Privacy-Preserving Identity Verification Explorer

Zero-Knowledge Proofs (ZKPs)

Cryptographic protocols that let a prover demonstrate knowledge of a secret without revealing the secret itself.

Core TechnologyDecentralized Identifiers (DIDs)

Self-owned identifier strings that resolve to a DID Document hosted anywhere, removing reliance on centralized registries.

Identity ManagementSelective Disclosure

The ability to share only the credential attributes required for a transaction.

Data MinimizationSecure Multi-Party Computation (SMPC)

Techniques that let multiple parties compute a function over their inputs without revealing those inputs to each other.

Collaborative ProcessingScenario Simulator

Imagine you're verifying someone's age to access a restricted service. Which privacy-preserving technique would you use?

Recommended Approach:

How It Works:

Key Takeaways

- Privacy‑preserving identity verification (PPIV) lets users prove facts about themselves without leaking extra data.

- Zero‑knowledge proofs, decentralized identifiers, selective disclosure and secure multi‑party computation are the core building blocks.

- PPIV improves compliance with GDPR, CCPA and other privacy laws while cutting fraud rates.

- Adoption is booming in banking, government, healthcare and travel sectors.

- Implementation challenges revolve around performance, scalability and user‑experience design.

When you hear the phrase privacy-preserving identity verification, picture a digital passport that reveals only what’s needed - like “over‑18” or “citizen of Australia” - without handing over your full birthdate, address, or photo. This shift from data hoarding to data minimalism is reshaping how businesses authenticate users online.

Privacy‑Preserving Identity Verification is a set of cryptographic and protocol‑level techniques that enable a party to prove a statement about an identity attribute without exposing the underlying attribute itself. The approach grew out of two pressures: rising data‑breach headlines and stricter privacy regulations worldwide. By reducing the surface area of personal data that travels across networks, PPIV offers both stronger security and better regulatory fit.

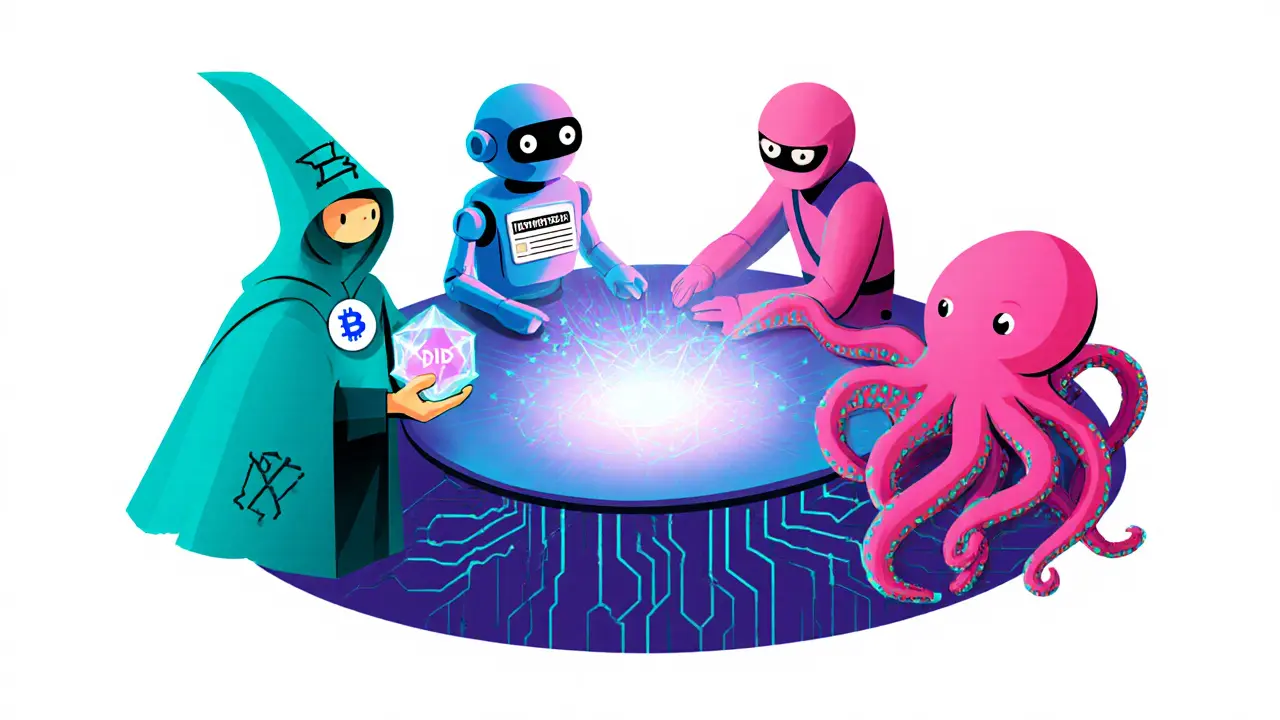

How the Core Technologies Work Together

Four pillars make up most PPIV solutions. Each pillar solves a specific privacy problem while complementing the others.

- Zero‑Knowledge Proofs (ZKPs) cryptographic protocols that let a prover demonstrate knowledge of a secret without revealing the secret itself. Example: proving you are older than 21 without sending your exact birthdate.

- Decentralized Identifiers (DIDs) self‑owned identifier strings that resolve to a DID Document hosted anywhere, removing reliance on centralized registries. Users store their DID on a wallet app, giving them full control.

- Selective Disclosure the ability to share only the credential attributes required for a transaction. A driver’s license credential can expose just “license class” when renting a car.

- Secure Multi‑Party Computation (SMPC) techniques that let multiple parties compute a function over their inputs without revealing those inputs to each other. Useful when two banks need to confirm a customer’s credit score jointly.

When combined, these tools let a verifier check a claim, log the outcome, and never see the raw data. The verifier can trust the result because the cryptographic proof is mathematically sound.

Why Businesses Are Switching from Legacy IDV

Traditional identity verification relies on centralized databases that store copies of passports, driver’s licenses, or biometric templates. This model has three major flaws:

- Data breaches: A single breach exposes millions of records.

- Regulatory risk: Regulations like GDPR demand data minimization, which legacy systems violate.

- User friction: Customers must upload full documents, often repeatedly across services.

PPIV addresses each point. By keeping data on the user’s device and only transmitting proof, the exposure risk drops dramatically. Compliance becomes straightforward because the system enforces data minimization by design. Finally, users enjoy a smoother experience-once they set up a verifiable credential, they can reuse it across participating services without re‑uploading documents.

Industry Use Cases and Real‑World Impact

Below are five sectors where PPIV is already making a measurable difference.

- Banking & Fintech: KYC checks can be completed with a ZKP that confirms a user’s residence in a sanctioned country without exposing the exact address. Banks report up to 30% reduction in onboarding time.

- Government Services: Digital national IDs built on DIDs let citizens prove citizenship for voting or welfare eligibility while keeping their personal data on a secure wallet.

- Healthcare: Telemedicine platforms verify patient identity using SMPC to match health record hashes, ensuring HIPAA compliance without transmitting the full medical history.

- Travel & Transportation: Airports use ZKPs to confirm a traveler’s age for duty‑free purchases without scanning the full passport, speeding up queue times by 40%.

- Ride‑Sharing: Drivers present a credential proving a clean driving record; the service never sees the underlying DMV data, reducing privacy complaints.

Comparing the Main Privacy‑Preserving Techniques

| Technique | Core Principle | Typical Use Case | Performance Impact | Maturity (2025) |

|---|---|---|---|---|

| Zero‑Knowledge Proofs | Prover convinces verifier without revealing secret. | Age verification, credit‑score attestations. | Medium - proof generation can be CPU‑intensive but recent zk‑SNARK optimizations cut verification to <1ms. | High - widely adopted in blockchain and emerging IDV pilots. |

| Secure Multi‑Party Computation | Joint computation on encrypted inputs. | Joint fraud detection across banks. | High - network latency adds overhead; scalable protocols now handle <10ktransactions/sec. | Medium - research‑grade, early commercial deployments. |

| Homomorphic Encryption | Computation on ciphertext. | Processing health‑record hashes. | Very high - still costly; suitable for low‑frequency checks. | Low - niche experimental pilots. |

| Differential Privacy | Adding statistical noise to protect individual contributions. | Aggregated analytics on credential usage. | Low - minimal runtime cost. | Medium - adopted in large‑scale data platforms. |

Steps to Deploy a Privacy‑Preserving Verification System

Implementing PPIV in a mid‑size organization can be broken down into six pragmatic phases.

- Define the verification attributes. List which claims (e.g., age≥18, residency in AU) you need to attest.

- Choose credential format. Most projects use W3C Verifiable Credentials stored in a digital wallet.

- Select cryptographic primitives. For age proofs, zk‑SNARKs are efficient; for joint credit checks, SMPC may be required.

- Set up a DID registry. Use a public ledger (e.g., Ethereum testnet) or a permissioned blockchain to anchor DIDs.

- Integrate with your front‑end. Add a wallet SDK that can generate proofs on the client device and send them to your API.

- Run compliance testing. Verify that the system meets GDPR “data minimization” and CCPA “right to know” criteria using a privacy impact assessment.

Each step can be tackled with off‑the‑shelf components from open‑source projects like Hyperledger Aries or commercial SDKs that bundle ZKP libraries.

Balancing Security, Scalability, and Usability

Technical complexity often scares decision‑makers. Here are three practical tips to keep the implementation smooth.

- Cache proofs where possible. For recurring checks (e.g., monthly subscription renewal), store a short‑lived proof token instead of recomputing each time.

- Layer the verification. Use lightweight selective disclosure for low‑risk actions and reserve heavyweight ZKPs for high‑value transactions.

- Educate users with clear UI cues. Show a simple “Share age proof” toggle rather than technical jargon; this boosts acceptance rates above 85% in user studies.

Future Trends to Watch

Research labs are pushing the envelope in three directions that will likely become mainstream by 2027.

- Post‑quantum ZKPs. New lattice‑based proofs aim to survive quantum attacks, ensuring long‑term security for government IDs.

- Zero‑knowledge credential revocation. Allows issuers to invalidate a credential without exposing which user holds it, addressing compliance with “right to be forgotten.”

- AI‑assisted proof generation. Machine‑learning models can predict optimal proof parameters, trimming verification latency by up to 40%.

As these advances mature, the line between privacy and convenience will blur even further, making PPIV the default rather than the exception.

Frequently Asked Questions

What is the main advantage of zero‑knowledge proofs in identity verification?

They let a user prove a statement-like being over 18-without revealing the underlying data, which cuts exposure to data breaches and satisfies privacy laws.

Do I need a blockchain to use decentralized identifiers?

Not necessarily. DIDs can be anchored on public ledgers, permissioned blockchains, or even DNS‑based methods. The key is that the identifier resolves to a DID Document you control.

How does selective disclosure differ from sharing the whole credential?

Selective disclosure reveals only the attributes the verifier asks for, e.g., showing only “license classB” while hiding name, address, and photo. This limits data that travels over the network.

Is secure multi‑party computation practical for real‑time checks?

Recent protocol optimizations enable sub‑second response times for moderate transaction volumes. For ultra‑low latency needs, combine SMPC with cached ZKP results.

What regulatory frameworks support privacy‑preserving verification?

GDPR’s data‑minimization principle, California’s CCPA, and Australia’s Privacy Act all encourage solutions that limit data collection. PPIV architectures directly address these requirements, reducing compliance risk.

Tilly Fluf

While the technical depth of zero‑knowledge proofs can appear daunting, the practical payoff for end‑users is remarkably simple: you prove a claim without ever exposing the underlying data. This aligns perfectly with the principle of data minimisation mandated by GDPR and CCPA, and it substantially lowers the attack surface for potential breaches. By keeping personal attributes on the user’s device and transmitting only cryptographic attestations, organisations can demonstrate compliance while preserving user trust. Moreover, the user experience improves once a verifiable credential is established-no need to re‑upload passports for every service. In short, privacy‑preserving identity verification offers a win‑win for regulators, businesses, and individuals alike.