Bitcoin moves slowly. Every transaction takes at least 10 minutes to confirm, and for full security, you need six blocks - that’s over an hour. For traders, exchanges, and institutional investors, that’s not just inconvenient - it’s expensive. Missed opportunities, locked capital, and public transaction amounts make Bitcoin’s main chain a poor fit for high-volume, high-stakes trading. Enter the Liquid Network, a sidechain built to solve exactly these problems - without touching Bitcoin’s core security.

What Is the Liquid Network?

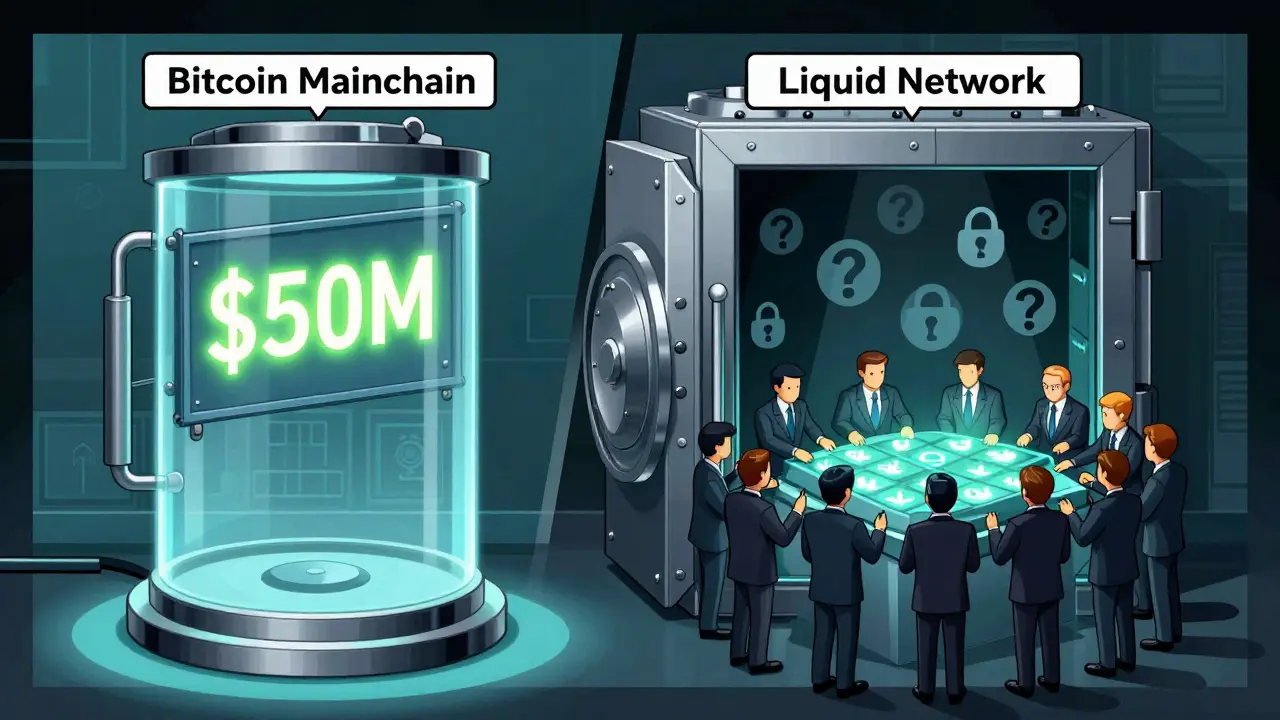

The Liquid Network is a Bitcoin sidechain launched in October 2018 by Blockstream. It’s not a new cryptocurrency. It’s not an altcoin. It’s Bitcoin - but faster, more private, and capable of issuing digital assets. Every L-BTC (Liquid Bitcoin) is backed 1:1 by real BTC locked on the Bitcoin mainchain. If you send 1 BTC to Liquid’s peg-in address, you get 1 L-BTC in return. When you want your BTC back, you burn the L-BTC and the original BTC is released. This system is called a two-way peg, and it’s verified by a federation of trusted parties.This isn’t a trustless system like Bitcoin. Liquid uses a federation of 73 financial institutions - including Kraken, Bitfinex, Coinbase Prime, and Swissquote - to validate blocks. At least 11 out of 15 active functionaries must sign each block. That’s centralized by Bitcoin standards, but it’s far more secure than most altcoins. And for institutions that need speed and privacy, it’s the trade-off they’re willing to make.

Why Liquid Is Faster Than Bitcoin

Bitcoin’s block time is 10 minutes. Liquid’s is 1 minute. That means transactions settle in 1-2 minutes instead of 60+. For an exchange moving millions in BTC daily, that’s the difference between losing money on slippage and locking in a profit.Here’s how it works: When you send L-BTC to another user on Liquid, the transaction is confirmed within 60 seconds. No waiting. No mempool congestion. No fee spikes. Liquid’s block time and smaller network size mean it doesn’t suffer from the same bottlenecks as Bitcoin. Independent tests show Liquid handles about 1,000 transactions per second - compared to Bitcoin’s 7. Fees? Around $0.35 per transaction, versus Bitcoin’s $1.50 average. That’s not just cheaper - it’s predictable.

Confidential Transactions: Hiding the Amount

On Bitcoin, anyone can see how much you sent. If you transfer 50 BTC, the whole world knows. That’s fine for personal use. Not fine for a hedge fund moving $20 million. Liquid fixes this with Confidential Transactions (CT), a cryptographic system that hides the transaction amount while still proving it’s valid.How? Instead of showing the numbers, CT uses blinding factors and cryptographic commitments. The network verifies that the inputs equal the outputs - without revealing what those numbers are. This means institutions can trade, settle, and transfer assets without tipping off competitors or the public. Tether, for example, issues $420 million worth of USDT on Liquid - all with hidden amounts. SIX Digital Exchange in Switzerland has tokenized $1.2 billion in equities using the same tech.

Issuing Tokens on Liquid

Bitcoin can’t issue tokens. Not without workarounds. Liquid can. It supports asset issuance natively. Companies can create their own tokens - stablecoins, security tokens, NFTs - and peg them to real-world value. These aren’t ERC-20 tokens on Ethereum. They’re native assets on Liquid, with the same security guarantees as L-BTC.Over $500 million in tokenized assets are already live on Liquid. That includes:

- USDT (Tether) - issued as a Liquid asset

- Tokenized bonds and equities from SIX Digital Exchange

- Private equity tokens from venture funds

- Commodity-backed tokens like gold and oil

These assets move at Liquid speed, with confidential amounts, and settle in minutes. No need for a separate blockchain. No need to trust a different network. Just use Bitcoin’s value as the foundation.

Liquid vs. Lightning Network

People often compare Liquid to the Lightning Network. Both aim to make Bitcoin faster. But they’re fundamentally different.Lightning is a layer-2 payment channel. It’s decentralized. It’s for micropayments. You open a channel, send dozens of off-chain transactions, then close it on-chain. But you can’t issue tokens. You can’t do confidential transactions. And if you need to move $10 million, you’re not opening a Lightning channel - you’re using Liquid.

Liquid is on-chain. It’s federated. It’s for institutional-grade transfers. It supports asset issuance. It hides amounts. It settles in 1 minute. Lightning settles in seconds - but only for small, frequent payments between known parties. Liquid is for moving large sums, privately, with full auditability.

Liquid vs. Other Sidechains

There are other Bitcoin sidechains - like Rootstock (RSK). RSK runs Ethereum smart contracts. That’s useful if you need DeFi or NFTs. But RSK doesn’t have Confidential Transactions. Its block time is 30 seconds - faster than Liquid - but its federation is smaller and less institutional. Liquid has more exchange participation, more assets issued, and stronger privacy.Mercury Protocol is a newer entrant, but it’s still small. Liquid holds 78% of the Bitcoin sidechain market share. It’s the de facto standard for institutional Bitcoin infrastructure.

Who Uses Liquid - And Why?

Liquid isn’t for casual users. It’s for professionals.- Exchanges: Bitfinex, Kraken, and BitMEX use Liquid for 89% of their BTC trading volume. Why? Faster settlements mean less counterparty risk and tighter spreads.

- Stablecoin issuers: Tether issues USDT on Liquid to avoid Bitcoin’s slow confirmations and public ledgers.

- Securities platforms: SIX Digital Exchange tokenizes stocks and bonds on Liquid because it’s the only Bitcoin-based system that offers privacy, speed, and regulatory compliance.

- Private wealth managers: Some use Liquid to move large BTC holdings without revealing transaction sizes to the public.

Individual users? Only the technically savvy. Most retail wallets don’t support Liquid. You need a compatible wallet like Blockstream Green, Jade, or AQUA. And you need to understand the peg-in process.

How to Use Liquid: Peg-In and Peg-Out

Getting started isn’t hard - but it’s not instant.To get L-BTC:

- Send BTC from your Bitcoin wallet to a Liquid peg-in address (provided by your Liquid wallet).

- Wait for 102 Bitcoin confirmations - about 17 hours.

- Your L-BTC appears in your Liquid wallet.

To get BTC back:

- Send L-BTC to a peg-out address in your Liquid wallet.

- Wait for 2 Liquid confirmations - about 2 minutes.

- The BTC is released on the Bitcoin network.

Most failures happen when users think the peg-in is instant. 102 confirmations is non-negotiable. Blockstream reported 127 cases in Q1 2024 where users panicked and canceled transactions too early.

Pros and Cons of Liquid

Pros:- 1-minute transaction finality

- Confidential transaction amounts

- Native asset issuance (stablecoins, securities)

- Low fees - around $0.35 per tx

- Used by major exchanges and institutions

- Backed by Blockstream’s strong technical team

- Federated model = centralization risk

- No smart contracts (unlike RSK or Ethereum)

- Peg-in takes 17 hours - not ideal for quick swaps

- Complex for beginners

- Depends on federation honesty - if 11 members collude, they could steal funds

Jameson Lopp, CTO of Casa, puts it bluntly: “You’re trading Bitcoin’s censorship resistance for speed and privacy.” That’s the core trade-off.

What’s Next for Liquid?

Liquid isn’t standing still. Blockstream has a clear roadmap:- Liquid v2 (Q3 2024): Uses Schnorr signatures to reduce transaction size by 25% and improve privacy.

- Taproot Assets (Q4 2024): Will allow even more private asset issuance using Bitcoin’s Taproot upgrade.

- RGB Protocol Integration (Q1 2025): Could bring limited smart contract capabilities - not full Ethereum-style, but enough for tokenized securities and escrow.

- More federation members: Coinbase Prime and Swissquote joined in April 2024, increasing geographic diversity.

Galaxy Digital predicts Liquid’s total value locked (TVL) will hit $3.5 billion by 2026. Right now, it’s $1.87 billion - still just 0.8% of Bitcoin’s market cap. But for institutional Bitcoin use, it’s already indispensable.

Is Liquid the Future of Bitcoin?

No. Bitcoin’s future is decentralized, permissionless, and trustless. Liquid isn’t that. But Bitcoin’s future also needs institutional adoption. And institutions won’t move billions on a 10-minute blockchain with public ledgers.Liquid isn’t replacing Bitcoin. It’s extending it. It’s the bridge between Bitcoin’s security and traditional finance’s need for speed, privacy, and asset issuance. It’s not for everyone. But for exchanges, asset managers, and traders - it’s the only viable option today.

If you’re a Bitcoin holder who wants to trade large amounts without revealing your moves, or if you’re an institution looking to tokenize assets on a secure, Bitcoin-backed chain - Liquid is the tool you need. Just understand the trade-offs. You’re not getting Bitcoin’s full decentralization. But you’re getting something far more valuable in practice: real-world utility.

Is Liquid Network a cryptocurrency?

No. Liquid Network is a Bitcoin sidechain. It doesn’t have its own currency. The native asset is L-BTC, which is always 1:1 backed by Bitcoin on the mainchain. L-BTC isn’t a new coin - it’s Bitcoin in a faster, more private form.

Can I use Liquid with my Coinbase or Binance account?

Not directly. Coinbase and Binance don’t offer native Liquid wallets. But Kraken, Bitfinex, and BitMEX do. If you’re trading on those exchanges, you can use Liquid internally. To use Liquid outside exchanges, you need a compatible wallet like Blockstream Green, Jade, or AQUA.

How secure is Liquid compared to Bitcoin?

Bitcoin is more secure because it’s fully decentralized. Liquid relies on a federation of 73 institutions. As long as at least 11 of the 15 active functionaries don’t collude, the network is secure. But if 11 or more act maliciously, they could steal funds or halt the network. That’s a trade-off for speed and privacy.

Why does peg-in take 17 hours?

Peg-in requires 102 Bitcoin confirmations to prevent double-spending attacks. That’s about 17 hours because Bitcoin blocks take 10 minutes each. This long wait ensures the BTC you’re locking is fully settled on the mainchain before L-BTC is issued. It’s a security measure - not a bug.

Can I send L-BTC to a regular Bitcoin address?

No. L-BTC only exists on the Liquid Network. Sending it to a Bitcoin address will result in permanent loss. Always use a Liquid-compatible wallet and confirm you’re sending to a valid Liquid address (it starts with ‘lq’).

Is Liquid regulated?

Liquid itself isn’t regulated - it’s a protocol. But assets issued on Liquid (like USDT or tokenized stocks) may be subject to regulations like the EU’s MiCA framework. Exchanges using Liquid must comply with KYC/AML rules. The network doesn’t enforce compliance - users and issuers do.

What wallets support Liquid?

Officially supported wallets include Blockstream Green (free, multi-platform), Jade (hardware wallet, $79), and AQUA (web-based, free). Some third-party wallets like Electrum with Liquid plugins also work. Avoid wallets that don’t explicitly list Liquid support.

Can Liquid replace the Lightning Network?

No. They serve different purposes. Lightning is for fast, small, peer-to-peer payments - like buying coffee or tipping. Liquid is for large, institutional transfers with privacy and asset issuance. You can use both - they’re complementary.

Does Liquid support smart contracts?

Not yet. Liquid doesn’t run Ethereum-style smart contracts. But future upgrades like RGB protocol integration (planned for Q1 2025) will allow limited programmable asset logic - like escrow, multi-signature releases, or token vesting - without full Turing completeness.

What happens if the Liquid federation shuts down?

If the federation stops signing blocks, new transactions stop. But your funds aren’t lost. You can still initiate a peg-out to recover your BTC - as long as you have the private keys to your L-BTC. Blockstream has contingency plans to allow users to reclaim BTC even if the federation becomes inactive.

Jennah Grant

Liquid’s Confidential Transactions are a game-changer for institutional trading. No more exposing your $20M moves to the whole blockchain sleuthing community. CT + 1-minute finality = institutional dream stack. The federation model is a necessary evil - better than altcoin rug pulls any day.

And yes, peg-in taking 17 hours is brutal, but it’s not a bug. It’s a feature. Bitcoin’s security model demands that. If you want instant swaps, go use an exchange - don’t cry when your sidechain doesn’t act like a centralized bank.

Also, Tether issuing USDT on Liquid? Genius. No more public ledger scrutiny on stablecoin flows. That’s the real value prop - privacy without sacrificing Bitcoin’s base layer security.