Crypto Exchange Risk Checker

Is This Exchange Safe?

Enter an exchange name or check the risk factors below to assess its legitimacy.

Critical Risk Factors

Check all factors present in the exchange's terms.

If you're looking for a crypto exchange that doesn't require ID verification, you might have come across BitFex. It promises anonymity, low fees, and easy sign-up - no documents, no questions asked. Sounds tempting, right? Especially if you're in Eastern Europe and tired of banks blocking crypto deposits. But here’s the truth: BitFex isn’t just risky - it’s dangerous.

What BitFex Actually Offers

BitFex launched in 2018 and targets users who want to trade crypto without going through KYC. Unlike Binance or Coinbase, you don’t need to upload a passport or selfie. Just an email and you’re in. That’s its main selling point. But that’s also where the red flags start.

They claim low trading fees, but no one knows how low. There’s no public fee schedule. No breakdown of deposit costs, withdrawal fees, or spreads. That’s not normal. Legitimate exchanges like Kraken or MEXC list every fee upfront. BitFex hides it. Why? Because if you can’t see the fees, you can’t compare. And if you can’t compare, you’re more likely to just click ‘deposit’.

The platform is basic. No advanced charts. No stop-loss orders. No margin trading. No API for bots. It’s a simple buy/sell interface - like a 2017-era crypto site. No mobile app. No multi-signature wallets. No insurance fund. If you’re used to trading on OKX or Bybit, this feels like using a flip phone in 2025.

The Anonymity Trap

BitFex says ‘no KYC’ - but that’s not the full story. Users report the same pattern over and over: you deposit, everything’s fine. Then, when you try to withdraw more than a few hundred euros, suddenly - ‘verification required.’

That’s not a glitch. It’s a trap. They lure you in with the promise of anonymity, then lock your funds unless you jump through hoops they never mentioned. One Reddit user, CryptoWatcher2025, deposited 500 EUR and couldn’t withdraw for three weeks. Support never replied. Another user on CryptoSlate said: ‘They never told me I’d need a utility bill and bank statement - until after I sent the money.’

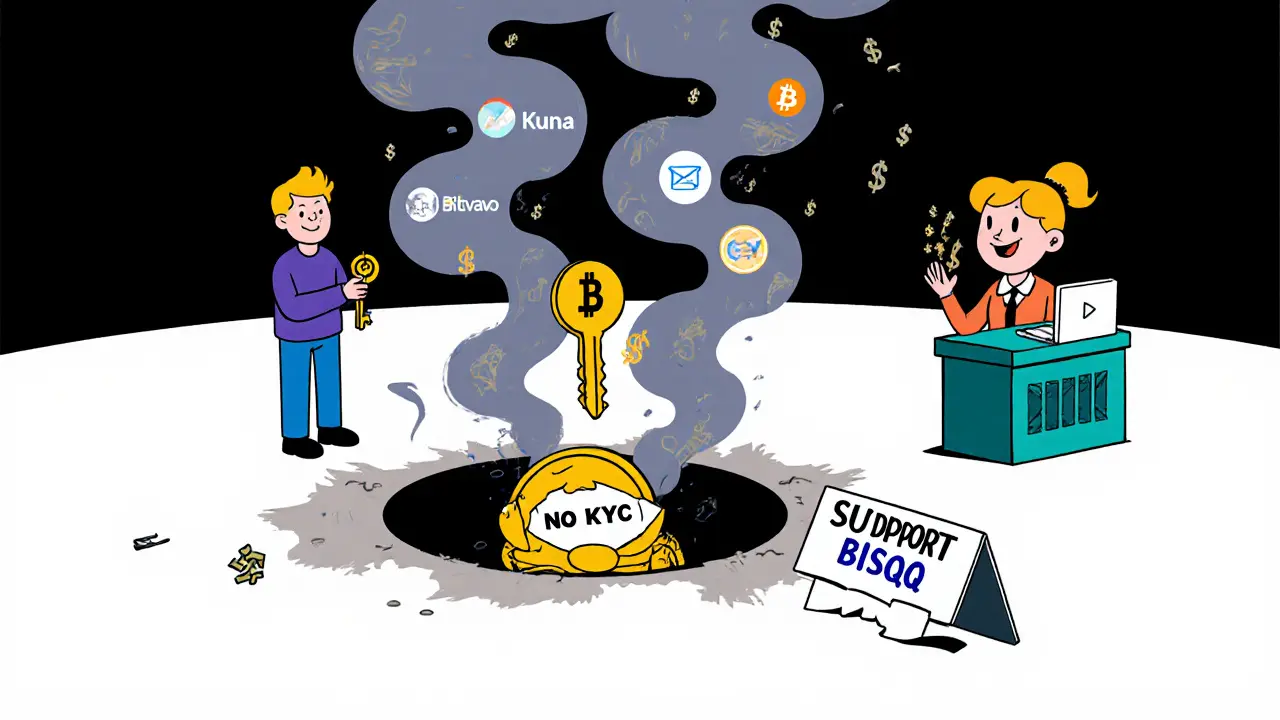

This isn’t privacy. It’s bait-and-switch. Real anonymous platforms like Bisq or Hodl Hodl don’t ask for documents after you deposit. They’re peer-to-peer, built on open protocols. BitFex is a centralized server you have zero control over. And once your funds are in, you’re at their mercy.

Security? There Isn’t Any

BitFex doesn’t publish any security information. No cold storage details. No multi-sig setup. No audit reports. No penetration test results. Nothing.

Compare that to Bitfinex - yes, the name is similar, but this is a completely different platform. Bitfinex was hacked in 2016 and lost $60 million. What did they do? They repaid every customer over time. They were transparent. They worked with regulators. BitFex? No public record of any security measures. Ever.

The UK Financial Conduct Authority (FCA) added BitFex-related domains to its official scam list in September 2025. That’s not a rumor. That’s a government warning. The FCA doesn’t list exchanges they just don’t like - they list ones that have already defrauded users. And BitFex is on it.

User Reviews Are a Nightmare

Trustpilot has only 12 reviews for BitFex - and they average 1.8 out of 5 stars. That’s worse than most sketchy NFT marketplaces.

Common complaints:

- ‘Funds frozen after deposit’

- ‘Withdrawal requests ignored for weeks’

- ‘Support email bounces back’

- ‘Account locked for no reason’

On Bitcointalk.org’s scam alerts section, there are 27 verified reports of users losing money. One user said they sent 1.2 BTC and got a reply: ‘Your transaction is under review.’ Two months later, the site went down. The domain changed. The support email disappeared.

There are no positive reviews from independent sources. The few ‘good’ testimonials you might find? They’re on BitFex’s own website - written in broken English, with stock photos. Classic scam tactic.

Why BitFex Exists (And Why It Won’t Last)

BitFex isn’t trying to compete with Binance. It’s not trying to be the next Kraken. It’s built for one thing: to collect deposits from people who don’t know any better.

It targets inexperienced traders in Eastern Europe - places where banking systems are slow, and crypto adoption is growing. People who want to avoid banks, but don’t understand how exchanges work. BitFex exploits that.

And here’s the kicker: global regulation is tightening. In 2025, 92 countries now require crypto exchanges to comply with anti-money laundering rules. BitFex refuses. That means banks will stop processing payments to them. Payment processors like Stripe or Adyen will cut them off. Their liquidity will dry up. Their servers will go dark.

Industry analysts at Deloitte and Gartner predict that by 2027, 90% of non-compliant exchanges will vanish. BitFex isn’t just behind the curve - it’s already on the wrong side of history.

What Happens If You Use It?

Let’s say you deposit $1,000 in ETH on BitFex. You think you’re safe because you didn’t give your ID. But here’s what actually happens:

- You can’t withdraw more than $300 without ‘verification’ - which wasn’t mentioned during signup.

- You submit documents. They disappear into a black hole. No confirmation. No reply.

- You contact support. The ticket system says ‘message sent.’ But no one replies.

- After 3 weeks, you check your balance. It’s gone. The site says ‘maintenance.’ Then it redirects to a different domain.

That’s not a glitch. That’s the business model.

According to the Blockchain Transparency Institute, only 29% of users who reported issues with BitFex ever got their money back. The rest? Gone. Forever.

What Should You Do Instead?

If you want privacy, there are better, safer options:

- Kuna (Ukraine) - fully regulated, supports local bank transfers, offers KYC-free small trades.

- Bitvavo (Netherlands) - EU-compliant, low fees, easy fiat deposits, strong customer support.

- Bisq - decentralized, no account needed, peer-to-peer trading, open-source code.

- Kraken - even with KYC, it’s one of the most secure exchanges. They’ve never lost user funds to a hack.

These platforms balance privacy with safety. They don’t trick you. They don’t vanish. They’re built to last.

BitFex? It’s a ticking time bomb. And if you’re the one holding the fuse, you won’t like the explosion.

Final Verdict

BitFex isn’t a crypto exchange. It’s a trap.

It looks simple. It sounds tempting. But behind the ‘no KYC’ promise is a structure designed to steal funds, not store them. The lack of security, the hidden fees, the regulatory warnings, the flooded scam reports - it’s all there. And it’s not a coincidence.

If you’re looking for anonymity, don’t risk your life savings on a platform that doesn’t even tell you who owns it. Use a regulated exchange with a proven track record. Your money - and your peace of mind - are worth more than a few minutes saved on signing up.

BitFex might still be online today. But in 2025, that doesn’t mean it’s safe. It just means it hasn’t been shut down yet.

sky 168

Just don't use it. Done.