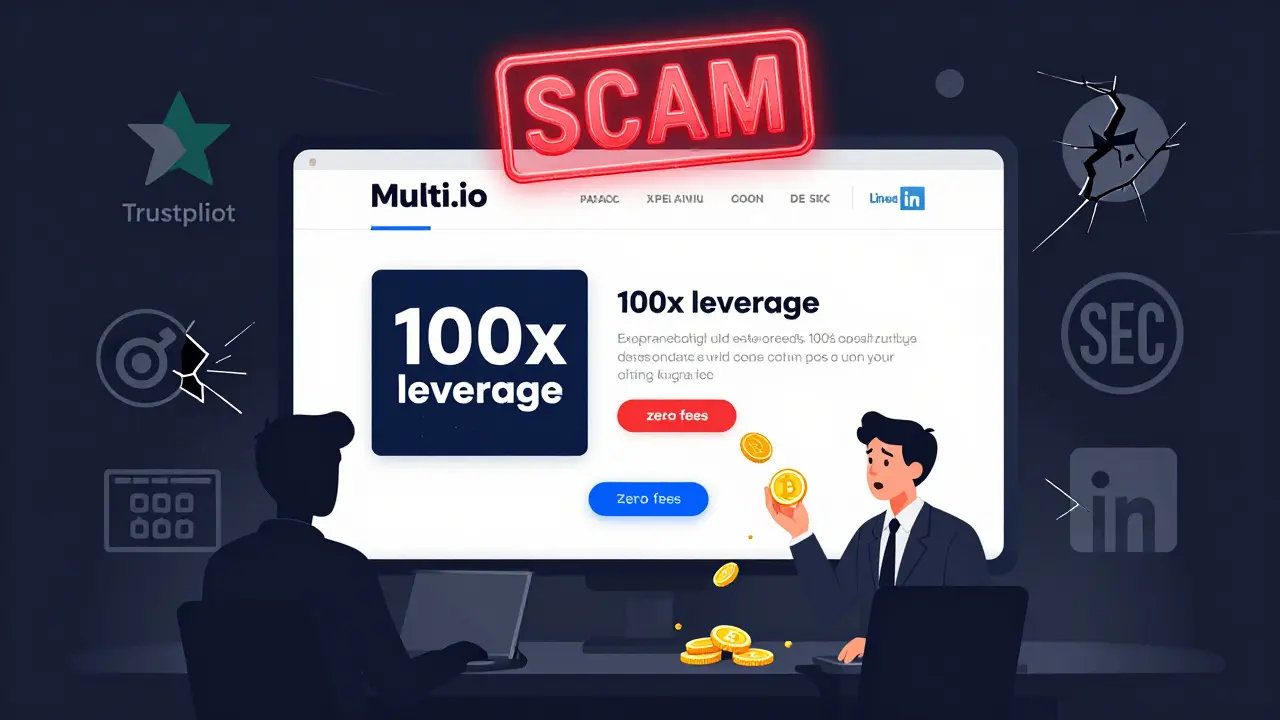

If you’ve seen ads for Multi.io promising low fees, 100x leverage, and hundreds of coins to trade, you’re not alone. Many people are asking the same question: Is Multi.io a real crypto exchange-or just another scam dressed up to look like Gate.io or Binance?

The short answer: There’s no credible evidence that Multi.io is a legitimate crypto exchange. Not a single trusted source-no reviews on Trustpilot, no mentions in NerdWallet’s 2025 exchange roundup, no regulatory filings, no security audits, no user forums discussing it. Even the most obscure exchanges like KuCoin or MEXC show up in multiple expert analyses. Multi.io doesn’t appear anywhere.

Why You Should Be Suspicious

Legitimate crypto exchanges don’t hide. They publish their company details, licensing info, security practices, and fee structures. Coinbase is registered with the SEC. Kraken holds a New York BitLicense. Binance has a public transparency report. Even Gate.io, which some people confuse Multi.io with, has a documented history: a 2019 hack, covered losses, public cold storage stats, and a team listed on LinkedIn.

Multi.io has none of that.

No corporate address. No registered legal entity. No contact email that works. No customer support team you can reach. No YouTube tutorials from real users. No Reddit threads. No GitHub repo. No press releases. No regulatory disclosures. Not even a Wikipedia page. That’s not just incomplete-it’s a red flag flashing in neon.

The Gate.io Confusion

There’s a reason you’re hearing about Multi.io. The domain name is suspiciously close to Gate.io, a real exchange launched in 2013 with over 1,000 cryptocurrencies and 100x leverage options. Gate.io has a solid track record, even after a 2019 security incident where they fully reimbursed users. Multi.io doesn’t have a 2019 hack story. It doesn’t have any hack story at all-because it likely doesn’t exist.

This isn’t an accident. Scammers use this tactic all the time: pick a well-known name, change one letter, register a similar domain, and run ads targeting people searching for the real thing. It’s called typosquatting. And it’s illegal in many countries.

What the Scam Looks Like

Here’s how it works:

- You click an ad: “Trade 1000+ coins with 100x leverage on Multi.io-zero fees!”

- You sign up. No ID needed. No KYC. That’s a huge red flag-real exchanges require identity verification by law.

- You deposit crypto. Maybe $500. Maybe $5,000.

- The site looks professional. Clean UI. Smooth charts. Maybe even fake live chat.

- You try to withdraw. Suddenly, you’re asked to pay a “security fee,” “tax,” or “verification deposit” to unlock your funds.

- You pay. The amount grows. $100 here. $300 there.

- Then the site goes dark. The domain vanishes. The social media accounts disappear.

This exact pattern was documented by the California Department of Financial Protection and Innovation (DFPI) in their Crypto Scam Tracker. They list dozens of platforms that used the same script. Multi.io fits perfectly.

Why Legit Exchanges Don’t Look Like This

Compare Multi.io’s silence to what real exchanges do:

- Coinbase: Lists all fees clearly (0.5% for small trades), shows insurance coverage ($250,000 per user), and publishes quarterly security reports.

- Kraken: Has a tiered verification system, uses multi-sig wallets, and discloses their cold storage percentages (95%+ offline).

- Crypto.com: Offers MFA with biometrics, SMS, and OTP, and has a public incident response protocol.

- Gate.io: Publishes its proof-of-reserves monthly and has a public bug bounty program.

Multi.io? Nothing. Not a single number. Not a single policy. Not even a privacy statement. If a company won’t tell you how they protect your money, you shouldn’t trust them with it.

Where to Find Real Alternatives

If you’re looking for a reliable exchange, here are five that actually exist and are verified by regulators:

- Coinbase - Best for beginners. Simple interface, FDIC-insured USD balances, $20 BTC bonus for new users who trade $100+.

- Kraken - Strong security, low fees for high-volume traders, and available in most U.S. states.

- Gate.io - Huge coin selection (1,000+), 100x leverage, and transparent reserve audits.

- Crypto.com - Great mobile app, crypto debit card, and strong compliance.

- Binance - Highest liquidity globally, but avoid if you’re in the U.S.-they don’t serve American customers directly anymore.

All of these have been reviewed by NerdWallet, Coincub, and Koinly in 2025. None of them are Multi.io.

What to Do If You Already Used Multi.io

If you sent crypto to Multi.io:

- Stop sending more money. No amount of “verification fees” will get your funds back.

- Document everything: screenshots of the site, transaction IDs, emails, chat logs.

- Report it to your local financial regulator. In Australia, that’s ASIC. In the U.S., file a complaint with the FTC and DFPI.

- Warn others. Post on Reddit’s r/CryptoCurrency, Trustpilot, or scam reporting sites like ScamAdviser.

Recovering crypto from a scam site is nearly impossible. But reporting it helps prevent others from falling for the same trap.

Final Verdict

Multi.io is not a crypto exchange. It’s a scam. It has no infrastructure, no compliance, no history, no transparency, and no credibility. It exists only to take your money and vanish.

Don’t be fooled by a clean website or flashy ads. Legitimate platforms don’t need to hide. They don’t need to mimic other names. They don’t need to avoid the spotlight.

If you can’t find a single trusted review, regulatory filing, or user report about a crypto platform-walk away. Every real exchange has a paper trail. Multi.io has a ghost trail.

Stick to the names you can verify. Your crypto is too important to gamble on a domain that doesn’t exist.

Alex Strachan

lol so Multi.io is just Gate.io with a typo and a sketchy ad budget? 🤡