BIT.com Fee Calculator

Calculate Your BIT.com Trading Fees

Enter your trading details above to see potential fees.

BIT.com is a high-risk exchange with no regulatory oversight. Never deposit more than you're willing to lose.

BIT.com isn’t another crypto exchange trying to look like Binance or Coinbase. It was built by the same team behind Bitmain - the company that made the chips powering most of the world’s Bitcoin miners. That means this isn’t some startup guessing at what traders want. It’s a platform designed by people who’ve spent years understanding how crypto markets move, especially when it comes to Bitcoin options.

Launched in August 2020, BIT.com quickly became a powerhouse in derivatives trading. By 2021, it was handling over $6 billion in Bitcoin options volume every day - second only to Deribit. That’s not luck. It’s engineering. The platform is backed by Matrixport, a $1 billion fintech firm that handles everything from lending to custody for institutional clients. So if you’re looking for a place that treats crypto like real finance, not just gambling, BIT.com has the pedigree.

What You Can Trade on BIT.com

BIT.com doesn’t mess around with basic spot trading alone. It’s built for people who want to go deeper. You’ve got:

- Spot trading - 65 pairs, including BTC, ETH, SOL, and USDT. Leverage up to 1:7.69.

- Futures - 110 pairs with leverage up to 1:100. All are USDT-margined, so no need to worry about price swings in your collateral.

- Options - Only three pairs, but they’re all Bitcoin. And they’re the reason BIT.com became famous. You can buy calls and puts with precise strike prices and expiry times, just like a Wall Street trader.

Most exchanges treat options like an afterthought. BIT.com treats them like its main product. If you’re hedging a long BTC position or betting on volatility, this is one of the few platforms where you can do it with real precision.

Fees and Pricing Structure

BIT.com uses a VIP tier system. The more you trade, the lower your fees. Here’s what you’ll pay as a regular user:

- Spot trading fees: 0.06% maker, 0.06% taker (no difference)

- Futures trading fees: 0.04% maker, 0.01% taker

That’s competitive. For futures, it’s cheaper than Binance and Kraken. Spot fees are average, but if you trade over $5 million a month, you drop to 0.04% on both sides. That’s institutional-level pricing.

Minimum deposit? $20. Minimum withdrawal? $10. That’s low enough for most retail traders. You can deposit BTC, ETH, USDT, or any of the 50+ coins they support. No fiat deposits - you’ll need to use a third-party bank partner to convert USD, AUD, or EUR into crypto first.

Security and Risk Controls

BIT.com doesn’t rely on cold storage alone. It has a two-tier protection system:

- Proprietary liquidation engine: Uses real-time risk modeling to close positions before they blow up. This isn’t just a simple price trigger - it factors in portfolio volatility, market depth, and correlation between assets.

- Insurance fund: Holds over 200 BTC as of 2025. That’s worth roughly $12 million at current prices. This fund covers losses if a trader’s position liquidates and there’s not enough margin left.

They also have something called Portfolio Margin. Instead of calculating risk on each trade separately, it looks at your whole portfolio. If you’re long BTC and short ETH, it knows those might offset each other. That means you can trade more with less collateral - a huge advantage for advanced traders.

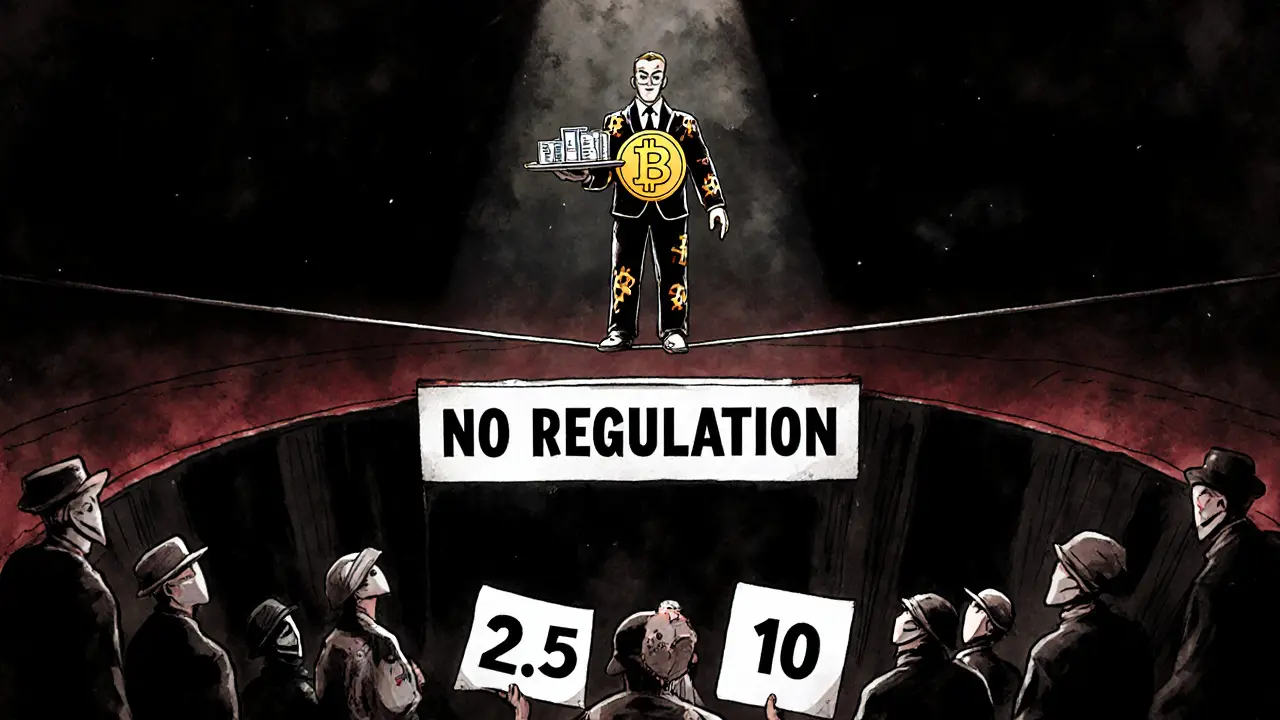

But here’s the catch: Traders Union, an independent watchdog, gave BIT.com a 2.61 out of 10. That’s alarmingly low. Why? Because of the restrictions.

Who Can’t Use BIT.com (And Why It Matters)

BIT.com blocks users from over 20 countries - including the United States, Canada, Singapore, Japan, Hong Kong, and even Australia. That’s not a typo. If you’re in Australia, you’re blocked. Same if you’re in the UK, Germany, or Brazil.

Why? Because BIT.com operates under Singapore’s financial regulations, but it doesn’t have licenses in most other jurisdictions. Instead of getting licensed everywhere, they just say no. That’s a red flag for anyone who values legal protection. If something goes wrong - say, your funds get frozen or a withdrawal fails - you have no recourse in your home country’s courts.

It’s also why they’re labeled high-risk. No regulatory oversight means no transparency. No audit reports. No public proof of reserves. You’re trusting a company that doesn’t answer to any government.

Copy Trading and Affiliate Program

Despite the restrictions, BIT.com has built a strong community of traders. Their copy trading platform lets you follow top performers. If you copy a manager who makes 15% monthly returns, you can earn up to 15% of their profits. That’s rare on crypto exchanges - most only offer flat referral bonuses.

The affiliate program is even more aggressive. You can earn up to 80% of the trading fees from people you refer. That’s not sustainable long-term, but it’s a powerful incentive to bring in new users. Many traders on Telegram and Reddit are pushing BIT.com hard because of this.

Mobile App and Tools

The web interface is clean, fast, and packed with charts. The mobile app (iOS and Android) matches it. You get real-time alerts, one-click trading, and access to all order types: limit, market, stop-limit, trailing stop, and even OCO (One-Cancels-the-Other).

They also offer:

- API access: Full REST and WebSocket APIs for algorithmic traders.

- Cloud mining: Rent hash power directly from BIT.com’s mining partners.

- RMM (Risk Management Model): Pre-built strategies for hedging, arbitrage, and volatility plays.

Customer support is available 24/7 via live chat, Telegram, and email. Response times are usually under 10 minutes during peak hours.

Is BIT.com Right for You?

Here’s who should consider BIT.com:

- You’re an experienced trader who understands options and futures.

- You’re outside the U.S., Canada, Singapore, Japan, or other restricted regions.

- You want to trade Bitcoin options with low fees and deep liquidity.

- You’re comfortable with zero regulatory protection.

Here’s who should avoid it:

- You’re in the U.S., Canada, or any other blocked country.

- You’re new to crypto and just want to buy Bitcoin and hold it.

- You need legal recourse if something goes wrong.

- You prefer exchanges with public audits and licensed operations.

BIT.com is not a beginner’s exchange. It’s a tool for people who know what they’re doing. If you’re trading derivatives, especially Bitcoin options, it’s one of the best platforms out there. But you’re trading on a high-wire without a safety net. No government watches over it. No insurance fund protects you if the exchange fails. You’re trusting the team behind it - and that’s a big leap.

Final Thoughts

BIT.com is a technical marvel. The infrastructure, the liquidity, the options pricing - it’s world-class. But it’s also a black box. You can’t see inside. You can’t ask for documents. You can’t complain to a regulator. That’s the trade-off.

If you’re outside the restricted zones and you’re serious about derivatives, BIT.com deserves a look. But never deposit more than you’re willing to lose. And always keep a backup wallet. This isn’t a bank. It’s a trading floor - and the rules are written by the house.

Is BIT.com legal in Australia?

No, BIT.com does not allow users from Australia. Despite being based in Singapore and operating under its regulations, the platform has explicitly blocked access from Australia, along with over 20 other countries including the U.S., Canada, and Japan. There is no legal pathway for Australian residents to use BIT.com, and attempting to bypass restrictions via VPN violates their terms of service and could result in account suspension.

Can I trade Bitcoin options on BIT.com?

Yes, BIT.com is one of the few exchanges offering Bitcoin options trading with real market depth. As of 2025, they support three Bitcoin options pairs, all margined in USDT. You can set strike prices, choose expiry times, and trade both calls and puts. The platform was ranked #2 globally in Bitcoin options volume in 2021 and still maintains strong liquidity for this product.

What are the fees on BIT.com?

Spot trading fees are 0.06% for both makers and takers. Futures trading fees are lower: 0.04% for makers and 0.01% for takers. These fees drop further as you move up the VIP tiers, with the highest tier (VIP 9) paying as low as 0.04% for spot and 0.01% for futures. There are no deposit fees, but withdrawal fees vary by cryptocurrency - check their fee schedule for exact amounts.

Does BIT.com have a mobile app?

Yes, BIT.com offers official mobile apps for both iOS and Android. The apps support all core features: spot and futures trading, options, portfolio margin, copy trading, and API access. The interface mirrors the web platform, with real-time charts, order placement, and 24/7 customer support via Telegram and live chat.

Is BIT.com safe to use?

BIT.com has strong technical security - including a $12 million insurance fund and advanced liquidation systems - but it lacks regulatory oversight. Independent watchdogs like Traders Union rate it as high-risk due to its lack of public audits, no license in most countries, and refusal to serve major markets. It’s safe from a technical standpoint, but not from a legal or compliance standpoint. Only use it if you understand and accept that risk.

What’s the minimum deposit on BIT.com?

The minimum deposit is $20 USD equivalent in any supported cryptocurrency. You can deposit as little as 0.00001 BCH, 0.0005 ETH, 0.01 ETC, or 0.001 LTC. There’s no minimum for USDT or BTC deposits. Withdrawals require a minimum of $10 USD equivalent.

Does BIT.com offer fiat deposits?

No, BIT.com does not accept direct fiat deposits like USD, AUD, or EUR. You must first buy crypto on a fiat-to-crypto exchange (like CoinSpot or Kraken), then transfer it to your BIT.com wallet. The platform only supports cryptocurrency deposits and withdrawals.

Can I copy trade on BIT.com?

Yes, BIT.com has a copy trading platform where you can follow professional traders. You can choose from a list of money managers, and if they make a profit, you earn up to 15% of their gains. Managers can also earn commissions from followers. This feature is popular among users who want exposure to expert strategies without managing trades themselves.

Jane A

This platform is a scam waiting to happen. No regulation? No oversight? You think you're trading Bitcoin but you're really just handing your keys to a bunch of guys in Singapore who don't answer to anyone. I've seen this movie before. Remember Mt. Gox? Same energy.