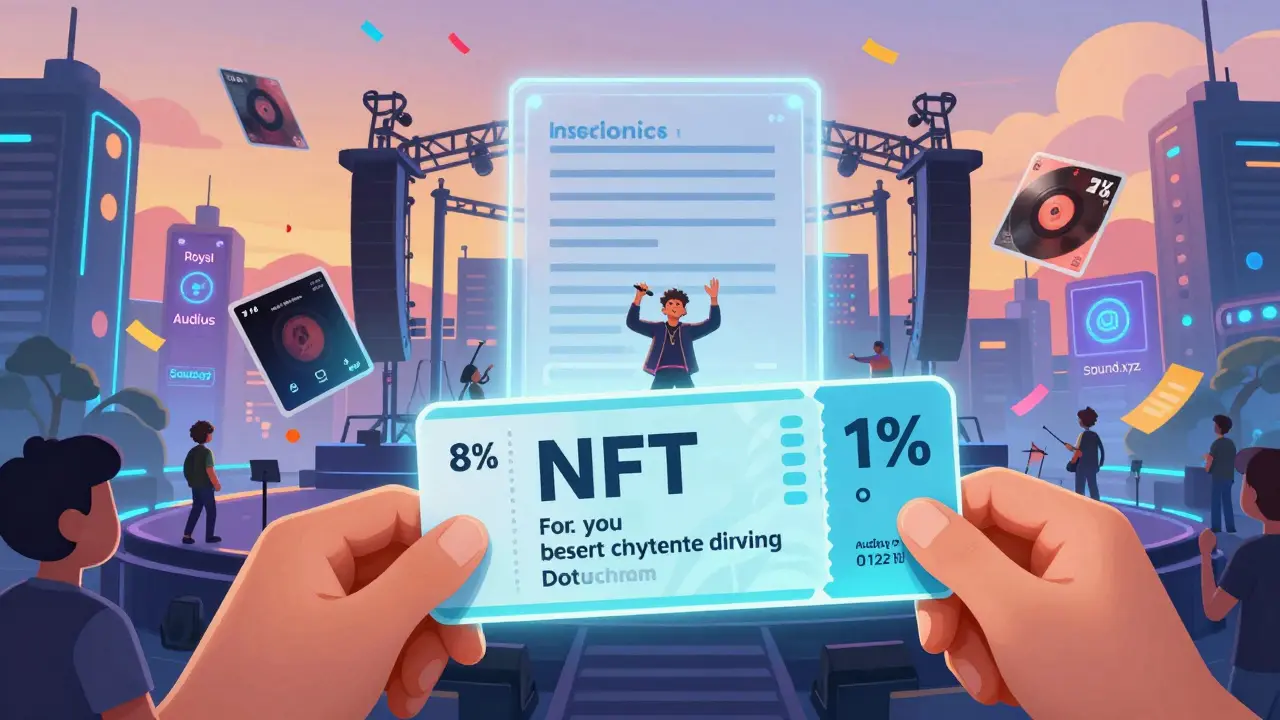

How NFTs Are Paying Artists More Than Streaming Ever Did

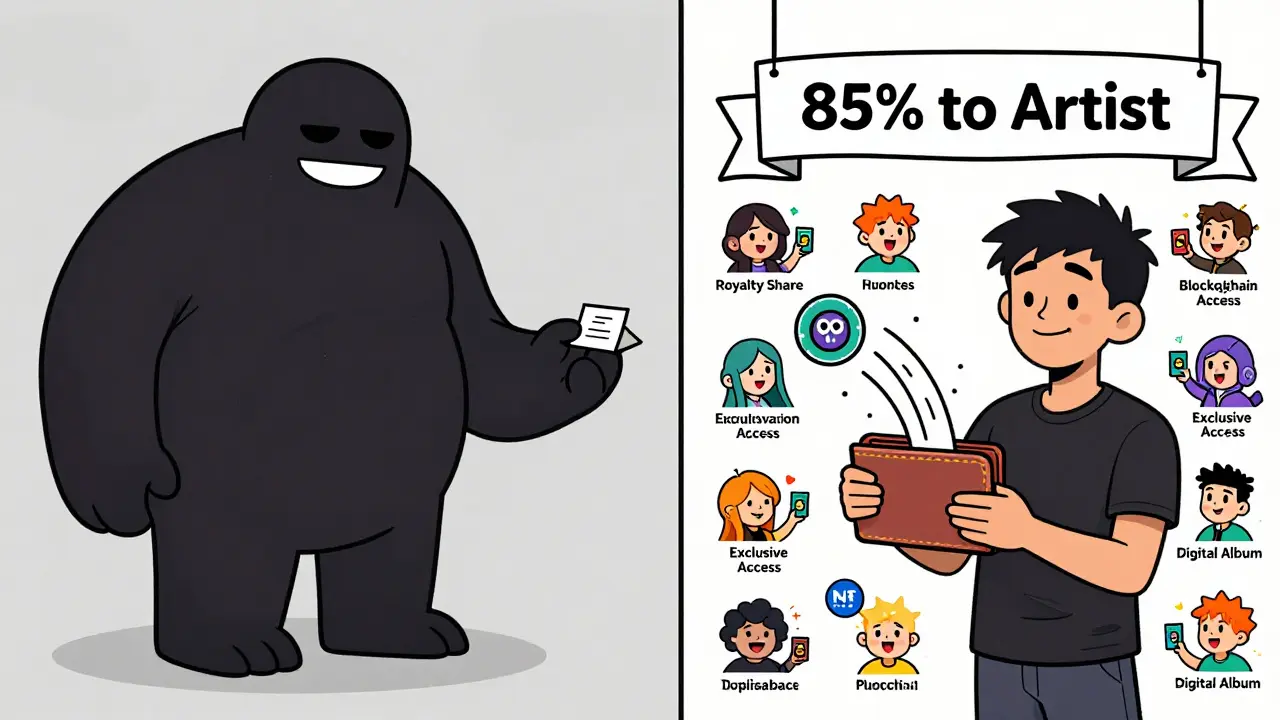

Streaming platforms like Spotify pay artists an average of 12-15% of revenue per stream. That means if a song makes $10,000 in streams, the artist gets about $1,200-after the label, distributor, and platform take their cuts. NFTs flip that model. When an artist sells an NFT tied to a song or album, they keep 70-90% of the sale. No middlemen. No 18-month royalty delays. Platforms like Royal and Opulous let artists mint NFTs that give fans partial ownership of future royalties. Each NFT might represent 0.0001% of a song’s publishing rights. When that song streams on Spotify or Apple Music, the NFT holder gets a tiny automated payment-no paperwork, no waiting.Take 3LAU, the electronic artist who sold his album Ultraviolet as NFTs in 2021. He made $11.7 million. But more importantly, he’s still earning quarterly royalties from those NFTs today. Fans who bought in are still getting paid when the music plays. That’s not speculation. That’s a functional business model.

Independent artists are leading this shift. According to a 2025 Soundcharts survey, 68% of music NFT creators are unsigned. For them, NFTs aren’t a gamble-they’re survival. One Reddit user, @IndieMusician42, sold 500 NFTs of their album for $25 each. In one week, they made $12,500. On Spotify, that same album would’ve taken two years to earn that much.

The Three Types of Music NFTs That Actually Work in 2025

Not all NFTs are created equal. By 2025, only three types have proven sustainable:- Royalty NFTs (Royal, Opulous): These give fans a share of future streaming income. Average annual returns range from 8-12%. Payments are automatic, distributed via smart contracts within 72 hours-compared to the industry standard of 6-12 months.

- Experience NFTs (Yellowheart, Moment House): These aren’t just tickets. They’re access passes to exclusive live shows, studio sessions, or backstage meetups. A 2024 Billboard study found fans who bought experience NFTs had 73% higher retention rates than those who bought regular tickets. The value isn’t in owning a file-it’s in belonging.

- Collectible NFTs (Sound.xyz, Catalog): These combine music with digital art. Each NFT is a unique package: a song, custom album art, a signed message from the artist. Average prices range from 0.5 to 2 ETH ($1,500-$6,000). Unlike speculative art NFTs, these often include ongoing perks like early access to new releases or voting rights on future projects.

These models outperform traditional revenue streams. NFTs generate 85% artist revenue, while Spotify gives only 13.3%. But they’re not for everyone. Only 15% of music fans own cryptocurrency, compared to 85% who use streaming services. That’s the biggest barrier.

Blockchain Behind the Scenes: Ethereum, Solana, and Polygon

Most music NFTs run on blockchains that handle transactions and smart contracts. Ethereum still leads with 62% of music NFT sales, but it’s expensive. Gas fees average $1.20 per transaction-too high for small sales. That’s why Solana (23%) and Polygon (15%) are growing fast. Polygon charges just $0.01 per transaction. For an artist selling 100 NFTs at $20 each, that’s $450 saved in fees alone.Smart contracts make this possible. They’re self-executing code on the blockchain. An artist can program a royalty of 7% to go to them every time the NFT is resold. That’s something no record label can do. If a fan sells their NFT for $500 later, the artist still gets $35. It’s automatic. It’s permanent. And it’s impossible in the old system.

Platforms like Audius use decentralized storage to host music files, so they can’t be taken down. With 6.5 million monthly active users in Q1 2025, it’s the largest Web3 music platform in the world. Artists upload directly. Fans stream without ads. And the platform takes no cut-revenue goes straight to the artist or their NFT holders.

Real Problems Still Holding NFTs Back

For all the promise, NFTs aren’t perfect. Three big issues remain:- User experience is still too complex. Only 28% of artists feel confident using NFT platforms, according to a 2024 Berklee study. Setting up a wallet, buying crypto, paying gas fees-it’s not intuitive. Platforms like Sound.xyz have cut the learning curve from 28 hours to 12, but most still feel like tech labs, not music stores.

- Copyright and metadata are messy. Only 35% of music NFTs correctly list all rights holders. Who owns the sample? The producer? The lyricist? If that info is wrong, royalties go to the wrong people. The U.S. Copyright Office now requires platforms to verify ownership before minting, but enforcement is still inconsistent.

- Regulation is scattered. The EU’s MiCA framework gives clearer rules, but the U.S. has no unified law. 63 pending legislative proposals are floating around as of March 2025. Artists don’t know if they’ll owe taxes as income, capital gains, or barter transactions. The IRS treats NFT sales as barter-meaning you pay tax on the fair market value at the time of sale, even if you didn’t cash out.

And then there’s trust. In 2022, rapper Lil Pump sold NFTs promising VIP concert access, merchandise, and studio time. None of it happened. A $1.2 million class-action lawsuit followed. That’s why platforms like Royal and Opulous have higher Trustpilot ratings (4.2 and 4.5) than Yellowheart (3.8). Fans trust transparency. They don’t trust empty promises.

How Fans Are Starting to Get Involved

Fans aren’t just buying music-they’re investing in careers. On Discord servers for Royal and Opulous, 15,000+ members help each other navigate wallets, track royalties, and plan NFT drops. It’s a community, not a marketplace.Some platforms are making it easier. Spotify’s 2025 partnership with Polygon lets your streaming history unlock NFT perks. If you’ve listened to an artist 50 times, you might get a free collectible or early access to their next drop. Bandcamp’s NFT integration in 2024 led to a 34% increase in artist revenue per user. People are starting to see NFTs not as crypto gimmicks, but as membership cards to something bigger.

Metaverse concerts are helping too. Fortnite hosted 120 virtual concerts in 2024, selling NFT tickets that gave fans access to exclusive in-game items. Epic Games made $47 million from those events. Fans didn’t just watch-they participated. And they kept the digital souvenirs.

What’s Next? The Road to Mainstream

By 2026, the Music Blockchain Alliance plans to launch a universal royalty standard. That means any NFT on any platform will be able to pay out correctly, no matter where the music is played. It’s the missing piece.AI is also stepping in. Sony’s 2024 ‘Dream Machine’ creates unique album art based on your listening habits. Your NFT might look different from someone else’s-even if you bought the same song. Personalization turns ownership into identity.

Enterprise is catching up. Universal Music Group launched its own NFT platform, Eiffel, in late 2024. It now handles 15% of UMG’s catalog NFT sales. If the biggest label in the world is building this, it’s not going away.

The goal isn’t to replace Spotify. It’s to give artists a better way to earn. The future of NFTs in music isn’t about flipping digital art for profit. It’s about building a fairer system: artists get paid fairly, fans get real value, and the middlemen who took 80% of the pie finally get sidelined.

It’s not magic. It’s code. And it’s working.

Are music NFTs still worth it in 2025?

Yes-but only if you’re using them for utility, not speculation. NFTs that offer royalty shares, exclusive access, or verified ownership are delivering real value. Those sold as ‘digital collectibles’ with no added benefits are mostly dead. The smartest artists now use NFTs to build fan communities and secure long-term income, not to chase quick flips.

Do I need cryptocurrency to buy music NFTs?

Yes, currently. You need a crypto wallet like MetaMask and some ETH, SOL, or MATIC to buy most music NFTs. But platforms are starting to simplify this. Some now let you pay with credit cards on Polygon, which converts the payment automatically. Still, you’ll need to understand basic wallet security-losing your private key means losing your NFTs forever.

Can I resell a music NFT and still get royalties?

It depends on how the NFT was programmed. If it’s a royalty NFT (like from Royal or Opulous), the artist usually gets a cut on every resale-often 5-10%. But the buyer doesn’t get royalties unless they’re part of the original royalty-sharing pool. Reselling just transfers ownership, not the royalty rights, unless explicitly coded otherwise.

How do I know if a music NFT is legitimate?

Check the platform’s reputation and the artist’s history. Look for verified accounts on platforms like Royal, Sound.xyz, or Audius. Read the smart contract details-if it promises royalties, check the percentage and payment frequency. Avoid NFTs with vague descriptions like ‘exclusive access’ without dates or details. And never buy from unverified sellers on OpenSea or random Discord links.

Are music NFTs environmentally friendly?

Most are now. Ethereum switched to a proof-of-stake system in 2022, cutting its energy use by 99.95%. Platforms like Solana and Polygon use even less energy. A single music NFT on Polygon uses less power than sending one email. Environmental concerns from 2021 are largely outdated-today’s music NFTs are as green as streaming.

What’s the biggest risk of buying a music NFT?

The biggest risk is buying something that doesn’t deliver on its promise. A 2024 study found 41% of music NFTs don’t properly document copyright ownership, meaning royalties might not go to the right people. Also, if the platform shuts down or the artist disappears, your NFT might become worthless. Always buy from trusted platforms with transparent contracts and active communities.

Eunice Chook

NFTs are just another way for rich artists to monetize their fanbase while pretending it’s revolutionary. 68% of creators are unsigned? That’s because the majors are waiting to buy the tech and crush it.