Iran Crypto Exchange Access Checker

| Exchange | Status | Reason |

|---|---|---|

| Nobitex | Limited Access | Requires CBI API connection; high compliance risk |

| Tether (USDT) | Restricted | Address freezes; limited purchases and holdings |

| Bittrex | Blocked | OFAC sanctions on Iranian-linked wallets |

| Binance | Blocked | Voluntary IP block to avoid secondary sanctions |

| Coinbase | Blocked | U.S. compliance policy |

| Kraken | Blocked | Compliance with U.S. sanctions |

Use this simple check to see if your favorite exchange is accessible:

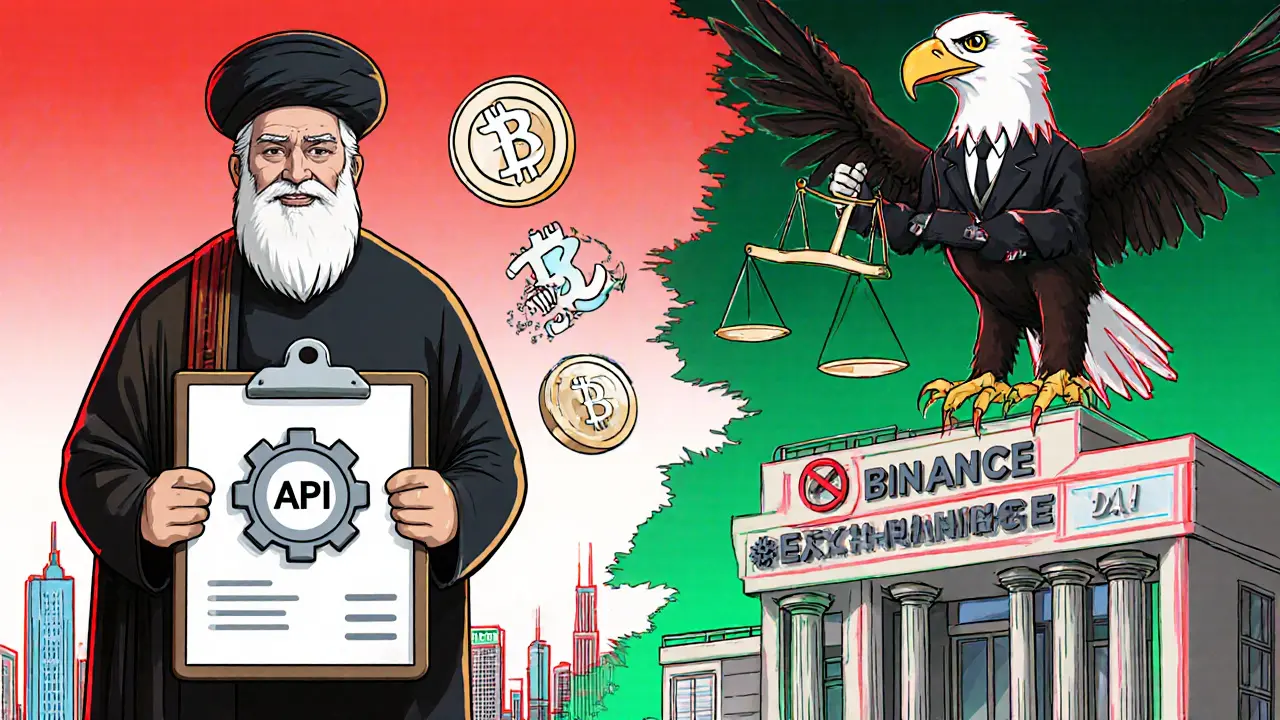

Iran crypto exchange bans have become a moving target in 2025, with the government tightening domestic controls while global sanction regimes force major platforms to shut out Iranian users. If you’re trying to understand which exchanges you can’t use, why they’re blocked, and how people are getting around the rules, this guide breaks it down step by step.

Key take‑aways

- The Central Bank of Iran now requires every crypto‑to‑fiat service to connect through a government‑run API, effectively limiting trading to state‑approved platforms.

- International sanctions led Tether, Bittrex and several smaller services to freeze or close Iranian accounts.

- Domestic exchanges like Nobitex remain operational but are under heavy scrutiny and often linked to frozen addresses.

- Users are turning to Turkish intermediaries, DAI on Polygon, and peer‑to‑peer networks to keep trading.

- New limits on stablecoin purchases (US$5,000 per year) and holdings (US$10,000) restrict exposure to global markets.

Why the bans matter

Understanding the why helps you decide whether to stay on a platform or look for alternatives. Iran’s approach mixes two forces:

- Domestic policy shifts: After years of a hands‑off stance, the Central Bank of Iran (CBI) issued a blanket ban on crypto‑to‑rial conversions on December272024. By early 2025 it opened a narrow door for exchanges that feed data to a government API, giving Tehran full visibility over who trades, how much, and which coins move across borders.

- International sanction pressure: The U.S. Treasury’s Office of Foreign Assets Control (OFAC) slapped new designations on crypto addresses linked to Iranian entities. Platforms that fail to comply risk losing access to U.S. banking, which is why they freeze Iranian accounts or shut down services altogether.

This two‑pronged model means even if an exchange isn’t officially prohibited by Tehran, it may still be unavailable because the provider can’t meet U.S. compliance demands.

Domestic regulatory landscape

Inside Iran, the CBI’s rules have evolved rapidly.

- Central Bank of Iran the nation’s monetary authority that oversees all fiat‑crypto interactions announced on December272024 that any website enabling direct crypto‑to‑rial payments would be blocked.

- In January2025 the bank rolled out a controlled API that only approved exchanges can use. The API forces users to register with their national ID, and every trade is logged in real time.

- On September272025 new limits on stablecoins were set: individuals may purchase at most US$5,000 of USDT or other stablecoins per year, and can hold no more than US$10,000 at any time.

- February2025 saw a blanket ban on all crypto advertising, both online and offline, making it harder for new platforms to reach Iranian users.

These measures don’t outright ban every exchange, but they create a high barrier to entry that most foreign platforms can’t or won’t meet.

International sanction‑driven blocks

While Tehran tightens its own rules, the U.S. and allied jurisdictions are cutting off the crypto lifelines that Iranian users rely on.

- Tether the issuer of the USDT stablecoin, subject to U.S. Treasury sanctions froze 42 Iranian‑linked addresses on July22025, many of which regularly transacted with the domestic exchange Nobitex.

- Bittrex, once a major U.S. exchange, was forced to freeze Iranian‑owned accounts after OFAC designated several crypto wallets associated with the Islamic Revolutionary Guard Corps (IRGC). A high‑profile lawsuit by an Iranian investor highlighted the real‑world impact.

- Other platforms, such as Binance and Coinbase, have voluntarily blocked Iranian IPs and accounts to avoid secondary sanctions, even though they haven’t issued an official “ban” list.

Because these firms operate under U.S. law, the risk of losing banking relationships outweighs the profit from a small user base in Iran, so they choose to stay on the safe side.

Which exchanges are effectively banned?

Below is a practical rundown of the services that Iranian users can’t access in 2025, either due to domestic API requirements or because the platform has shut them down.

| Exchange | Ban Reason | Current Status for Iran |

|---|---|---|

| Nobitex Iran’s largest domestic crypto exchange | Domestic scrutiny; linked to frozen Tether addresses | Operational but requires CBI API login; high compliance risk |

| Tether (USDT) stablecoin issuer under U.S. sanction pressure | Address freezes; limits on purchases and holdings | Limited - only through approved CBI‑linked platforms |

| Bittrex U.S. exchange forced to comply with OFAC | OFAC sanctions on Iranian‑linked wallets | Accounts frozen; new sign‑ups blocked |

| Binance | Voluntary IP block to avoid secondary sanctions | Access denied from Iranian IP ranges |

| Coinbase | U.S. compliance policy | Service unavailable to Iranian residents |

| Kraken | Compliance with U.S. sanctions | Blocked for Iranian users |

Notice that the list mixes domestic (Nobitex) and foreign platforms (Tether, Bittrex, Binance, etc.). The common thread is either a legal requirement to use the CBI API or a compliance decision driven by U.S. sanctions.

How users are getting around the blocks

Even with the heavy hand of regulators, people find ways to stay active in crypto.

- Turkish intermediaries: Turkish crypto market a regional hub where Iranian traders can open accounts with fewer sanctions constraints offers P2P platforms and OTC desks that accept Iranian buyers, often using Turkish Lira as a bridge currency.

- Alternative stablecoins: After Tether freezes, many turned to DAI on the Polygon network. DAI’s decentralized nature makes it harder for a single issuer to freeze accounts.

- Peer‑to‑peer networks: Telegram groups and local P2P exchanges let users swap Bitcoin or Ethereum directly, bypassing centralized KYC entirely.

- VPN and proxy services: Some still use VPNs to hide Iranian IPs and access blocked foreign exchanges, though this risks account termination if detected.

These workarounds carry their own risks-lower liquidity, higher fees, and potential legal exposure-so they’re not for the faint‑hearted.

Risks you should watch

Before you dive into any of these alternatives, keep the following in mind:

- Legal exposure: Even if an exchange isn’t officially banned in Iran, using a platform that violates U.S. sanctions could land you on a watchlist.

- Asset freezes: As Tether showed, stablecoins can be frozen retroactively. Diversify across multiple coins if you need liquidity.

- Data privacy: The CBI API logs every trade. If you value anonymity, peer‑to‑peer routes are safer, but they lack buyer protection.

- Tax obligations: Iran’s new speculation tax (enacted August2025) treats crypto gains like gold or forex. Failure to report can lead to penalties.

- Exchange solvency: Some platforms, like the now‑bankrupt Bittrex, may disappear, leaving funds stuck.

Tips for staying compliant and secure

- Stick to exchanges that use the CBI’s approved API if you want to stay on the right side of domestic law.

- Limit stablecoin purchases to the US$5,000 annual cap to avoid triggering automatic account reviews.

- Keep detailed records of every trade-exchange name, date, amount, and wallet address-to simplify tax filing.

- Consider splitting assets: hold a portion in decentralized stablecoins (DAI, USDC on Polygon) and the rest in locally approved platforms.

- Stay updated on OFAC designations; a new sanction can freeze an address overnight.

Frequently Asked Questions

Is Nobitex completely banned in Iran?

No. Nobitex remains the biggest domestic exchange, but it now must connect through the Central Bank’s API and share full user data with the government. That makes it heavily regulated, not outright banned.

Can I still use Binance from Iran?

Binance blocks Iranian IP addresses as part of its U.S. compliance program, so direct access is unavailable. Some users employ VPNs, but Binance may suspend the account if it detects the location mismatch.

What stablecoins are safe to hold in Iran?

USDT faces strict purchase and holding caps and has a history of address freezes. Decentralized stablecoins like DAI on Polygon or USDC on a non‑U.S. chain are less likely to be frozen, but they still fall under the annual purchase limit.

How does the new tax law affect crypto traders?

Starting August2025, any profit from buying and selling crypto is taxed as speculative income. The rate mirrors capital gains on gold - roughly 15% for individuals, with higher brackets for larger gains. Keeping a ledger of trades helps you calculate the tax owed.

Are there any legal ways to move crypto out of Iran?

The safest legal route is to use a CBI‑approved exchange that supports cross‑border withdrawals to a foreign banking partner, often via a Turkish intermediary. Anything that bypasses the API or uses anonymous VPNs walks a thin line with both domestic and international law.

In short, the landscape isn’t a simple blacklist of exchange names. It’s a mix of domestic API mandates, U.S. sanctions, and emerging workarounds. By understanding which forces are at play, you can choose a platform that stays within the rules while still giving you access to the global crypto market.

olufunmi ajibade

This is wild - Iran’s government is basically turning crypto into a state-monitored ATM. I’m from Nigeria, and we’ve been dodging forex controls for years, but this? This is next-level control. They’re not just banning exchanges - they’re forcing every trade to leave a digital fingerprint. And yet, people still find ways. That’s the real story here.