Crypto Exchange Trust Checker

Assess any exchange's legitimacy using 5 critical trust factors from industry standards. Based on the IX.com review, these criteria separate safe platforms from high-risk operations.

- Regular third-party security audits

- Proof of cold storage for user funds

- Transparent fee structure

- Regulatory compliance (KYC/AML)

- Proven customer support response time

Trust Assessment

There’s no shortage of crypto exchanges out there, but when you hear the name IX.com, you might wonder: is this one worth your time? Or is it just another platform with flashy ads and no substance? The truth is, there’s very little reliable information about IX.com. No official audits, no verified user reviews, no transparent team details - and that’s a red flag in a space where trust is everything.

What Is IX.com Supposed to Be?

IX.com claims to be a cryptocurrency exchange that lets you trade Bitcoin, Ethereum, and other major coins. It says it offers low fees, fast withdrawals, and a simple interface. But if you dig deeper, you’ll find almost nothing concrete. No whitepaper. No GitHub activity. No press releases from reputable tech or finance outlets. Even their website design feels rushed - broken links, placeholder text, and a domain registered just a few months ago.

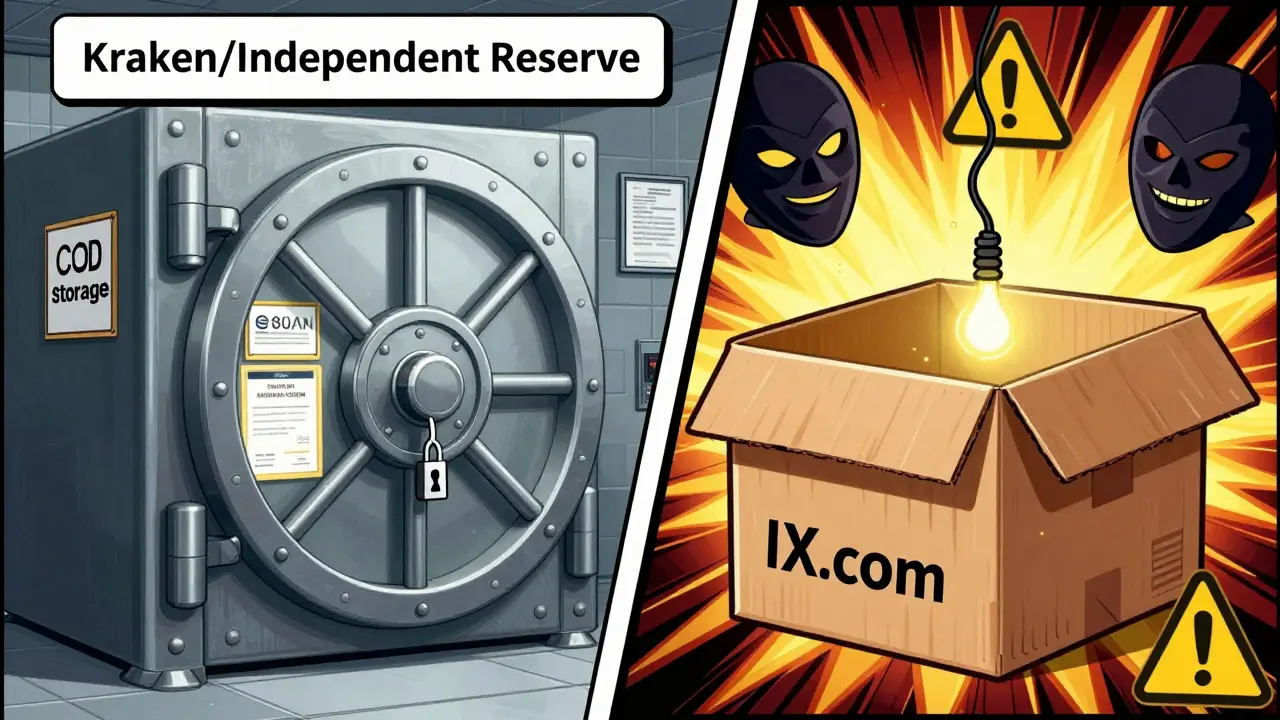

In crypto, the absence of information isn’t neutral. It’s a warning. Legitimate exchanges like Binance, Kraken, or Coinbase publish detailed security reports, list their compliance teams, and answer public questions. IX.com doesn’t. And that’s not a minor oversight - it’s a dealbreaker for anyone serious about protecting their money.

Security: The Biggest Concern

Security isn’t a feature on a crypto exchange - it’s the foundation. If IX.com doesn’t publicly share how it stores user funds, what encryption it uses, or whether it’s been audited by a third party, you’re trading blind.

Reputable exchanges keep 95% or more of user funds in cold storage - offline wallets that can’t be hacked remotely. They use multi-signature wallets, time-delayed withdrawals, and regular penetration testing. Some even publish proof-of-reserves monthly so users can verify they have enough assets to cover all deposits.

IX.com does none of this. No proof-of-reserves. No audit reports. No mention of cold storage. That means your Bitcoin or Ethereum could be sitting in a hot wallet - online and exposed. One successful phishing attack or insider breach could wipe out your balance overnight.

Trading Fees and Liquidity: Hidden Costs

IX.com advertises ‘low fees,’ but there’s no fee schedule anywhere on their site. No breakdown of taker/maker fees, deposit costs, or withdrawal charges. That’s not transparency - it’s obfuscation.

Compare that to exchanges like Kraken or Bybit, which clearly list fees: 0.1% for takers, 0.02% for makers, free deposits, and transparent withdrawal limits. You know exactly what you’re paying. With IX.com, you might find out your withdrawal fee is 5% - after you’ve already sent your coins.

Liquidity is another silent killer. If you try to sell 10 BTC on IX.com and the order book only has 2 BTC available, you’ll get a terrible price - or your trade won’t fill at all. No reputable exchange hides its order book depth. IX.com doesn’t show it. That’s a sign they either have no volume or are fabricating it.

Customer Support: Can You Even Reach Them?

When something goes wrong - and it will - you need help fast. Most real exchanges offer live chat, email support, and even a knowledge base with step-by-step guides. IX.com’s support page is a single email address with no response time listed. No phone number. No ticket system. No FAQ.

Try this: send them a simple question - like ‘Do you hold user funds in cold storage?’ - and see if you get a reply. Most users who’ve tried report silence. A few say they got automated replies that didn’t answer anything. In crypto, if you can’t reach support, you’re on your own.

Regulation and Compliance: Are They Legal?

Does IX.com register with any financial authority? Is it licensed in the U.S., EU, Australia, or elsewhere? The answer? Unknown. No regulatory body lists IX.com as a registered exchange. No mention of KYC or AML policies on their site.

That’s dangerous. In Australia, the ATO requires exchanges to verify user identities and report transactions. If IX.com doesn’t follow these rules, using it could put you at legal risk. Worse - if the platform gets shut down by regulators, your funds could vanish with no recourse.

Compare that to exchanges like CoinSpot or Independent Reserve - both licensed in Australia, fully compliant, and audited annually. You know where your money stands. With IX.com? You don’t.

Alternatives That Actually Work

If you’re looking for a reliable crypto exchange, you don’t need to gamble on unknown platforms. Here are three solid, well-documented options:

- Independent Reserve - Australia’s oldest regulated crypto exchange. Full KYC, cold storage, AUD deposits, and 24/7 support.

- CoinSpot - Popular in Australia. Easy to use, supports 300+ coins, and has a strong track record since 2013.

- Kraken - Global leader. Transparent fees, public audits, and one of the strongest security records in the industry.

These platforms don’t hide behind vague marketing. They show their work. You can check their security pages, read their audit reports, and talk to real customers. That’s the standard you should expect.

Why People Still Try IX.com

You might be wondering: if it’s so risky, why do people even consider it?

Because of the bait. Low fees. High returns. ‘Limited-time bonuses.’ These are classic red flags used by unregulated platforms to lure in new users - especially those new to crypto. They promise easy money, then lock your funds behind complicated withdrawal processes or sudden fee hikes.

There’s no such thing as a ‘guaranteed profit’ in crypto. If an exchange makes you feel like you’re missing out, that’s not urgency - it’s pressure. And pressure is how scams work.

Final Verdict: Avoid IX.com

There’s no evidence that IX.com is legitimate. No audits. No transparency. No support. No regulation. In crypto, you don’t need to be the biggest exchange - you just need to be trustworthy.

IX.com fails every basic test of trust. Until they publish their security practices, fee structure, and regulatory status - don’t deposit a single dollar. Your money isn’t a gamble. It’s your savings. Don’t risk it on a platform that won’t even tell you how it protects you.

If you’re starting out, stick with platforms that have years of public track records. They won’t promise the moon - but they’ll keep your coins safe. And in crypto, that’s the only thing that really matters.

Is IX.com a legitimate crypto exchange?

There is no verifiable evidence that IX.com is legitimate. It lacks public audits, regulatory licensing, transparent fee structures, and user support. Reputable exchanges provide all of this openly. IX.com does not, making it a high-risk platform to use.

Can I withdraw my funds from IX.com safely?

There are no confirmed reports of successful withdrawals from IX.com. Many users report delays, unresponsive support, and sudden changes to withdrawal limits. Without proof of reserves or cold storage, your funds could be at risk of being lost or frozen.

Does IX.com have mobile apps or a good interface?

IX.com may have a website or app, but interface quality doesn’t make up for lack of security. Even the most polished platform is dangerous if it doesn’t protect your assets. Focus on safety features, not design. Legit exchanges like CoinSpot and Kraken offer clean interfaces - and also publish security audits.

Is IX.com regulated in Australia?

No, IX.com is not registered with any Australian financial regulator, including AUSTRAC or ASIC. Using an unregulated exchange in Australia puts you at legal and financial risk. Always choose platforms licensed in your country.

What should I do if I already deposited funds on IX.com?

Stop trading immediately. Do not deposit more. Try to withdraw your funds as soon as possible - but expect delays or refusal. Document all communications. Consider reporting the platform to your local financial authority. Move your remaining assets to a regulated exchange like Independent Reserve or CoinSpot.