Before September 2025, owning or trading Bitcoin in Jordan was a legal gray area. You could buy crypto on international exchanges, send it via P2P apps, or even mine it in your garage - but no one was officially allowed to run a crypto business there. That changed with the passage of Law No. 14 of 2025, the Virtual Assets Transactions Regulation Law. This wasn’t just a tweak to old rules. It was a complete reversal: from outright ban to full regulation. And now, everything hinges on whether you’re licensed or not.

What the Law Actually Says

The law doesn’t ban crypto. It bans unlicensed crypto activity. If you’re a Jordanian citizen using Binance or Coinbase from your phone? Still legal. But if you set up a local exchange, run a crypto ATM, or even advertise a crypto service to people in Jordan - you need a license. The Jordan Securities Commission (JSC) is now in charge. They’re the gatekeepers. And they’re strict.

Under this law, any virtual asset service provider - that’s exchanges, wallet providers, staking platforms - must be formally registered. The definition of "taking place within the territory" is broad: if you market to Jordanians, have a local office, or process payments in Jordanian dinars, you’re under JSC jurisdiction. Even if your server is in Singapore, you’re still subject to Jordanian law if you target its 11.1 million people.

Violations? They’re not a slap on the wrist. The law spells out a minimum one-year prison sentence and fines up to JOD 100,000 (about $141,000). That’s not just for big operators. It applies to anyone running a small crypto service without approval. In a country where the average monthly salary is around JOD 500, this penalty is designed to scare off amateurs.

Who’s in Charge and What They Require

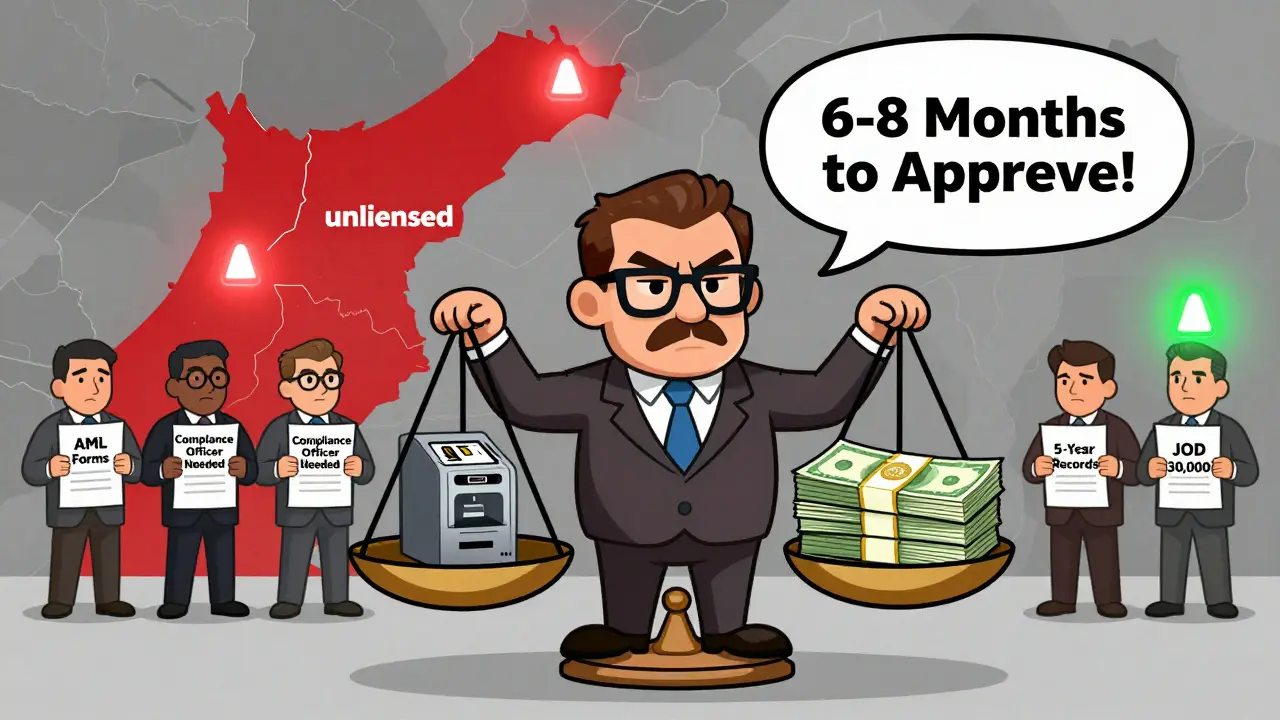

The JSC doesn’t just hand out licenses. They demand full compliance with Jordan’s AML/CFT Law No. 46 of 2007. That means every licensed business must:

- Verify the identity of every customer (Customer Due Diligence)

- Apply extra scrutiny for politically exposed persons (PEPs)

- Monitor all transactions in real time

- Report any suspicious activity to the Anti-Money Laundering Unit (AMLU)

- Keep records for five full years

- Appoint a dedicated AML compliance officer

- Follow the Travel Rule - sharing sender and receiver info on transactions over JOD 10,000

There’s no wiggle room. Even if you’re a startup with three employees, you still need a full compliance system. The JSC estimates it takes most firms 6 to 8 months to get everything in order. And the cost? It’s steep. The licensing process alone costs JOD 30,000 ($42,250) in non-refundable fees: JOD 5,000 for the application, JOD 15,000 for document review, and JOD 10,000 for the final operational check. That’s more than most Jordanian startups make in their first year.

How It Compares to Neighbors

Jordan isn’t the first in the region to regulate crypto. The UAE has had a clear, multi-layered system since 2020. Bahrain launched its own sandbox in 2022. But Jordan’s approach is different. It’s not trying to be Dubai. It’s trying to fix a problem.

In 2023, Jordan landed on the FATF grey list because regulators couldn’t track crypto flows. Money laundering risks were high. The country’s informal crypto market - mostly peer-to-peer trades over WhatsApp and Telegram - was growing fast. With an estimated 1.2 million users (10.8% of the population), Jordan had one of the highest crypto adoption rates in the Arab world. But zero oversight.

So Jordan did something rare: it didn’t try to stop adoption. It tried to control it. Unlike Kuwait, Egypt, or Iraq - which still ban crypto outright - Jordan created a legal pathway. But it didn’t make it easy. The goal wasn’t to attract big investors. It was to close the loopholes that made the country vulnerable.

Compare that to the UAE, where over 500,000 people trade crypto daily on licensed platforms. Jordan’s market is still mostly informal. Only 15% of users use international exchanges. The rest rely on P2P networks. That’s why the JSC is focused on bringing those underground flows into the light - not on competing with Abu Dhabi.

Who’s Struggling and Why

The biggest pain point? The sudden shift. Before 2025, many Jordanians were already running crypto services - quietly. Now, they’re told: "You’ve been illegal for years, and now you have to pay $42,000 to become legal."

Local exchange operators say the biggest hurdle isn’t the rules - it’s the lack of clarity. The licensing fees are published. The compliance requirements are detailed. But the minimum capital requirement? Still not announced. One CEO of a pre-2025 crypto platform told CoinTelegraph Middle East: "We’ve spent months preparing documents. But we can’t move forward until we know how much cash we need to keep in reserve."

There’s also a skills gap. A September 2025 survey by the Jordan Fintech Association found that 73% of startups couldn’t set up proper transaction monitoring tools. They didn’t have the tech. And they didn’t have the people. The National Employment Council reported a 40% shortage of professionals trained in blockchain compliance. There aren’t enough AML officers. Not enough blockchain auditors. Not enough lawyers who understand crypto law.

Even the JSC’s own help desk - launched to assist applicants - has a 68% satisfaction rate. Users complain of slow responses, confusing forms, and language barriers. While support is available in both Arabic and English, many small business owners say the process feels designed for lawyers, not entrepreneurs.

The Real Impact on Users

For regular people, the law hasn’t changed much - yet. You can still buy Bitcoin. You can still send it. You can still hold it. The law targets businesses, not individuals.

But the indirect effects are real. Before 2025, you could use local P2P platforms to buy crypto with cash. Now, those platforms have shut down or gone dark. Some users report longer wait times and higher prices on international exchanges because fewer local liquidity providers exist.

Reddit threads like r/CryptoJordan show mixed reactions. "Finally, a legal framework," says one user. "But that $141,000 fine? That’s a jail sentence for a guy trying to make rent."

Another user, a blockchain developer, said: "The regulation will attract real investors. But right now, it’s just another wall between us and growth."

Social media sentiment analysis from the Jordan Digital Economy Monitor found 62% of users support the clarity - but 78% fear it will crush small businesses. That’s a big red flag. If the law scares off the very people who built the market, it could stall adoption for years.

What’s Next?

The government isn’t done. In early 2026, the ministerial committee announced plans to regulate DeFi platforms - things like lending protocols and automated yield farms. That’s a logical next step. If you regulate exchanges, you have to regulate the services that connect to them.

Even more interesting: the Central Bank of Jordan is preparing to launch its own Central Bank Digital Currency (CBDC) by late 2026. That’s not crypto. It’s a digital version of the Jordanian dinar. And it’s being built on the same infrastructure the JSC just created.

There’s also talk of making Jordan a hub for Sharia-compliant digital assets. With 42 Islamic financial institutions already operating in the country, it’s not far-fetched. Imagine halal crypto staking, asset-backed tokens compliant with Islamic finance rules - it’s possible. And Jordan is one of the few countries in the region that could pull it off.

But none of this matters if the JSC can’t handle the load. Right now, only 12 staff members are assigned to virtual asset oversight. The IMF says capacity building is critical. Without more trained inspectors, auditors, and analysts, the system could collapse under its own weight.

Standard & Poor’s gives Jordan an 82% chance of success over five years - but only if they get off the FATF grey list. That’s the real metric. Not how many licenses are issued. Not how much money is raised. But whether international watchdogs believe Jordan can actually enforce its own rules.

Bottom Line

The Central Bank of Jordan didn’t ban crypto. It didn’t embrace it. It controlled it. The 2025 law is a response to pressure - not ambition. It’s a fix for a problem, not a vision for the future. And it’s working - slowly.

If you’re a Jordanian citizen, you can still trade crypto. But if you want to build a business around it, you’re entering a high-stakes game. The rules are clear. The costs are high. The penalties are brutal. And the people enforcing them? They’re still learning.

The real test won’t come in 2026. It’ll come in 2028. Will Jordan’s crypto market grow? Or will it shrink under bureaucracy? Will the JSC become a model - or a cautionary tale? Right now, it’s too early to say. But one thing’s certain: Jordan’s crypto policy isn’t about freedom. It’s about control. And that’s not going to change anytime soon.

Is it illegal to own Bitcoin in Jordan?

No, it’s not illegal to own Bitcoin or any other cryptocurrency in Jordan. The law targets businesses and service providers - not individual users. You can still buy, hold, and send crypto through international exchanges like Binance or Coinbase. The restrictions only apply if you operate a local exchange, wallet service, or crypto business within Jordan without a license.

What happens if I run a crypto exchange without a license?

You face serious legal consequences. Under Law No. 14 of 2025, operating an unlicensed virtual asset service in Jordan can lead to a minimum one-year prison sentence and fines up to JOD 100,000 (about $141,000). This applies even if you’re a small operator or just started out. The law doesn’t make exceptions for beginners or startups. Enforcement is strict, and authorities are actively shutting down unlicensed platforms.

How much does it cost to get licensed in Jordan?

The total cost to apply for a license through the Jordan Securities Commission is JOD 30,000 (approximately $42,250). This includes a JOD 5,000 preliminary application fee, a JOD 15,000 compliance documentation review fee, and a JOD 10,000 operational readiness assessment fee. These are non-refundable. In addition, businesses must cover ongoing compliance costs - like AML software, staff training, and audits - which can add tens of thousands more per year.

Can I still use P2P crypto apps in Jordan?

Yes, peer-to-peer (P2P) trading is still allowed. Many Jordanians use apps like LocalBitcoins, Paxful, or Telegram groups to trade crypto directly with others. As long as you’re not running a business or advertising services to the public, these personal transactions aren’t regulated. However, large or frequent P2P trades may attract scrutiny from the Anti-Money Laundering Unit, especially if they exceed JOD 10,000 in value.

Will Jordan’s crypto policy change again soon?

Yes, changes are expected. The government has already announced plans to regulate decentralized finance (DeFi) platforms by Q1 2026. Additionally, the Central Bank of Jordan is preparing to launch its own Central Bank Digital Currency (CBDC) in late 2026. These moves suggest the regulatory framework is still evolving. Expect tighter rules on lending, staking, and algorithmic trading in the coming months. The focus remains on closing gaps - not expanding freedom.

Central Bank of Jordan crypto policy has shifted from prohibition to control. It’s not about banning crypto - it’s about making sure no one can hide behind it. The road ahead is long, and the stakes are high.