Cyprus Crypto Transaction Compliance Calculator

Results will appear here after calculation

When you think of Cyprus and crypto, you might picture sunny beaches, low taxes, and a thriving startup scene. But behind the scenes, the country’s banks have quietly built some of the strictest controls on crypto transactions in the EU. If you’re running a crypto business in Cyprus-or trying to move money between crypto and euros-you need to understand the real rules, not the marketing.

Why Cyprus Banks Are Tightening the Noose on Crypto

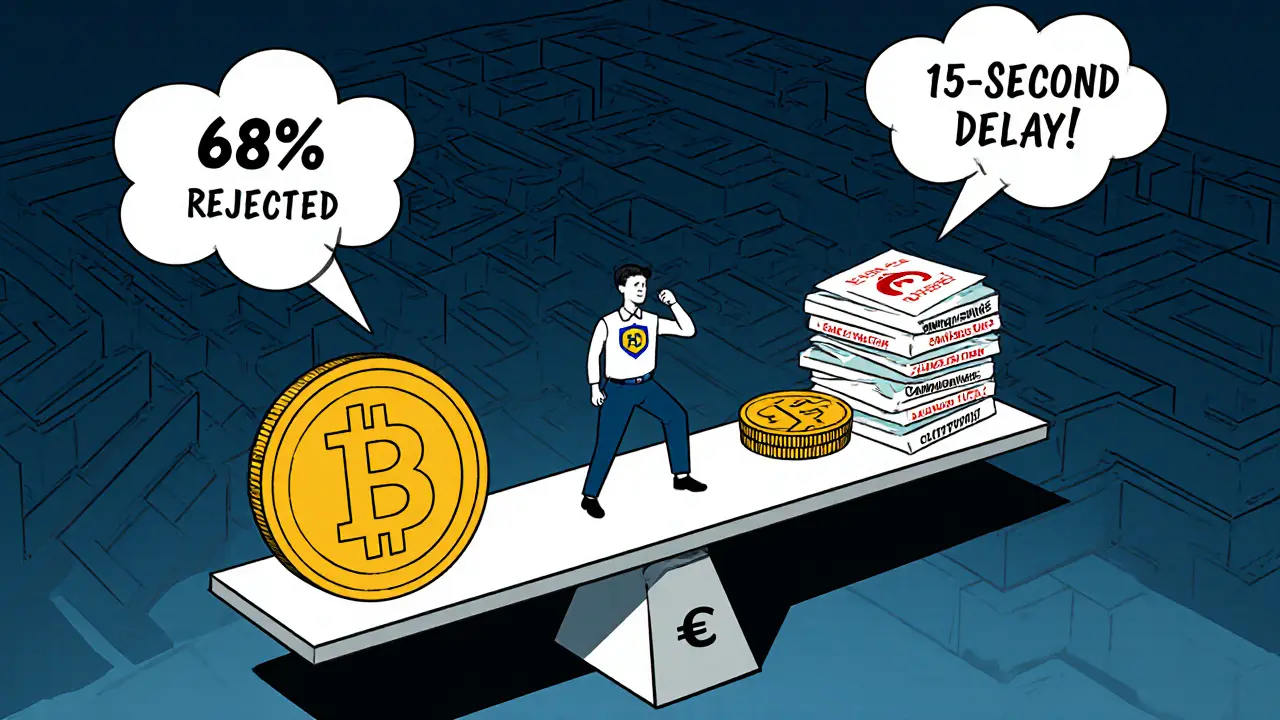

Cyprus doesn’t ban crypto. In fact, it’s one of the few EU countries that doesn’t tax capital gains on crypto sales. But that doesn’t mean banks are welcoming crypto businesses with open arms. The truth is, banks in Cyprus are scared. Not of crypto itself, but of getting fined millions for breaking EU anti-money laundering (AML) laws. Since June 2025, every bank operating in Cyprus has been legally required to treat crypto-asset service providers (CASPs) like any other financial institution. That means if you’re a crypto exchange, wallet provider, or trading platform, you’re now under the same watchful eye as a bank. The Cyprus Securities and Exchange Commission (CySEC) registered 87 CASPs by mid-2025, but getting a bank account? That’s still a nightmare for most. The Central Bank of Cyprus (CBC) has made it clear: cryptocurrencies are not legal tender. They’re not money. They’re assets. And when you try to move them into or out of a bank account, the system treats it like a high-risk transaction. That’s why 68% of crypto businesses in Cyprus reported trouble opening or keeping a bank account, according to a Q2 2025 survey by the Cyprus Blockchain Association.The Travel Rule: The Hidden Gatekeeper

The biggest change came with the EU’s Transfer of Funds Regulation (TFR), which Cyprus implemented in June 2025. This is called the Travel Rule. And it’s the main reason your crypto transfers are slower, harder, and more paperwork-heavy than ever. Here’s how it works: if you send more than €1,000 in crypto from one wallet to another, the bank or exchange must verify the identity of both the sender and receiver. That means your name, ID number, and address must travel with the transaction-just like a wire transfer. This isn’t optional. It’s mandatory. And it’s not just for exchanges. If you’re using a self-hosted wallet (like MetaMask or Ledger) and try to deposit crypto into a Cypriot bank, the bank will freeze the transaction until they can verify who you are. Many users report delays of 3-7 days while banks scramble to check names against EU sanctions lists. The Unit for Combating Money Laundering (MOKAS) received over 1,200 suspicious transaction reports from CASPs in just the first three months after the rule went live.Real-Time Checks and the 15-Second Delay

Banks in Cyprus now have to verify the beneficiary of every crypto transaction in real time. That sounds fast, but it’s not. Early trials showed transaction processing times increased by 15-20 seconds per transfer. For businesses moving hundreds of transactions a day, that adds up to hours of lost productivity. The system works like this: when you initiate a crypto-to-euro conversion, your bank pulls up a live check with CySEC’s registry to confirm the sender is a licensed CASP. If they’re not registered, the transaction is blocked. If they are, the bank still needs to match the wallet address to a verified identity. No exceptions. No shortcuts. Fines for getting this wrong are brutal. Banks that fail to verify a transaction can be hit with penalties of up to €5 million-or 10% of their annual turnover, whichever is higher. That’s why most banks would rather say no than risk it.

Who’s in Charge? The Dual-Regulation Maze

Cyprus doesn’t have one regulator for crypto. It has two. CySEC handles everything except electronic money tokens (EMTs). That includes Bitcoin, Ethereum, DeFi tokens, NFTs, and most stablecoins. They’re the ones who license exchanges, enforce AML rules, and audit CASPs. If you’re running a crypto business, you need CySEC approval to operate legally. The Central Bank of Cyprus (CBC) controls EMTs-stablecoins pegged to the euro, like EURS or EURT. They’re the only crypto assets banks are allowed to hold directly. But even then, banks need special permission. And they still have to apply the same Travel Rule checks. This split creates confusion. A business might be approved by CySEC but still get turned down by a bank because the CBC hasn’t cleared their EMT structure. It’s not a bug-it’s a feature. The government wants to control the flow of money tightly, even if it slows things down.The Sanctions Trap: One Wrong Move, One Fine

In September 2025, Cyprus launched its National Sanctions Unit. This is a new government body that watches every crypto transaction for links to sanctioned individuals or countries. It’s not just about Russia or Iran anymore. The unit flags anyone connected to entities on EU or UN lists-even if the connection is indirect. If your wallet address was once linked to a wallet owned by a sanctioned person (even years ago), your bank might freeze your account. You won’t get a warning. You won’t get an explanation. You just wake up to a locked account and a 30-day investigation. This has created a chilling effect. Many crypto entrepreneurs now avoid self-hosted wallets entirely. They use only licensed exchanges, even if it costs them more in fees. Why? Because exchanges handle the sanctions screening for you. It’s easier than fighting with your bank later.

Laura Hall

bro i just tried to cash out 500 euros from my meta mask and my bank froze my account for 10 days. no explanation. no email. just silence. now i’m using kraken like a good little sheep.