Iraq's Crypto Ban: Impact & Enforcement Tracker

Current Status

The ban remains in effect but enforcement is minimal. Underground crypto activities persist.

Key Facts

- Ban issued in 2017

- No major prosecutions

- Active underground market

Compare Iraq With Other Countries

Iraq

2017 • Financial crime, volatility, energy

Banking restrictions, occasional arrests

China

2021 • Energy, capital control

Nationwide shutdown, heavy penalties

Egypt

2018 • Religious rulings, fraud

Bank bans, public warnings

Enforcement Overview

Official Measures

- Banks block crypto transactions

- Financial institutions must comply

- Legal framework prohibits all activity

Real-World Enforcement

- Sporadic arrests (few convictions)

- No large-scale prosecutions

- Small-scale traders operate covertly

Economic Impact Simulation

Simulate how the ban affects cross-border transactions:

Estimated Economic Impact:

Results will appear here

When the Iraq cryptocurrency mining ban was announced in 2017, the Central Bank of Iraq prohibited all crypto trading and mining, citing financial crime, market volatility, and consumer protection concerns. Fast forward to 2025 and the ban is still on the books, but the reality on the ground looks very different. A handful of underground traders, a few covert mining rigs, and a patchwork of enforcement actions tell a story that official statements never mention. If you’ve ever wondered why the ban matters, how it’s being enforced, or what it means for anyone trying to use digital money in Iraq, you’re in the right place.

TL;DR

- 2017: Central Bank of Iraq (CBI) banned all cryptocurrency trading and mining.

- Enforcement: sporadic arrests, no large‑scale prosecutions, and vague legal guidelines.

- Underground scene: active trading groups on social media, hidden mining rigs, and informal meet‑ups.

- Global context: Iraq joins China, Egypt, Bangladesh, and six others with total bans.

- Impact: higher banking costs, cross‑border payment delays, and missed economic opportunities.

Why the Ban Was Issued in 2017

The Central Bank of Iraq issued the 2017 prohibition after a series of internal risk assessments. The bank warned that crypto assets were “unregulated financial instruments” that could facilitate money laundering, evade taxes, and destabilise a fragile economy already wrestling with inflation and oil‑price swings. The statement also singled out the massive energy consumption of Bitcoin the flagship proof‑of‑work cryptocurrency, arguing that mining could strain Iraq’s power grid.

In parallel, the Kurdistan Regional Government issued a fatwa against the OneCoin scheme in 2018, reinforcing a unified stance across Iraq’s semi‑autonomous regions.

How Enforcement Looks on the Ground

Officially, the ban is absolute: banks cannot process crypto‑related transactions, and financial institutions must block any digital‑wallet activity. In practice, enforcement has been uneven. Reports from the underground community mention at least two arrests for running mining farms, but there are no public court records of crypto‑specific convictions. Legal expert Hayan Al‑Khayyat has not seen formal trials for crypto offenses, suggesting that authorities often opt for warnings over prosecution.

The lack of clear legal precedent creates a gray zone. Small‑scale traders keep a low profile, using encrypted messaging apps and private Facebook groups to buy, sell, and exchange digital coins. Mining operations hide in basements, warehouses, or even inside small businesses that can mask electricity usage.

The Underground Crypto Community

Meet Ahmed Crypto a 33‑year‑old trader from Baghdad who manages roughly $10,000 in digital assets. He runs a discreet Facebook page where he coordinates peer‑to‑peer trades. Ahmed says the Central Bank’s stance is “backward” and believes a regulated framework could benefit both banks and users. He adds, “Whatever you do, we will find alternative ways and precautions to avoid prosecution.”

Another voice, Ashur Al‑Nuaimi an active member of the local crypto scene, argues that the ban stems from a lack of understanding about blockchain the underlying distributed ledger technology. Both Ahmed and Ashur point out that the underground market stays alive because digital assets provide a hedge against a weak local currency and a way to receive remittances.

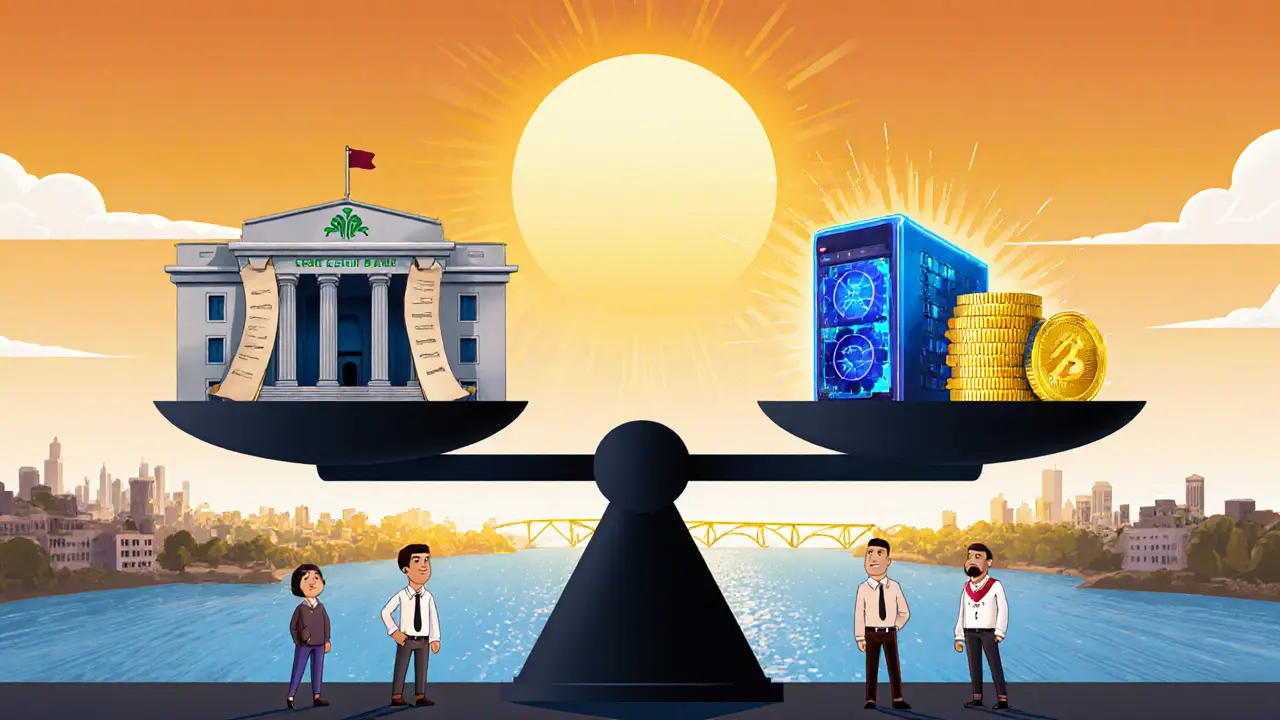

How Iraq Stacks Up Against Other Ban Countries

| Country | Year of Ban | Primary Reason(s) | Enforcement Style |

|---|---|---|---|

| Iraq | 2017 | Financial crime, volatility, energy consumption | Banking restrictions, occasional arrests |

| China | 2021 | Energy policy, capital control, financial stability | Nationwide shutdown of mining farms, heavy penalties |

| Egypt | 2018 | Religious rulings, fraud concerns | Bank bans, public warnings |

| Bangladesh | 2017 | Criminal penalties for possession | Police raids, legal prosecution |

| Algeria | 2018 | Legal ambiguity, security worries | Regulatory notices, limited enforcement |

| Morocco | 2017 | Consumer protection, AML concerns | Bank alerts, occasional seizures |

| Bolivia | 2017 | Economic stability, fraud risk | Central bank warnings, no criminal code |

| Russia | 2022 | Geopolitical sanctions, financial control | Licensing restrictions, fines |

What sets Iraq apart is the coexistence of a formal ban with a relatively low‑key enforcement record. Countries like China and Bangladesh have turned enforcement into a public, punitive campaign, while Iraq’s approach feels more “quietly restrictive.” This mix of official prohibition and underground persistence is a key reason why the ban has had mixed results.

Economic Ripple Effects

For businesses that rely on cross‑border payments, the ban adds a layer of friction. International partners can’t use crypto to speed up settlements, so they fall back on traditional correspondent banking, which is slower and often subject to sanctions checks. The anti‑money‑laundering (AML) framework in Iraq now has to scrutinise every foreign transaction more closely, driving up compliance costs.

On the flip side, the ban has spurred a small but growing market for “crypto‑friendly” remittance services that operate offshore. Users in Iraq sometimes route funds through neighboring Gulf states where crypto regulations are looser, creating a parallel financial channel that operates outside the official system.

Lessons Learned and Future Outlook

The Iraqi case highlights a classic policy dilemma: a strict ban can signal government intent, but without consistent enforcement it may never fully stop the activity it targets. The underground community shows that when people need a financial tool-whether to hedge inflation, send money home, or invest-they’ll find a way.

Experts argue that a regulated framework could turn the hidden mining rigs into taxable assets, generate revenue, and bring the sector under AML oversight. So far, the Central Bank has issued no roadmap for loosening the ban, and public statements remain firm. Until a shift occurs, traders will continue to operate in the shadows, and the country will miss out on potential tech‑driven economic benefits.

Frequently Asked Questions

Is it illegal to own cryptocurrency in Iraq?

Yes. The Central Bank of Iraq classifies any transaction, holding, or mining of digital assets as prohibited. While few prosecutions have been public, the law technically makes ownership illegal.

Can I mine Bitcoin in Iraq without getting caught?

Technically you cannot. The ban covers all proof‑of‑work mining because of its energy impact. In practice, small miners hide equipment and use unregistered electricity, but risk of raids or arrests remains.

What penalties could I face for crypto trading?

The law does not specify exact prison terms, but authorities can seize equipment, freeze bank accounts, and issue administrative fines. Past cases have mostly resulted in warnings and confiscations rather than lengthy jail sentences.

How does Iraq’s ban compare to China’s?

China carried out a massive, coordinated shutdown of mining farms in 2021 with heavy penalties. Iraq’s enforcement is far less visible; it relies on banking restrictions and occasional arrests, making the underground scene more viable.

Is there any sign the ban will be lifted?

As of 2025, the Central Bank has not announced any policy review. Industry voices keep urging a regulated approach, but official statements remain unchanged.

Anurag Sinha

Yo, have you ever noticed how every time a government drops a crypto ban, the shadow networks just get louder? It's like they're feeding the same beast they claim to fear. I swear the same guys who warned about 5G are now whispering about hidden mining farms in the desert. The Central Bank claims they're protecting us, but who’s really pulling the strings? Some unseen boardroom, probably with ties to the oil majors, doesn’t want decentralised power shifting away. And the energy argument? Yeah right, the real power lies in controlling the narrative. In fact, the ban is a smokescreen for political donors to cash in on the crypto crackdown.