For citizens in Bangladesh, trading cryptocurrency isn’t just risky-it’s legally dangerous. Since 2017, the Bangladesh Bank has banned all cryptocurrency activity: buying, selling, holding, or even mining Bitcoin or USDT is illegal. No exceptions. No gray areas. Yet, despite this, thousands of people still trade crypto every day. Why? Because the rules haven’t stopped the behavior-they’ve just pushed it underground, where the risks get worse.

Legal Consequences Are Real

If you’re caught trading crypto in Bangladesh, you’re not just breaking a rule-you’re violating the Anti-Money Laundering Act. Authorities have prosecuted people for using international exchanges like Binance and KuCoin. Even though these platforms remain accessible on the Google Play Store and Apple App Store, that doesn’t mean you’re safe. The government doesn’t need to block apps to enforce the ban. They just need to track your bank transactions, phone records, or payment receipts. One woman in Dhaka lost her business license and was fined 2 million BDT after her bank flagged recurring transfers to a crypto agent. No trial. No warning. Just a notice from the bank and a summons from the Financial Intelligence Unit.

How People Get Crypto-And Why It’s Dangerous

Most Bangladeshis don’t use regulated exchanges. They can’t. Instead, they rely on two methods: international cards or local agents. Using a Visa or Mastercard linked to a foreign currency account sounds easy, but it leaves a digital trail. Banks monitor outbound transfers. If you send $5,000 to Binance, your account gets flagged. Your bank might freeze your account. You might be forced to explain where the money came from. If you can’t, you risk criminal charges.

The more common route? Local agents. These are people-often shop owners, delivery drivers, or even students-who act as middlemen. You give them 100,000 BDT. They give you 0.85 BTC or 85,000 USDT. They pocket a 5-10% spread. Sounds simple? It’s not. These agents operate without contracts, without ID checks, and without oversight. Many disappear overnight. Others overcharge you by manipulating prices. In 2024, over 200 people in Chittagong lost more than $1.2 million to fake agents who vanished after collecting cash. No police report helped. No court could recover the money. The law doesn’t protect you because the activity itself is illegal.

2025’s New Rules Made Things Worse

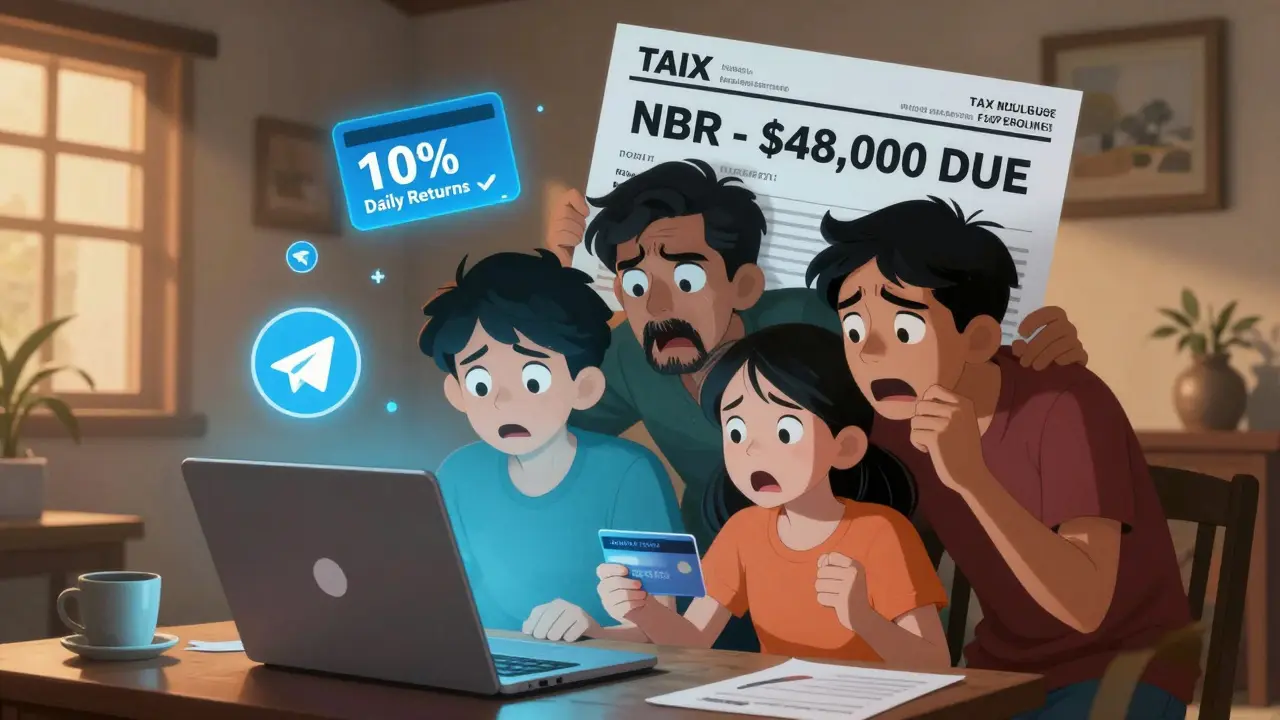

In early 2025, the government rolled out a new digital identity system requiring biometric verification for all financial apps. On paper, it was meant to stop fraud. In practice, it broke the underground economy. Local exchanges lost 30% of their users in one week. Why? Because the system blocked access to crypto apps unless you verified your face and fingerprints with government databases. Most traders didn’t want to leave that trail. So they moved to Telegram. Now, thousands of crypto groups run on encrypted channels. No KYC. No oversight. Just direct cash-for-crypto deals. And with no accountability, scams exploded. Fake bots promise 10% daily returns. You send 50,000 BDT. The bot vanishes. No one to call. No one to sue. Just silence.

Taxation? Even If It’s Illegal

You might think, "If it’s illegal, I don’t owe taxes." But the National Board of Revenue doesn’t see it that way. Under the Income Tax Ordinance of 1984, any income-legal or not-is taxable. That means if you bought Bitcoin for 500,000 BDT and sold it for 1.2 million BDT, you owe 30% tax on the profit. But here’s the trap: reporting that profit means admitting you broke the law. So most people don’t file. That leaves them vulnerable to double penalties: prosecution for illegal trading, and fines for unreported income. One trader in Sylhet received a tax notice for $48,000 in crypto gains. He didn’t pay. Three months later, his bank account was frozen. He still hasn’t gotten it back.

Why Neighboring Countries Are Different

Compare Bangladesh to India or Pakistan. India taxes crypto at 30% and deducts 1% at source. It’s strict, but it’s transparent. You know where you stand. Pakistan has even started experimenting with Bitcoin reserves. Bangladesh? No middle ground. No regulated exchange. No legal framework. No tax guidance. Just a flat ban. That forces people into riskier alternatives. You can’t access the safety nets that exist elsewhere. You’re stuck with unregulated agents, encrypted Telegram groups, and zero legal recourse.

Security and Banking Risks

When you trade crypto in Bangladesh, you’re not just risking your money-you’re risking your entire financial life. Banks are forbidden from dealing with crypto-related accounts. If your bank finds out you’ve been sending money to a crypto agent, they can freeze your savings, close your account, and report you to the central bank. That means no more loans. No mortgages. No business credit. One small business owner in Rajshahi lost access to his company’s payroll account after a single crypto transfer. He had to pay his employees in cash for six months.

And what about security? Without regulated platforms, you’re on your own. No two-factor authentication you can trust. No customer support if your wallet gets hacked. No insurance if you lose your private key. You’re using random apps downloaded from sketchy websites. One man in Khulna lost $18,000 after installing a fake crypto wallet from a Telegram link. He thought he was saving money. He ended up losing everything.

The Bigger Picture: Capital Flight and Economic Damage

This isn’t just about individual losses. The underground crypto economy is draining Bangladesh’s currency. In 2025, offshore stablecoin platforms processed over $1.7 billion in Bangladeshi Taka deposits. That’s money leaving the country. It weakens the local currency, fuels inflation, and makes it harder for ordinary people to afford basics like food and fuel. The government calls it capital flight. Economists call it a silent crisis. And it’s growing because the ban isn’t working-it’s just making the system more dangerous.

What Happens Next?

The government shows no sign of changing course. In fact, they’ve doubled down. New surveillance tools are being rolled out to track cryptocurrency-related transactions through mobile payment apps and bank transfers. Mining operations have been outlawed, but hidden farms still run in warehouses in Chittagong. The crackdown is coming. And when it does, the people who took the biggest risks will be the ones who lose the most.

There’s no safe way to trade crypto in Bangladesh right now. Every path leads to higher risk: legal, financial, or personal. The ban didn’t stop crypto-it made it more dangerous. And for the people caught in the middle, the cost isn’t just money. It’s freedom, security, and trust in the system itself.

Is it legal to buy Bitcoin in Bangladesh?

No. The Bangladesh Bank banned all cryptocurrency transactions in 2017. This includes buying, selling, holding, or mining Bitcoin and other digital assets. Any activity involving crypto is considered illegal under anti-money laundering laws. Violators can face prosecution, fines, or asset freezes.

Can I get arrested for trading crypto in Bangladesh?

Yes. While enforcement isn’t consistent, there have been multiple documented cases of people being arrested and prosecuted for crypto trading. Authorities use bank transaction logs, mobile payment records, and agent networks to identify offenders. Charges typically fall under the Anti-Money Laundering Act, which carries criminal penalties.

What happens if my bank finds out I traded crypto?

Your bank is legally required to report any suspicious transactions related to crypto. If they detect transfers to known crypto platforms or agents, they may freeze your account, close it, or report you to the Financial Intelligence Unit. This can lead to loss of access to savings, loans, or business accounts. In some cases, it triggers criminal investigations.

Do I have to pay taxes on crypto profits in Bangladesh?

Yes, according to the National Board of Revenue. Even though crypto trading is illegal, the Income Tax Ordinance of 1984 applies to all income, regardless of legality. If you make a profit from crypto, you’re legally required to report it. But reporting means admitting to breaking the law, creating a dangerous legal trap with potential double penalties.

Why are people still trading crypto if it’s banned?

Many people trade crypto because they see it as a way to protect savings from inflation, access global markets, or send money abroad without high remittance fees. The ban hasn’t stopped demand-it’s just forced trading underground. People use local agents, Telegram groups, and international platforms with weak verification. The risks are higher, but the perceived benefits still drive participation.

Are there any safe ways to trade crypto in Bangladesh?

No. There are no legal, regulated, or safe ways to trade cryptocurrency in Bangladesh. All current methods-whether through agents, Telegram, or international exchanges-carry severe legal, financial, and security risks. The government has not indicated any plans to legalize or regulate crypto in the foreseeable future.

perry jody

Bro, I get it - crypto’s the only way out when your local currency’s falling apart 🤷♂️ But man, the risks in Bangladesh? Wild. I’ve seen friends lose everything to sketchy agents. No safety net, no recourse. It’s like playing Russian roulette with your life savings.