Setting up a crypto mining operation in 2025 isn’t like buying a graphics card and plugging it in. It’s a serious business decision that requires upfront cash, technical know-how, and a realistic view of electricity costs. If you’re thinking about mining Bitcoin or another cryptocurrency, you need to know what you’re getting into-because most people lose money before they even turn on their first rig.

Hardware: ASICs Are the Only Real Option for Bitcoin

Forget using your gaming PC or laptop. In 2025, Bitcoin mining is dominated by ASIC miners-specialized machines built for one thing: solving SHA-256 hashes. GPUs are still used for mining altcoins like Ethereum Classic or Ravencoin, but for Bitcoin, ASICs are non-negotiable. Models like the Antminer S21 Pro or Whatsminer M66S are the current standards. These machines cost between $2,000 and $17,000, depending on their hash rate and efficiency.

Efficiency matters more than raw power. Look at the joules per terahash (J/TH) rating. A miner using 22 J/TH is better than one using 30 J/TH-even if the slower one costs less. Why? Because electricity eats up 80% of your operating costs. A miner that’s 25% more efficient could save you thousands over its lifespan.

Don’t forget the supporting gear. You’ll need a high-wattage PSU (Power Supply Unit) with at least 20% more capacity than your miner’s max draw. A 3,000-watt miner needs a 3,600-watt PSU. Cheap PSUs fail under load, and when they do, they can take your ASIC with them. Budget $50-$300 for a solid one.

Location, Location, Location: Electricity Costs Decide Everything

Here’s the hard truth: if your electricity bill is over $0.12 per kWh, Bitcoin mining is probably not profitable for you. In places like California, Germany, or Australia’s eastern states, the math rarely works. But in Perth, where industrial power rates hover around $0.08-$0.10 per kWh, there’s a real shot.

Use a mining profitability calculator-sites like WhatToMine or CryptoCompare let you plug in your hardware, electricity rate, and current network difficulty. You’ll see your break-even point. Most ASICs take 12 to 24 months to pay for themselves under ideal conditions. If your power is too expensive, that number could stretch to 3+ years. And if Bitcoin’s price drops during that time? You’re stuck with a very expensive space heater.

Don’t ignore cooling. ASICs run hot-like, 80°C hot. If your room hits 30°C, your miner’s efficiency drops. Basic fans cost $50-$500. But if you’re running more than five rigs, consider passive cooling in a well-ventilated garage or, if you’re serious, immersion cooling in mineral oil. That can cost $10,000+, but it cuts noise and power use by 15%.

Software and Setup: It’s Simpler Than You Think

Once the hardware arrives, assembly is straightforward. Most ASICs come pre-assembled. You just plug in the power, connect the Ethernet cable, and turn it on. But the real work starts with software.

You don’t pay for mining software. Free options like CGMiner, Awesome Miner, and Cudo Miner do the job. But here’s where beginners mess up: they pick the wrong OS. Windows 10 is fine for one miner. But if you’re running five or more, switch to HiveOS or RaveOS. These Linux-based systems are built for mining. They let you monitor all your rigs from a dashboard, auto-restart failed units, and update firmware remotely. No need to touch each machine physically.

Set up a cryptocurrency wallet before you start. Use a non-custodial wallet like Electrum for Bitcoin. Never leave your coins on an exchange. Mining rewards go straight to your wallet address, and if you use a service that holds your keys, you’re trusting someone else with your money.

Join a Mining Pool-Don’t Go Solo

Solo mining? That’s like buying one lottery ticket every week and expecting to win the jackpot. Bitcoin’s network difficulty is so high that even a top-tier ASIC might only find a block once every 18 months on its own. That’s not a business-it’s gambling.

Join a mining pool. Pools combine the hash power of hundreds or thousands of miners. When the pool finds a block, rewards are split based on how much work each miner contributed. You get small, consistent payouts-usually daily or hourly.

Popular pools include F2Pool, AntPool, and Slush Pool. Look for pools with low fees (under 2%), reliable payout thresholds (under 0.01 BTC), and good uptime. Set up your worker name and password in your mining software, point it to the pool’s server address, and you’re done.

What You’re Not Thinking About: Noise, Heat, and Long-Term Risk

ASICs sound like jet engines. Even with fans, a single unit can hit 80 decibels. Five of them in your garage? Your neighbors will complain. Soundproofing with acoustic foam or building an external shed adds $500-$5,000. But if you’re mining at home, it’s worth it.

Then there’s risk. Bitcoin’s price can swing 20% in a week. Mining difficulty resets every two weeks, usually upward. Hardware fails. Cooling systems break. Your power company might raise rates. And if you’re mining in a country with unclear crypto regulations-like Australia-you could face sudden legal changes.

Most home miners quit within 18 months. Not because they didn’t make money. But because they didn’t plan for the grind. Mining isn’t passive income. It’s a 24/7 job that requires monitoring, maintenance, and constant learning.

Is It Worth It? The Hard Numbers

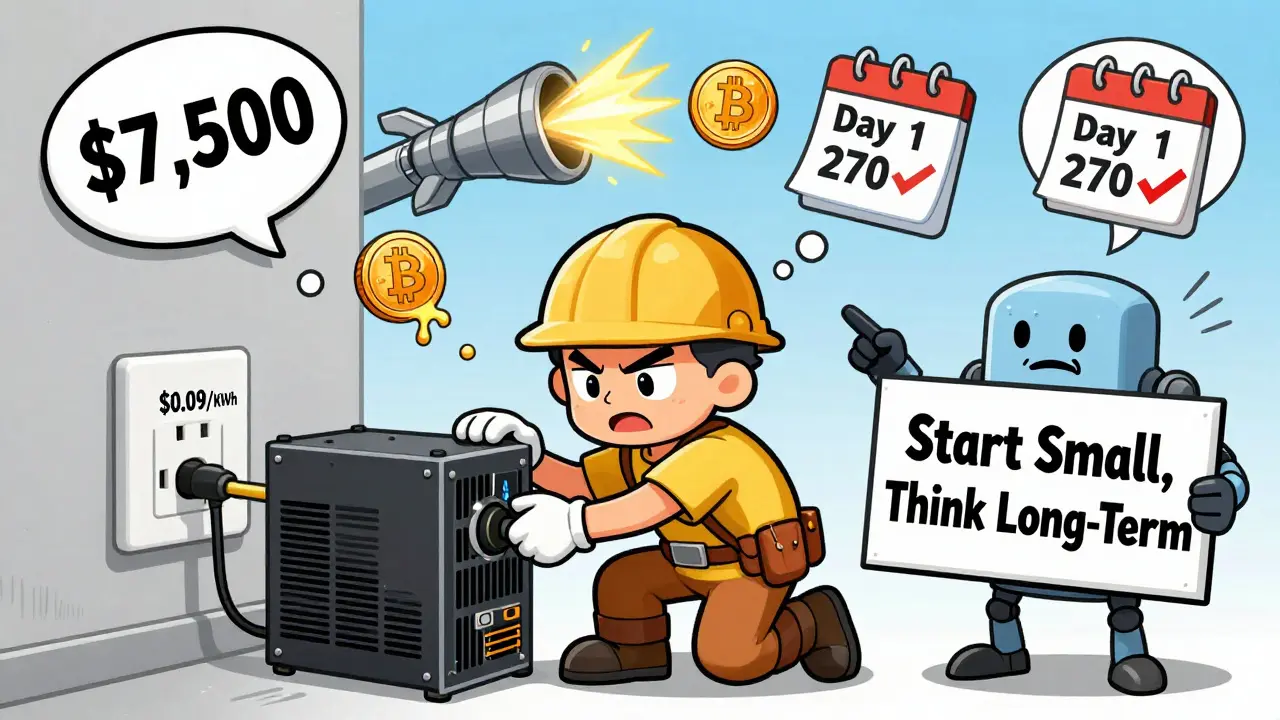

Let’s say you buy an Antminer S21 Pro ($7,500), a 3,600W PSU ($200), and install basic cooling ($300). Total upfront: $8,000.

It uses 3,250W at full load. At $0.09/kWh in Perth, that’s $7.02 per day in electricity. Monthly: $210.

At current difficulty and Bitcoin price ($72,000), you’ll earn about 0.0006 BTC per day. That’s roughly $43/day. Profit before costs: $36/day. After electricity: $36 - $7 = $29/day. That’s $870/month.

At that rate, you break even in 9 months. After that, pure profit. But this assumes Bitcoin stays above $65,000, difficulty doesn’t spike, and your miner doesn’t die early.

Now imagine your electricity rate jumps to $0.14. Your profit drops to $12/day. Break-even stretches to 18 months. And if Bitcoin crashes to $40,000? You’re losing money.

Final Advice: Start Small, Think Long-Term

If you’re serious, start with one ASIC. Test the setup. Monitor your power bill for a month. See how hot your space gets. Learn how to use HiveOS. Join a pool. Wait six months. Then decide if you want to scale.

Don’t go all-in on day one. Don’t buy used miners unless you know their hours and warranty status. Avoid cloud mining contracts-they’re almost always scams. And never mine on your phone or laptop. That’s just wasting electricity.

Crypto mining in 2025 isn’t for hobbyists. It’s for people who treat it like a factory. If you’re willing to learn, monitor, and adapt, it can work. But if you’re looking for easy money? You’re already too late.

Can I mine Bitcoin with a regular computer or GPU in 2025?

No. Bitcoin mining requires ASIC hardware. GPUs are too slow and use too much electricity for the reward. Even high-end gaming cards like the RTX 4090 can’t compete with a single ASIC miner. You’ll spend more on power than you’ll earn in Bitcoin.

How much electricity does a Bitcoin miner use?

A top-tier ASIC like the Antminer S21 Pro uses about 3,250 watts. That’s the same as running 30 LED light bulbs nonstop. At $0.10/kWh, that’s $7.80 per day. If you run five of them, you’re looking at $39 per day-over $1,000 a month just in power.

Is crypto mining legal in Australia?

Yes, mining cryptocurrency is legal in Australia. There are no federal laws banning it. However, local councils may have rules about noise, electrical load, or zoning-especially if you’re running a large setup from home. Always check with your local council before installing multiple ASICs.

What’s the best mining pool for beginners?

Slush Pool is the oldest and most reliable Bitcoin mining pool. It has low fees (2%), pays out daily, and offers clear dashboards for new users. F2Pool is another solid choice with good global support. Avoid pools with hidden fees, irregular payouts, or no customer support.

How long do ASIC miners last?

Most ASIC miners last 3-5 years under continuous operation. But performance degrades over time. After 2 years, efficiency drops 10-15% due to dust buildup and component wear. Regular cleaning and good cooling can extend lifespan. If your miner is older than 3 years, it’s likely no longer profitable unless electricity is extremely cheap.

Can I make money mining altcoins instead of Bitcoin?

Yes, but it’s riskier. Coins like Ethereum Classic, Ravencoin, or Dogecoin can be mined with GPUs and sometimes offer better short-term returns. But their prices are more volatile, and their networks are smaller. If the coin’s value crashes or the community abandons it, your hardware becomes useless. Bitcoin’s network is the most stable-so if you want reliability, stick with it.