Crypto Asset Classification Tool

Asset Classification Assistant

The 2025 Investment and Securities Act created a three-tier classification system for crypto assets. This tool helps you determine which category your asset falls into under the new regulations.

Regulatory Impact

Understanding your asset's classification is critical for compliance. This tool uses the 2025 Investment and Securities Act framework to determine which regulatory requirements apply to your asset. Remember that the CLARITY Act provides a clear three-tier system that simplifies compliance for market participants.

When the Investment and Securities Act 2025 a federal law that reorganizes how digital assets are regulated in the United States rolled out, the crypto world felt a seismic shift. Traders, custodians, and compliance officers all had to ask: what does this mean for daily operations, for product design, and for the bottom line? The answer is a mix of streamlined paperwork, new licensing paths, and a clearer label for every token you might hold.

Why the Act Matters for Everyday Crypto Traders

Before July 2025, most crypto firms lived under a cloud of “regulation by enforcement.” The Securities and Exchange Commission (SEC) would chase down a token they thought looked like a security, while the Commodity Futures Trading Commission (CFTC) claimed jurisdiction over the same asset as a commodity. That tug‑of‑war created costly legal reviews, delayed product launches, and a constant fear of fines.

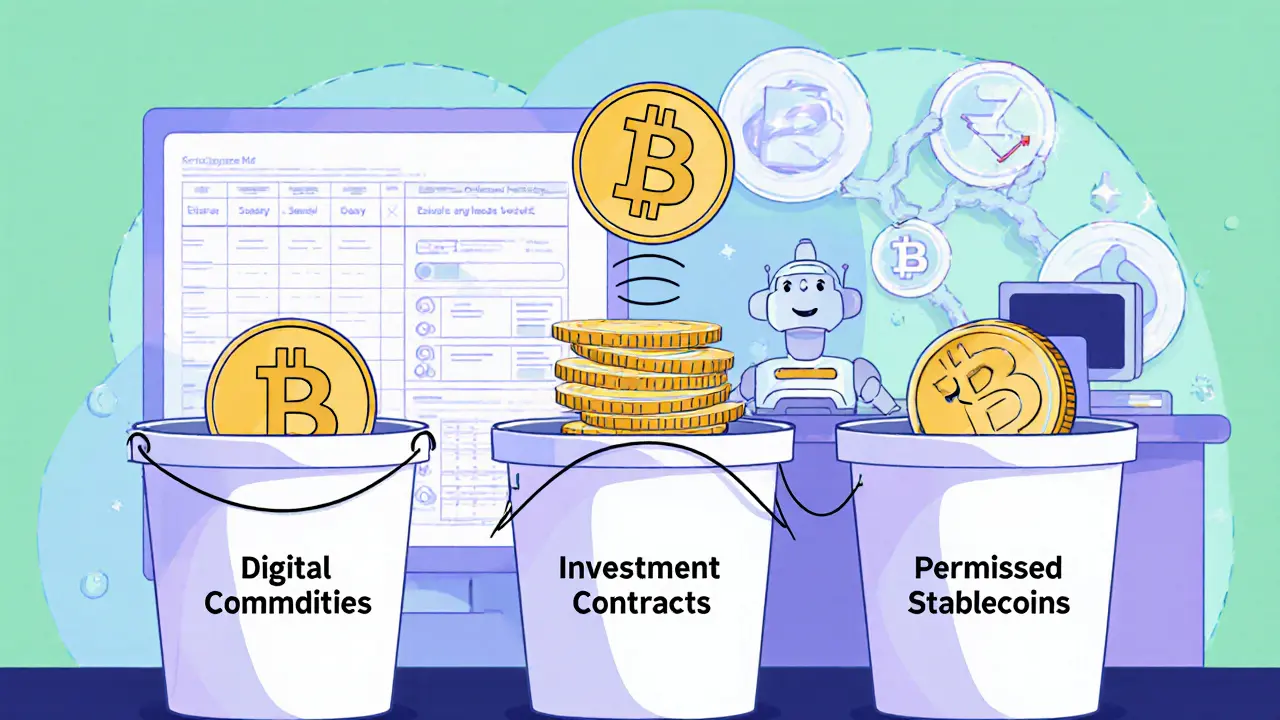

The crypto trading regulations introduced by the Investment and Securities Act 2025 put an end to that ambiguity. By codifying three distinct categories-digital commodities, investment contracts (security tokens), and permitted payment stablecoins-the law gives each market participant a roadmap instead of a maze.

Breaking Down the Three‑Tier Classification

The act’s core mechanism is best explained with the CLARITY Act a companion bill that sorts crypto assets into three regulatory buckets:

- Digital commodities - assets like Bitcoin and Ethereum that fall under CFTC oversight. They are now treated as "covered securities" for interstate trading, which means state blue‑sky laws no longer apply.

- Investment contract assets - tokens that meet the classic Howey test and stay under SEC jurisdiction. These include many security‑token offerings and equity‑linked coins.

- Permitted payment stablecoins - USD‑backed stablecoins regulated through the GENIUS Act the law that sets rules for stablecoins tied to the U.S. dollar. They can be brokered by registered broker‑dealers, ATSs, or national exchanges.

This structure removes the need for a token‑by‑token Howey analysis and gives firms a clear checklist: “Is my token a commodity, a security, or a stablecoin?”

What Changes for Brokers, Exchanges, and ATSs

Prior to the act, a broker‑dealer that wanted to list Bitcoin had to seek a separate CFTC registration or risk running afoul of the SEC’s anti‑fraud rules. Now the SEC must allow registered broker‑dealers to offer digital commodities alongside traditional securities, provided they comply with the new record‑keeping standards.

Exchanges will need to upgrade their blockchain‑based books and records to satisfy the SEC’s modernized filing requirements. Most vendors are already rolling out “crypto‑ready” modules that capture transaction hashes, custody proofs, and on‑chain audit trails.

Alternative Trading Systems (ATSs) gain a major advantage: they can host both equity ETFs and spot Bitcoin pools under a single regulatory umbrella, eliminating the need for duplicate compliance teams.

Impact on Registered Investment Advisers (RIAs) and CTAs

For RIAs, the biggest relief is the exemption from Rule 204A‑1 reporting on digital commodities. Because Bitcoin is now a commodity, advisors no longer have to pre‑clear employee personal trades or file Form PF disclosures for those positions. The compliance manual can be trimmed down to a single “crypto policy” that distinguishes commodities from securities.

Firms that focus exclusively on commodity‑type assets may consider registering as Commodity Trading Advisors (CTAs) with the CFTC. That path brings its own reporting obligations but often offers lower capital requirements than a full SEC‑registered advisory license.

Conversely, advisors dealing with security tokens must retain their SEC registration and continue to follow the traditional investment‑adviser rules-no shortcuts there.

Custody Solutions: From State Trust Companies to Federal Frameworks

The act also unlocks a new custody model. A September 2025 SEC no‑action letter (the “State Trust Letter”) lets regulated advisers hold crypto assets with qualified state trust companies. This gives institutional investors a federally‑backed safe‑harbor that was missing before.

For larger banks that prefer a federal charter, the GENIUS Act paves the way for a future amendment to the custodian rules, meaning we may soon see national banks offering insured crypto deposits.

Comparing the Pre‑2025 Landscape with the New Regime

| Aspect | Before 2025 | After 2025 |

|---|---|---|

| Asset Classification | Case‑by‑case Howey test | Three‑tier system (commodity, security, stablecoin) |

| Broker‑Dealer Access | Limited to securities; separate CFTC licensing needed for commodities | SEC must allow broker‑dealers to trade digital commodities and permitted stablecoins |

| State Blue‑Sky Laws | Applicable to many tokens | Digital commodities classified as covered securities → exemption |

| RIA Reporting | Rule 204A‑1 applies to most crypto holdings | Commodities excluded, reducing surveillance burden |

| Custody Options | Fragmented, limited to offshore or state‑level solutions | State trust company pathway; future federal custodian rules hinted |

This side‑by‑side view makes it clear why many institutional players are fast‑tracking product launches now that the uncertainty has lifted.

Real‑World Examples of Early Adoption

State Street Global Advisors announced an “on‑chain ETF” prototype that will hold a basket of digital commodities, leveraging the new CTA registration path. Meanwhile, Galaxy Asset Management’s SPDR Galaxy ETFs have added a Bitcoin‑commodity share class, allowing investors to gain exposure without navigating the old SEC‑CFTC tug‑of‑war.

On the exchange side, a major U.S. ATS rolled out a dual‑listing platform that hosts both a traditional equity index fund and a spot Ethereum pool, all under one SEC‑approved broker‑dealer license.

For smaller DeFi startups, the hill isn’t completely flat yet. The act’s compliance costs-especially for AML/KYC upgrades and on‑chain record‑keeping-are still a hurdle, but the clear regulatory path makes fundraising easier than it was in 2023.

What to Watch Moving Forward

Even with the 2025 framework in place, the SEC plans additional rulemakings on custody, on‑board reporting, and retail crypto products. The “Regulatory Flex Agenda” released in spring 2025 hints at tighter rules for crypto‑based mutual funds, which could affect how asset managers bundle digital commodities.

Congress may also refine the CLARITY Act’s definitions, especially around hybrid tokens that have both commodity and security features. Keeping an eye on the legislative calendar is now part of every crypto trading desk’s risk‑management routine.

Finally, global peers are watching. The EU’s MiCA regime continues to focus on all‑encompassing crypto regulation, while the U.S. takes a more targeted, stablecoin‑first approach. For traders, this means arbitrage opportunities may arise as different jurisdictions adopt divergent rules.

Quick Checklist for Crypto Firms Post‑Act

- Map every token you hold to one of the three categories.

- Update compliance manuals to reflect new reporting exemptions for digital commodities.

- Verify that your broker‑dealer or ATS partner has filed the SEC’s updated blockchain‑record‑keeping amendment.

- Consider whether a CTA registration makes sense for commodity‑only strategies.

- Evaluate custody options: state‑trust companies now have SEC backing, but monitor forthcoming federal custodian guidance.

- Train all Access Persons on the new classification system to avoid accidental securities filings.

Frequently Asked Questions

Does the Investment and Securities Act 2025 affect existing crypto ETFs?

Yes. ETFs that hold digital commodities can now be structured as CTA‑registered products, eliminating the need for a separate securities exemption. Security‑token ETFs still require SEC registration, but the act simplifies the filing process.

Do I still need a CFTC license to trade Bitcoin?

No. Bitcoin is classified as a digital commodity under the act, and the SEC now permits broker‑dealers to offer it without a separate CFTC registration, provided they follow the new record‑keeping rules.

What are the compliance implications for DeFi protocols?

DeFi projects must assess whether their native tokens fall into the commodity or security category. If a token is a commodity, the protocol can operate under the CTA framework; if it’s a security, it must register with the SEC or qualify for an exemption. The act does not create a separate DeFi regulator.

How does the GENIUS Act limit stablecoin risk?

The GENIUS Act requires USD‑backed stablecoins to hold a 1:1 reserve of liquid assets, undergo regular audits, and submit quarterly reports to the SEC. This transparency reduces redemption risk and aligns stablecoins with the same safety standards as traditional money‑market funds.

Will smaller crypto firms struggle with the new reporting requirements?

Implementation costs are higher for firms that lack existing compliance infrastructure. However, many SaaS compliance platforms now offer pre‑built modules for the 2025 rules, helping smaller players meet the standards without building everything from scratch.

Kyla MacLaren

Finally a law that actually tells us where Bitcoin belongs-no more guesswrok.