GM Holding (GM) Token Calculator

Current Market Overview

Current Price

$0.00001106

Market Cap

$12,090

Circulating Supply

~99.99 million

Max Supply

200 million

Investment Calculator

Results

Risk Assessment

Low Liquidity Risk: High volatility expected due to small market cap.

Transparency Risk: Limited public information on team and partnerships.

Speculative Investment: High potential returns but significant risk of loss.

GM Holding crypto has been popping up on price trackers, but many wonder what it actually does and whether it’s worth a look. Below you’ll find a plain‑English rundown of the token’s purpose, tech basics, market stats, buying steps, and where it might head.

Quick Facts

- Built on the Waves‑NG protocol via the Waves Platform

- Max supply: 200million GM; circulating supply: ~99.99million

- Current price (Oct2025): $0.00001106 USD

- Market cap: roughly $12,000 USD

- Main trade venue: PancakeSwap (BSC) using contract 0xd523…06061

What Is GM Holding (GM)?

When you first see GM Holding (GM) is a cryptocurrency token built on the Waves‑NG protocol, the description can feel vague. In simple terms, GM is a digital asset that aims to fund and accelerate technology and finance projects across Latin America, with a focus on Colombia. The team markets the token as a “greatest ally” for farmers, students, entrepreneurs, miners and other stakeholders who need blockchain‑based tools to modernise their operations.

Technical Specs & Supply Numbers

The token lives on the Waves Platform, a blockchain known for fast transactions and low fees. GM follows the Waves‑NG protocol, which supports token creation, smart contracts and asset tokenisation without heavy gas costs.

- Maximum supply: 200million GM

- Circulating supply (reported): ~99.99million GM

- Token standard: Waves‑compatible BEP‑20 style (usable on Binance Smart Chain via a bridge)

Data discrepancies exist - some explorers list the circulating supply as zero, which usually means the reporting API hasn’t picked up the token’s bridge‑minted balance yet. The discrepancy is a red flag for investors who need to verify actual liquidity.

Market Data & Recent Performance

GM is a low‑cap coin sitting around the #4,500 mark on major aggregators. As of the latest snapshot:

| Metric | Value |

|---|---|

| Price (USD) | $0.00001106 |

| 24‑hour volume | $48,800 - $54,200 |

| Fully diluted market cap | ≈ $2,500 |

| Current market cap | ≈ $12,090 |

| All‑time high | $0.1777 (2021) |

| 52‑week range | $0.0000132 - $0.000199 |

Volatility is typical for micro‑caps: 24‑hour price swings have ranged from -1.41% to +6.54% depending on the data source. The token’s holder count hovers just under 1,000, indicating a thin community.

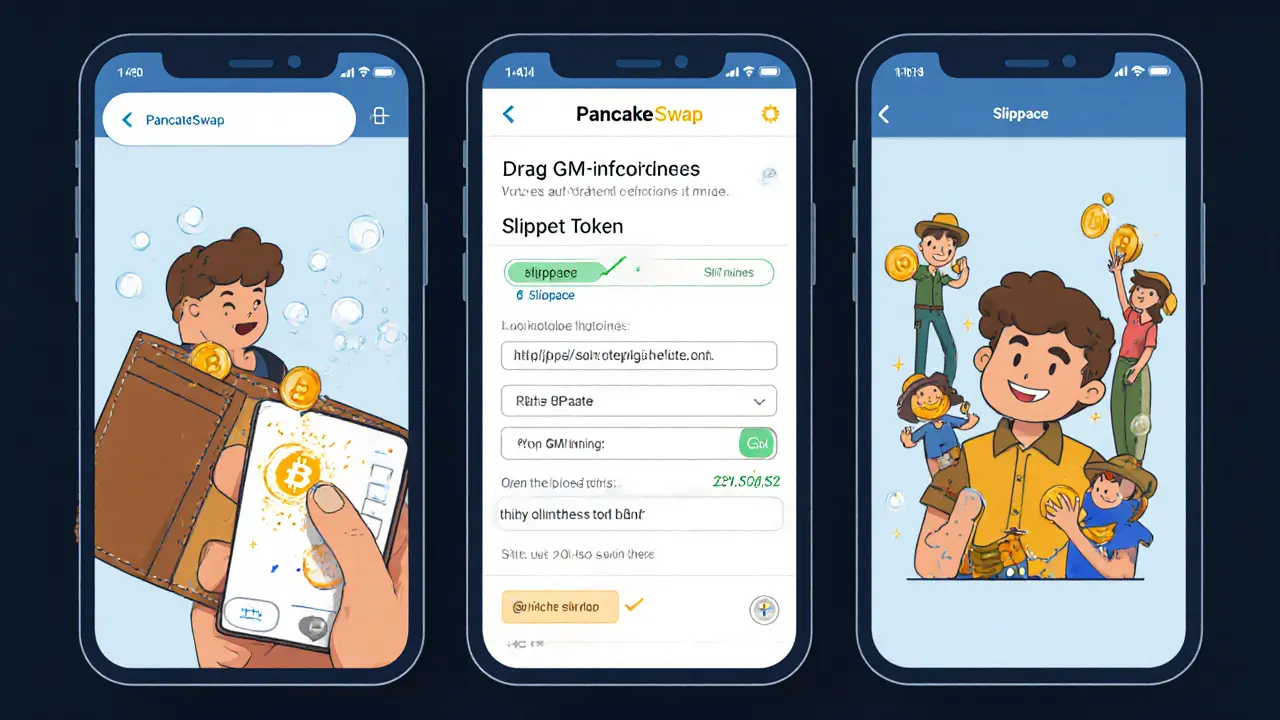

How to Buy GM Token

Because GM isn’t listed on major centralized exchanges, you’ll need a decentralized route. The most common method is through PancakeSwap on the Binance Smart Chain. Here’s a quick step‑by‑step:

- Set up a BSC‑compatible wallet (MetaMask, Trust Wallet, or Binance Chain Wallet).

- Fund the wallet with BNB for gas fees.

- Go to PancakeSwap’s Swap page.

- Paste the GM contract address:

0xd523f5097fe10cb8760f7011796a6edf7a268061into the “Select a token” field. - Enter the amount of BNB you wish to trade, review slippage settings (2-5% works for low‑liquidity tokens), and confirm.

- After the transaction, add the GM token to your wallet manually so you can see the balance.

Always double‑check the contract address - scammers often copy‑paste similar strings. Because liquidity is shallow, expect noticeable price impact for larger swaps.

Use Cases & Vision for Latin America

The project’s narrative centres on tokenising real‑world assets in Colombia, especially mining titles and land‑based projects. In practice, this could mean issuing a GM‑backed token that represents a share of a copper mine or a coffee plantation, allowing investors worldwide to buy fractional exposure.

Beyond mining, GM’s roadmap mentions services for:

- Farmers - micro‑loans and supply‑chain tracking via blockchain.

- Students - scholarship disbursements recorded on an immutable ledger.

- Entrepreneurs - easy token creation for local startups.

If these partnerships materialise, the token could gain real utility beyond speculation. However, the roadmap is vague, and no binding agreements with Colombian ministries or major agribusinesses have been publicly disclosed.

Risks & Criticisms

Investors should treat GM like any other ultra‑small cap crypto - the upside can be huge, but the downside is total loss. Key red flags include:

- Liquidity crunch: With only a few thousand dollars of daily volume, exiting a position can be costly.

- Data inconsistencies: Conflicting reports on circulating supply and holder counts raise transparency concerns.

- Regulatory uncertainty: Tokenising Colombian mineral rights could attract scrutiny from both Colombian and international regulators.

- Team anonymity: The public team page is sparse, making it hard to verify experience or accountability.

These factors don’t automatically make GM a scam, but they do demand thorough due‑diligence before committing funds.

Future Outlook & Price Predictions

Forecasts from CoinLore use historical price trends, RSI, MACD, Fibonacci levels and AI models to project massive growth: $0.0762 by 2026, $0.2809 by 2029, and even $0.8262 by 2040. The most bullish scenario pushes the token past $1.00 in 2041 - a 100,000% jump from today.

Those numbers are highly speculative. They assume the token will nail its tokenisation strategy, secure meaningful partnerships, and survive the intense competition within the Waves ecosystem. Realistically, a modest increase to $0.00005-$0.0001 by 2026 is more in line with historical micro‑cap behavior, especially if the community remains under 1,000 holders.

Bottom line: GM’s price ceiling depends on whether the project moves beyond hype and actually delivers tangible blockchain solutions in Colombia. Without that, the token may stay a niche curiosity.

Frequently Asked Questions

What blockchain does GM Holding use?

GM is issued on the Waves‑NG protocol via the Waves Platform, but it is typically bridged to Binance Smart Chain for trading on PancakeSwap.

How many GM tokens exist?

The max supply is 200million GM. About 99.99million are reported as circulating, though some explorers show zero due to data sync issues.

Where can I trade GM?

The most reliable venue is PancakeSwap on BSC. You can also find GM price feeds on CoinMarketCap and CryptoSlate, but direct buying on centralized exchanges isn’t available yet.

Is GM Holding a good long‑term investment?

It’s a high‑risk, high‑potential play. Success hinges on the team’s ability to tokenise Colombian assets and grow a real user base. Without those milestones, the token could remain illiquid.

What are the biggest risks of buying GM?

Low liquidity, unclear token distribution, possible regulatory hurdles, and limited transparency on the development team are the primary concerns.

Mark Briggs

Sure, another token promising moon but basically a meme.