Thailand isn’t just letting crypto happen-it’s building a legal house for it. If you’re thinking about launching or using a cryptocurrency exchange in Thailand, you’re not dealing with vague rules or gray areas. The government has laid out a clear, strict, and expensive path. And as of April 2025, that path got even tighter.

Why Thailand’s Rules Are Different

Most countries either ban crypto exchanges or ignore them. Thailand chose a third way: regulate everything. This isn’t about stopping innovation. It’s about controlling it. The Securities and Exchange Commission (SEC) of Thailand is the government body responsible for supervising digital asset businesses, enforcing compliance, and maintaining a public registry of licensed operators has been running this system since 2018, but the latest updates in 2025 made it one of the most detailed frameworks in Southeast Asia.Here’s the bottom line: if you’re serving Thai users, you need a license. No exceptions. Not even if your company is based in Singapore or the U.S. The 2025 amendments closed the loophole that let foreign platforms operate quietly. Now, any exchange-even one hosted in another country-that targets Thai customers must apply for and receive a Thai license. That’s a big deal. It means Thailand is treating crypto like banking. If you want to touch Thai money, you play by Thai rules.

The Three Types of Licenses You Can Get

You can’t just apply for “a crypto license.” Thailand separates digital asset businesses into three main categories, each with its own rules:- Digital Asset Exchange - This is what most people think of: platforms where users trade Bitcoin, Ethereum, and other tokens. This is the most common license type.

- Digital Asset Broker - These firms act as intermediaries between buyers and sellers but don’t hold user funds. Think of them as crypto matchmakers.

- Digital Asset Dealer - These are firms that trade crypto on their own account, often for institutional clients. Very few companies apply for this one.

There are also licenses for ICO portals, custodial wallet providers, fund managers, and advisors-but these are rare. As of 2025, only two companies hold each of those licenses. Why? Because the requirements are even more complex, and demand is low. Most operators focus on exchanges.

The Financial Hurdles Are Real

Let’s get straight to the numbers. This isn’t a startup-friendly system. The upfront cost is brutal:- Minimum share capital: 50 million THB (about $1.4 million USD). This money must be deposited into a Thai bank account before you even submit your application. You can’t use this cash for operations-it’s locked as a guarantee.

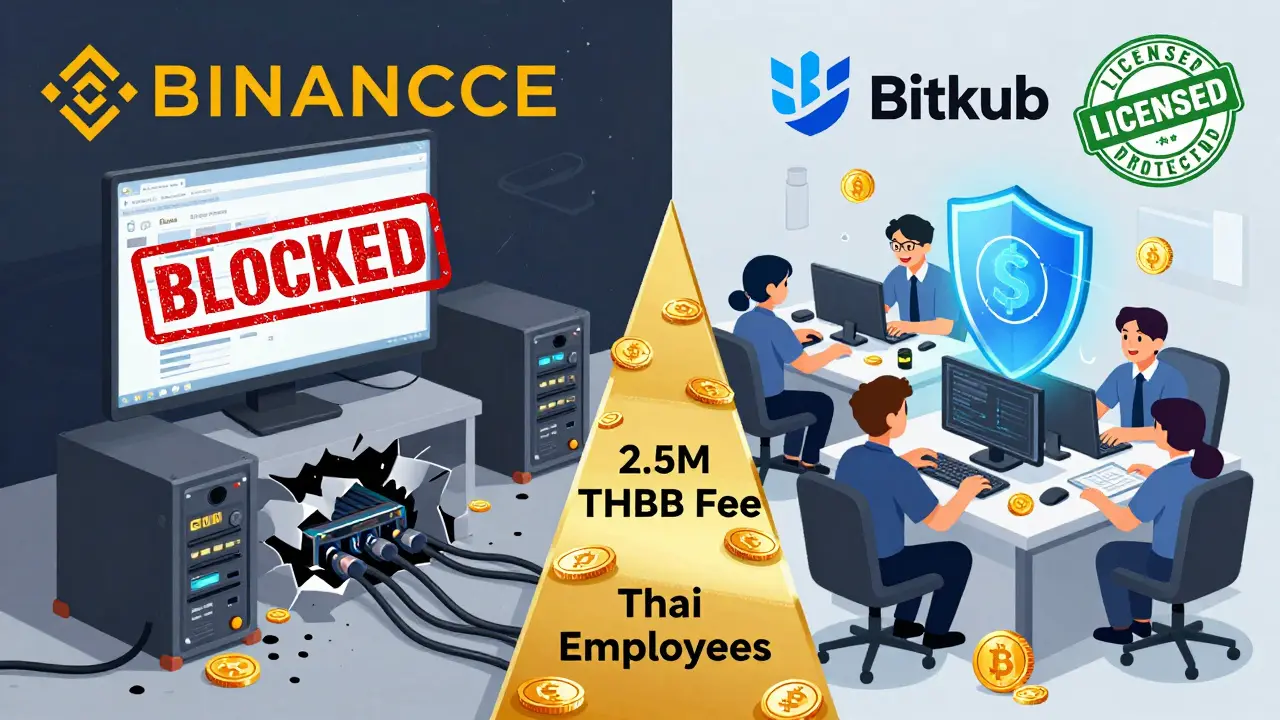

- Licensing fee: 2.5 million THB (around $700,000 USD). This is a non-refundable payment to the Ministry of Finance.

That’s a total of 52.5 million THB (roughly $2.1 million USD) just to apply. And that’s before legal fees, office rent, staff salaries, cybersecurity systems, or compliance software.

Most companies spend an extra $500,000 to $1 million on consultants, audits, and infrastructure before they even file. You need a Thai legal entity, a physical office in Bangkok, at least two Thai employees, local accounting systems, and a fully compliant AML-CFT (anti-money laundering and counter-terrorism financing) program. The SEC doesn’t accept offshore setups. You have to be physically present.

How Long Does It Take?

The official processing time is 150 days. But in reality, it takes 6 to 12 months to even get to that point.Why so long? Because the SEC doesn’t just look at your application-they audit your entire operation. They check:

- Are your KYC (Know Your Customer) procedures foolproof?

- Do your cybersecurity protocols meet Thai standards?

- Can you prove your team has real experience in finance or tech?

- Do your financial projections make sense?

- Is your IT infrastructure hosted in Thailand or with approved providers?

Many applicants get rejected because they didn’t prepare properly. One company spent $800,000 on software, only to find out the SEC required a different data encryption standard. Another lost months because their Thai legal representative didn’t understand the corporate structure requirements. This isn’t paperwork. It’s a full operational rebuild.

Who’s Already Licensed?

As of 2025, Thailand has 12 licensed exchanges, 13 brokers, and 3 dealers. That’s not a lot-but it’s enough. These are the only platforms Thai users can legally trade on. If you’re using any other exchange, you’re doing so without legal protection.Popular local names like Bitkub is one of Thailand’s largest licensed digital asset exchanges, serving over 5 million users with full SEC compliance and Zipmex is a licensed Thai-based exchange that offers crypto trading, staking, and savings products under SEC supervision dominate the market. Foreign exchanges like Binance or Coinbase don’t have Thai licenses, so they can’t legally market to Thai users. If you see an ad for Binance in Thai, it’s against the law.

Users are catching on. The SEC’s website has a public list of licensed operators. People check it before depositing money. That’s how serious this is.

What Happens If You Don’t Get Licensed?

The SEC doesn’t just send warning letters. They shut you down. If you’re operating without a license and serving Thai customers:- Your website can be blocked by Thai ISPs

- Your bank accounts in Thailand can be frozen

- You can be fined up to 5 million THB ($140,000 USD)

- Executives can face criminal charges

There have already been multiple arrests and asset seizures. The government isn’t bluffing. They’ve built this system to protect ordinary people-not to protect businesses.

Is This Good for the Market?

Yes-and no.On one hand, Thailand’s system gives users confidence. When you see the SEC logo on an exchange, you know it’s been audited. You know your funds are protected. You know there’s a legal path if something goes wrong. That’s rare in crypto.

On the other hand, the cost and complexity mean only big players can compete. Local startups with $500,000 in funding can’t make it. That’s why 90% of licensed exchanges are either Thai-owned with foreign investment or international firms with deep pockets.

It’s also why there are so few custodial wallet providers or fund managers. The barriers are too high. The market doesn’t need them yet. But if demand grows, the SEC will likely create simpler tiers for smaller operators.

What’s Next?

The 2025 update was just the beginning. The SEC has already started testing regulatory sandboxes-like one in 2025 that let tourists convert crypto to Thai baht at airports. That’s innovation with guardrails.Next up? DeFi protocols and NFT marketplaces. Right now, those aren’t covered. But experts say it’s only a matter of time. The SEC wants to be ready. They’re watching how Singapore and Hong Kong handle these new areas-and they’re building their own rules.

For now, if you’re serious about crypto in Thailand, you have two choices: pay the price and get licensed, or stay out. There’s no middle ground.

Can a foreign company get a Thai crypto exchange license?

Yes, but only if they set up a legal entity in Thailand with a physical office, Thai employees, and local bank accounts. Foreign ownership is allowed, but operations must be fully localized. The SEC requires the same compliance standards regardless of where the company is headquartered.

Do I need to be Thai to apply for a crypto license?

No, you don’t need to be Thai. But you must have at least two Thai employees on payroll, a registered Thai company, and a physical office in Thailand. The application must be submitted by a Thai legal representative who is responsible for compliance.

What happens if I already operate a crypto exchange without a license?

If you’re serving Thai users without a license, your operations are illegal. The SEC can block your website, freeze your bank accounts, fine you up to 5 million THB, and pursue criminal charges against your executives. You should stop immediately and consult a Thai legal expert to assess your options.

How often does the SEC update its list of licensed exchanges?

The SEC updates its public registry regularly-usually every 1 to 3 months. You can check the official website at sec.or.th to verify if an exchange is licensed. Never trust third-party lists or screenshots.

Are there any alternatives to getting a Thai license?

No. If you’re targeting Thai users, there’s no legal workaround. Even if you host servers overseas or use a different language, if Thai residents can access your platform, you’re subject to Thai law. The 2025 amendments made this crystal clear.