Learn how to buy cryptocurrency with Russian rubles in 2025 using P2P platforms, instant card purchases, and trusted exchanges. Avoid scams, understand bank color codes, and navigate KYC requirements with this step-by-step guide.

Learn how to earn free SAND tokens in The Sandbox metaverse airdrop 2025. No purchase needed - just play, create, and earn with one of the biggest blockchain gaming platforms.

BX Thailand was a trusted Thai crypto exchange that shut down in 2020. Learn why it failed, what made it secure, and where to trade now in Thailand.

Safuu (SAFUU) promised 382,945% APY but collapsed to $0.16 by 2025. No rewards, no team, no liquidity. It's a dead crypto scam with no future.

TagCoin (TAG) is a nearly inactive cryptocurrency with a rare central bank license but zero real-world use. Once promoted as a global rewards token, it hasn't traded meaningfully since 2019 and is excluded from major crypto platforms.

Blockchain blocks store transaction data in a secure, immutable format using cryptographic hashes, Merkle trees, and decentralized consensus. Learn how blocks are structured, why data can't be erased, and how new upgrades are cutting storage costs.

By 2025, NFTs in music are no longer hype-they're a practical tool for artists to earn fair royalties and fans to own real value. Discover how blockchain is changing who gets paid, how, and why it matters.

ADEN is a new decentralized derivatives exchange offering gasless trading and near-zero fees. But with untracked volume and no user base, is it viable in 2025? A no-nonsense review.

FstSwap is a fast, low-fee decentralized exchange on BNB Chain, ideal for traders who want quick swaps without high gas costs. No KYC, no middleman - just connect your wallet and trade. Here's what you need to know in 2025.

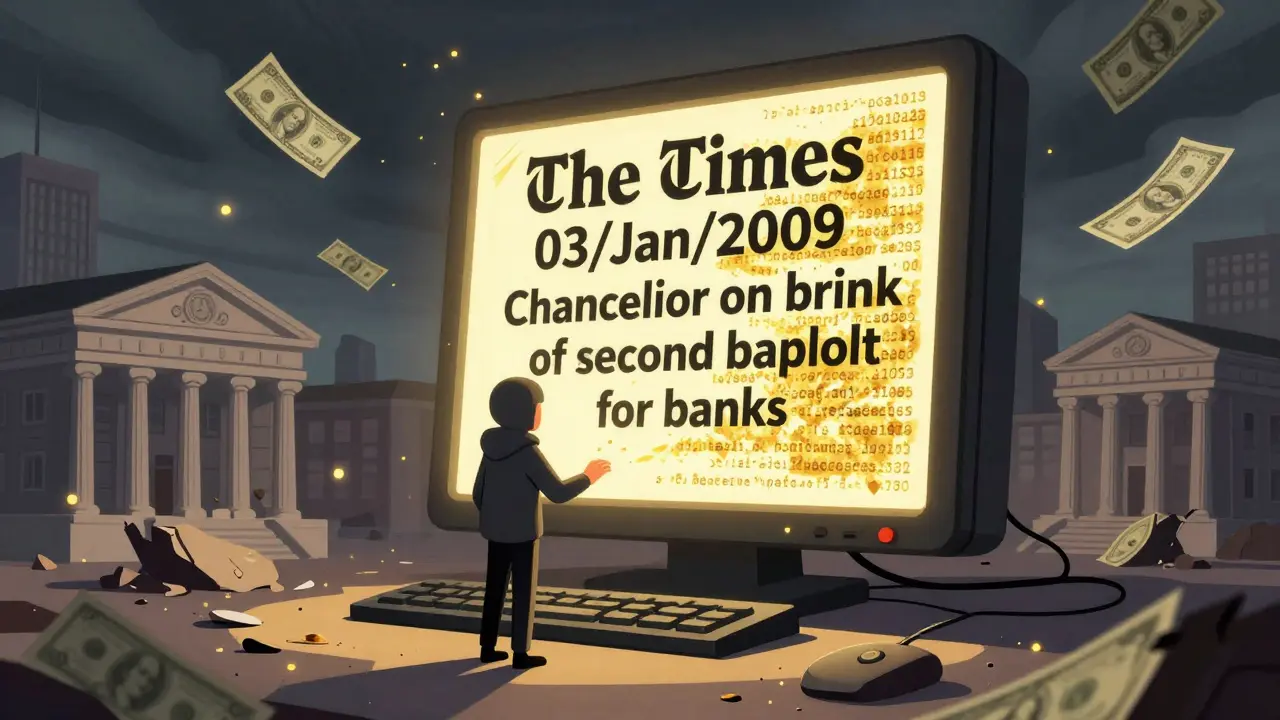

The Genesis Block of Bitcoin contains a hidden message quoting a 2009 newspaper headline about bank bailouts. It's not just a timestamp - it's a political statement that defines Bitcoin's purpose.

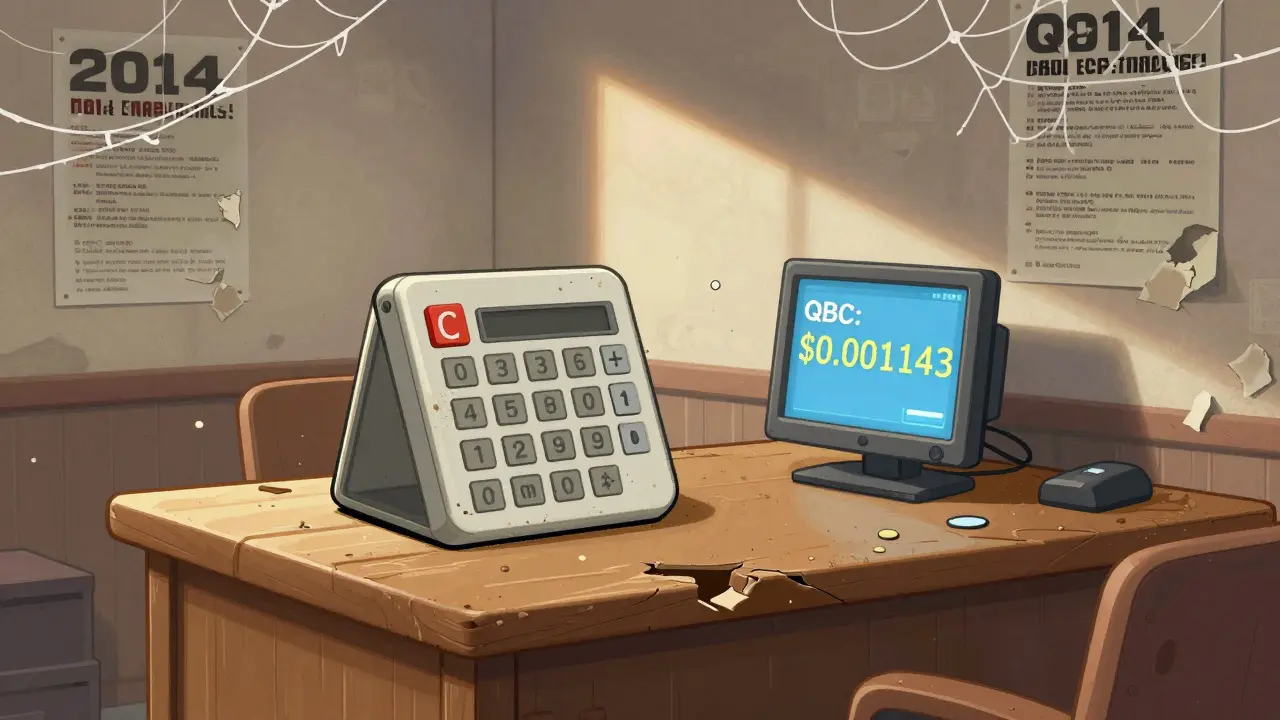

Quebecoin (QBC) is an abandoned cryptocurrency launched in 2014 with no active development, trading, or community. Learn why it failed and why it has no value today.

Learn how to qualify for the Cryptopolis CPO airdrop before the BIG IDO launch in January 2026. Discover the steps, requirements, and real value behind this legitimate Web3 identity project.