Crypto Access Eligibility Calculator

Your Eligibility Assessment

Determine if you qualify for regulated crypto exchange access based on Russian government requirements for 2025

How the System Works

According to Russian regulations effective in 2025:

Highly qualified investors can access regulated exchanges with:

- ≥ 100 million rubles in total assets

- OR

- ≥ 50 million rubles in annual income

These requirements mean only about 0.1% of Russian citizens qualify legally.

Results

Enter your income and assets to see eligibility results

If you're a Russian citizen trying to buy, sell, or hold cryptocurrency in 2025, you're not just fighting market volatility-you're navigating a legal maze designed to keep you out. While owning crypto isn't technically illegal, the system is built to make it nearly impossible for ordinary people to use it legally. The government doesn't want you trading Bitcoin on Binance. It doesn't want you using crypto to send money abroad or protect savings from ruble swings. And it’s made sure of that with layers of rules, bank blocks, and forced compliance that only the wealthiest can bypass.

What the Law Actually Says

Russia passed its first crypto law in 2020, Law No. 259-FZ. On paper, it said crypto was legal to own. But right away, it banned using it for payments inside Russia. That wasn’t a loophole-it was a trap. You could hold Bitcoin, but you couldn’t use it to pay for groceries, rent, or even a taxi. The message was clear: crypto is a speculative asset, not money. And by January 2021, that rule was enforced. Banks stopped processing crypto-related transactions. Exchanges were told not to onboard Russian users without heavy vetting. Then came the sanctions after February 2022. When Western countries cut Russia off from SWIFT and froze assets, the government didn’t ban crypto-it weaponized it. In mid-2023, it launched the Experimental Legal Regime (ELR). This wasn’t for you. It was for state-owned companies and sanctioned corporations that needed to trade oil, gas, or metals with countries like China, India, or Turkey. These companies could use digital assets as settlement tools, but only under strict government supervision. The rest of the population? Left behind.Who Can Actually Trade Crypto Legally?

If you want to trade crypto legally in Russia today, you have to be part of the 0.1%. The Central Bank of Russia now says only “highly qualified investors” can access regulated platforms. To qualify, you need either:- An investment portfolio worth at least 100 million rubles (about $1.1 million USD)

- Or an annual income over 50 million rubles (around $550,000 USD)

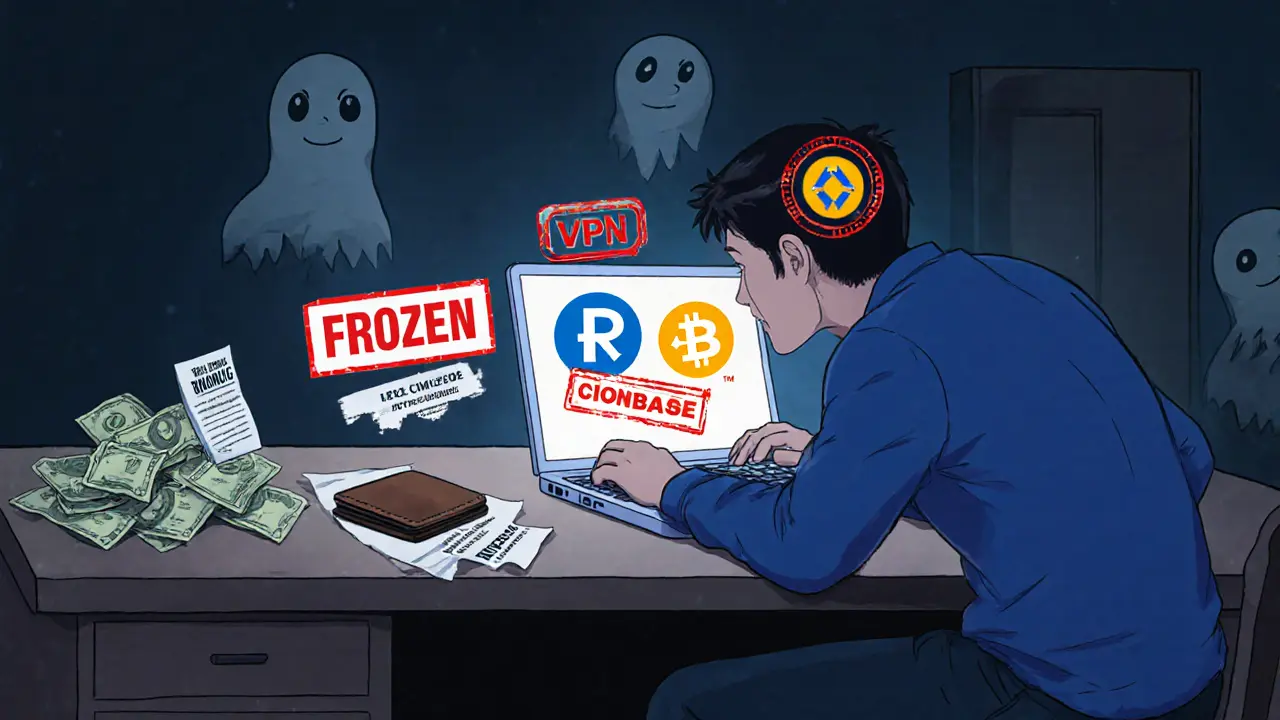

What Happens When You Try to Use Binance or Coinbase

Most Russian users turn to global exchanges like Binance or Coinbase. But those platforms aren’t ignoring the rules-they’re following them. Coinbase has frozen over 25,000 Russian accounts since 2022, citing sanctions compliance. Binance now requires Russian users to upload proof of address and government ID-even if they’re using a VPN. And if your account holds more than €10,000 in crypto, services get restricted. You can’t withdraw to a Russian bank. You can’t cash out to a Russian card. You’re stuck with crypto you can’t easily convert to cash. Trustpilot reviews from Russian users tell the story: Coinbase has a 2.1/5 rating. Binance is at 2.8/5. The top complaints? Frozen accounts, failed KYC checks, and no customer support. A September 2025 survey by Coincub found that 68% of Russian users failed identity verification on major platforms. Another 41% had accounts frozen without explanation. And 79% couldn’t cash out their crypto back into rubles through any legal channel.

The Underground Market: P2P and VPNs

With banks and exchanges shutting the door, Russians turned to peer-to-peer (P2P) trading. Platforms like LocalBitcoins and Paxful exploded in usage. From 2022 to 2025, P2P trading volume in Russia grew by 217%, according to Chainalysis. But this isn’t safe. The Central Bank explicitly warns that P2P trading can lead to account blocks. And sellers? They’re often scammers. There’s no buyer protection. No chargebacks. If you send rubles and don’t get Bitcoin, you’re out of luck. To even access these platforms, you need a VPN. Most Russian internet providers block crypto-related sites. So you install a VPN, create an offshore email, and hope your identity doesn’t get flagged. It’s a constant game of cat-and-mouse. One month, a platform works. The next, it’s down. Your account gets banned. You start over. Rinse and repeat.Why This System Exists

The Russian government’s goal isn’t to stop crypto. It’s to control it. By banning ordinary citizens from crypto, they prevent capital flight. If people could easily buy Bitcoin and move money out of Russia, the ruble would collapse faster. By creating a narrow legal path for sanctioned trade, they let big companies bypass Western financial controls-while keeping the rest of the population locked in. It’s a brutal form of financial apartheid. The elite can trade crypto legally. The rest are pushed into the shadows. And while the government claims this protects financial stability, the opposite is true. Chainalysis reports that 87% of all crypto transactions in Russia now happen outside regulated channels. That means no oversight. No tax collection. No accountability. The black market is thriving-and the state has no real way to stop it.

Is There Any Hope for Change?

In October 2025, the Central Bank announced a small shift: banks can now operate in the crypto sector. But with major caveats. They must limit crypto exposure to just 1% of their capital. They need new risk models. They can’t promote it to retail customers. This isn’t openness-it’s containment. They’re letting banks dabble, but only if it doesn’t threaten the system. Some reports suggest the Finance Ministry may lower the “qualified investor” threshold. But no concrete changes have been made. Meanwhile, the EU’s 19th Sanctions Package targets “dirty Russian crypto” schemes, making it harder for Russian entities to use crypto for sanctions evasion. That’s not helping regular users-it’s forcing the elite to get smarter, not more open. Analysts at Bernstein predict Russia’s crypto market won’t normalize until at least 2028. Until then, the only people who can use crypto legally are those who can afford a $1 million portfolio. Everyone else? They’re stuck with P2P, VPNs, and the constant fear of losing their bank accounts.What You Can Do-If You’re Determined

If you’re a Russian citizen who still wants to hold crypto, here’s what works-barely:- Use a reliable, paid VPN. Free ones get blocked fast.

- Sign up for Binance or Kraken using a non-Russian email and ID from a friend or relative abroad.

- Use P2P platforms to buy crypto with rubles-but only deal with verified sellers with high ratings.

- Keep your holdings under €10,000 to avoid triggering restrictions.

- Never link your crypto wallet to your Russian bank account. Use separate accounts.

- Store crypto in a hardware wallet. Never leave large amounts on exchanges.

The Bigger Picture

Russia’s crypto restrictions aren’t about protecting citizens. They’re about control. The government doesn’t trust its people with financial freedom. It doesn’t trust them to make their own choices. So it built a system where only the ultra-rich get access-and everyone else gets punished for trying. Meanwhile, Bitcoin and other cryptocurrencies keep moving. They don’t care about borders, sanctions, or bank licenses. They’re decentralized by design. And that’s exactly why the Russian state fears them. Not because they’re dangerous. But because they’re free. For now, if you’re a Russian citizen and you want crypto, you’re not just investing in digital assets. You’re investing in defiance.Can Russian citizens legally buy Bitcoin in 2025?

Yes, owning Bitcoin is legal in Russia, but buying it through regulated exchanges is nearly impossible for ordinary citizens. Only those with over 100 million rubles in assets can access licensed platforms. Everyone else must use offshore exchanges, P2P trading, or VPNs-all of which carry legal and financial risks.

Why do Russian banks block crypto-related transactions?

The Central Bank of Russia prohibits banks from facilitating crypto transactions to prevent capital flight and protect the ruble. Frequent small P2P trades are flagged as suspicious, and banks are required to freeze accounts that show crypto activity. This is part of a broader strategy to control money flows and limit access to global financial systems.

Can I use Binance or Coinbase if I live in Russia?

You can technically sign up, but services are heavily restricted. Binance now requires proof of address and ID, and accounts over €10,000 face service limits. Coinbase has frozen over 25,000 Russian accounts since 2022. Both platforms comply with international sanctions, so Russian users face high chances of account freezes and failed verification.

What’s the Experimental Legal Regime (ELR) in Russia?

The ELR is a government-approved system that lets sanctioned Russian companies use digital assets for international trade-like paying for oil or metals to countries outside the West. It’s not for individuals. Only vetted corporations can participate, under strict state oversight. Regular citizens have no access to this system.

Is P2P crypto trading safe in Russia?

It’s risky. While P2P trading is the most common way Russians buy crypto, the Central Bank warns it can lead to bank account blocks. There’s no buyer protection, scams are common, and sellers can disappear after you send rubles. It’s the only option for most-but it’s not secure or reliable.

Will Russia ever allow normal crypto access for citizens?

Unlikely in the near term. Analysts predict the current two-tier system will last until at least 2028. The government has no incentive to open access-it benefits from keeping capital controlled and the ruble stable. Any future changes will likely only benefit the wealthy elite, not ordinary people.

Louise Watson

Crypto isn't about legality. It's about freedom.