RBT Token Airdrop Checker

Enter details about the RBT airdrop claim you've encountered to determine if it's legitimate or potentially fraudulent.

Analysis Result

If you’ve been scrolling through CoinMarketCap and spotted a listing for RBT (Rabbit Token) - a token that currently shows a $0 price and zero volume - you’re probably wondering whether an RBT airdrop is on the horizon. The short answer: the public data is thin, the token looks inactive, and any airdrop claim should be treated with caution. Below we break down everything that is actually known, compare RBT with other rabbit‑themed projects, and give you a practical checklist for spotting a legitimate airdrop.

TL;DR - Quick Takeaways

- RBT lists on CoinMarketCap with 100B total supply, 20B circulating, but no price or volume.

- The listing is in “preview” mode - no official website, socials, or whitepaper linked.

- No credible source has confirmed an upcoming airdrop for RBT.

- Stay wary of scams that mimic airdrop announcements.

- Monitor official channels (if they ever appear) and use a secure wallet like MetaMask.

What Is RBT (Rabbit Token)?

RBT is presented on CoinMarketCap as a token with a massive 100billion total supply and 20billion currently circulating. The listing shows a price of $0 and zero 24‑hour trading volume, indicating that the token is either not listed on any exchange or is in a pre‑launch state. No official website, social media links, or whitepaper are attached to the CoinMarketCap entry, which is unusual for a project that is ready to distribute tokens.

Current Market Status

Because the token shows no trade activity, market data such as market cap, price history, and volume are all blank. This usually means one of three things:

- The token is still in development and hasn’t been deployed on a public blockchain.

- The project has been abandoned or delayed.

- The listing is a placeholder that could be used for future promotional campaigns (including airdrops).

Without a public blockchain address, it’s impossible to verify whether any wallets hold RBT or whether a smart contract for distribution exists. As of October2025, community forums and Telegram groups that usually buzz around airdrops have no mention of an RBT giveaway.

Why the “RBT Airdrop” Rumor Exists

Crypto enthusiasts love airdrops because they’re free tokens handed out to early supporters. The rumor around RBT likely stems from two sources:

- CoinMarketCap’s “preview” badge, which sometimes precedes launch‑phase promotional events.

- Confusion with other rabbit‑themed projects that have actually executed airdrops, such as Rocky Rabbit (RBTC) on the TON network in 2024.

Mixing up projects is common; each token has a distinct ticker and blockchain, but marketing materials often use the same cute rabbit imagery.

How to Verify a Real Airdrop

Before you start filling out Google Forms or sending tiny amounts of ETH to a “verification” address, run through this checklist:

- Official Announcement: Look for a post on the project’s verified Twitter, Medium, or Telegram. A genuine airdrop is always announced by the core team.

- Smart Contract Transparency: A credible airdrop will publish the contract address. You can paste it into a block explorer (e.g., Etherscan) to see the distribution code.

- No Up‑Front Fees: Real airdrops never ask you to pay gas or send tokens before you receive anything.

- Community Verification: Check if reputable crypto communities (r/CryptoCurrency, Bitcointalk) have discussed the airdrop.

- Domain Matching: The project’s website domain should match the socials. Phishing sites often use slight variations (e.g., rabbit‑token.io vs rabbittoken.io).

Comparison With Similar Rabbit‑Themed Tokens

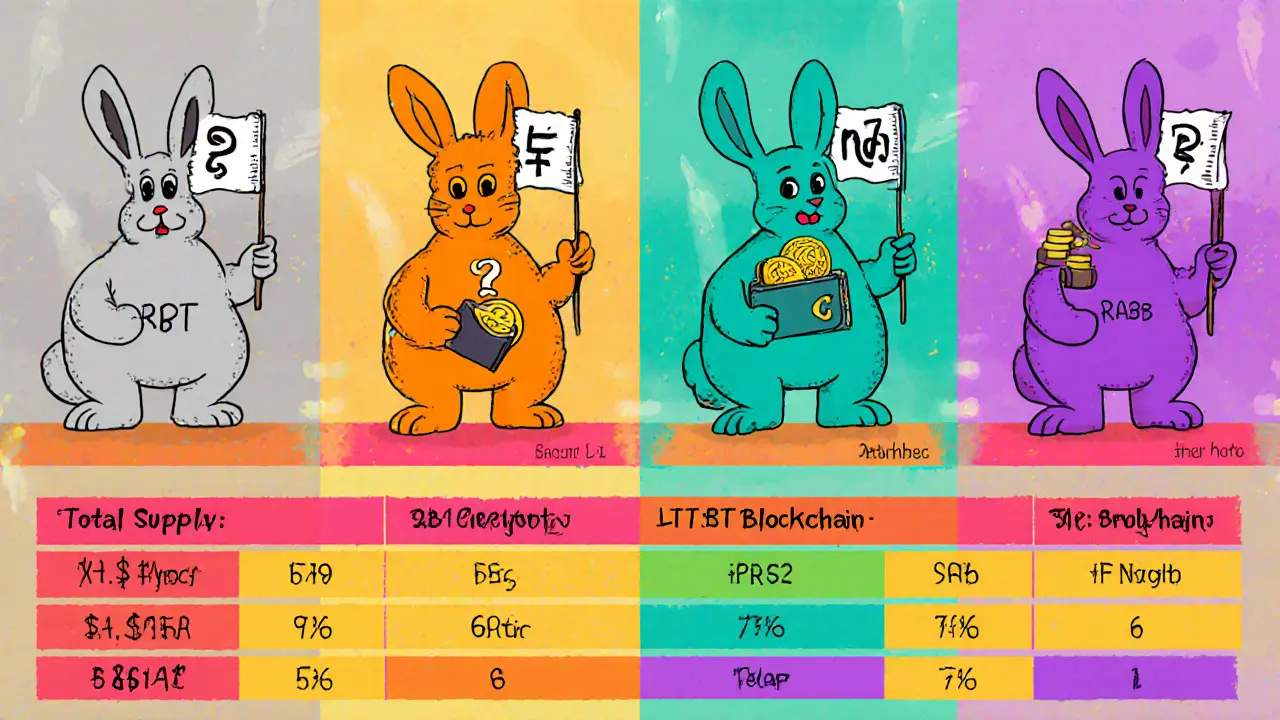

| Token | Total Supply | Circulating Supply | Current Price (USD) | Blockchain | Airdrop Status |

|---|---|---|---|---|---|

| RBT (Rabbit Token) | 100B | 20B | $0 (no market) | Undisclosed (likely BSC/Ethereum) | Unverified / No official info |

| RBTC (Rocky Rabbit) | 500M | 150M | $0.0025 (average) | TON | Completed Sep2024 - 25M participants |

| RAB (Rabbit Wallet) | 100M | 64M | $0.0011 | Ethereum | Occasional promotional airdrops (no schedule) |

| LTRBT (Little Rabbit v2) | 1T | 250M | $0.00000000034 | Binance Smart Chain | No airdrop announced |

Notice how only RBTC has a documented airdrop and a clear price. RBT sits in a gray zone with no on‑chain data, which is a red flag for anyone hunting free tokens.

How to Prepare If an RBT Airdrop Does Appear

Should the RBT team finally publish an official claim link, follow these steps to keep your funds safe:

- Set Up a Secure Wallet: Use a non‑custodial wallet like MetaMask. Never share your private key or seed phrase.

- Connect Only the Needed Network: If the token is on Ethereum, add the custom RPC for the mainnet. If it’s on Binance Smart Chain, switch networks accordingly.

- Verify the Claim Contract: The announcement should include the contract address. Paste it into Etherscan (or BscScan) and check the “Read Contract” tab for a “claim” function.

- Do a Small Test Claim: If the airdrop allows partial claims, request a tiny amount first to ensure the contract works as advertised.

- Avoid Phishing Links: Hover over URLs, check the domain spelling, and copy‑paste the link into a browser instead of clicking directly from a chat.

Red Flags Specific to RBT‑Style Scams

Scammers love obscure tokens because there’s little public data to debunk them. Watch out for these patterns:

- Messages that claim you need to send a "tiny fee" to receive the airdrop.

- Requests for your private key, seed phrase, or any wallet‑exported file.

- Announcements posted only in private Discord groups with no public verification.

- Links that redirect you to a URL ending in .xyz, .tk, or other low‑reputation TLDs.

If any of these appear, walk away. Real projects never ask for private credentials.

Where to Find Reliable Updates

The best way to stay informed is to monitor the few official channels that actually exist for a project. As of now, RBT has no verified Twitter or Telegram, but you can set up Google Alerts for "RBT token" and "Rabbit Token airdrop". Also consider following reputable crypto news sites like CoinDesk, The Block, and CryptoSlate; they will usually cover any major airdrop launch.

Bottom Line

RBT looks more like a placeholder token on CoinMarketCap than an active project ready to hand out free coins. Until the core team publishes verifiable information - a website, a contract address, and a clear airdrop roadmap - treat any claim of an RBT airdrop with skepticism. Use the safety checklist above, keep your wallets offline until you’re sure, and stay tuned to official channels.

Frequently Asked Questions

Is there an official RBT airdrop happening right now?

No. As of October2025 there is no verified announcement from the RBT team. All mentions are speculative.

How can I tell if a claim about an RBT airdrop is a scam?

Look for the five red‑flag signs listed earlier: fee requests, private key requests, unverified private groups, suspicious domains, and lack of a contract address.

What blockchain does RBT run on?

The public data does not specify a blockchain. Most similar tokens use Ethereum or Binance Smart Chain, but without a contract address this remains unknown.

Can I claim RBT tokens now by connecting my wallet to CoinMarketCap?

No. CoinMarketCap is a market data aggregator, not a distribution platform. Any website claiming to let you claim RBT directly from CoinMarketCap is fraudulent.

Should I buy RBT based on the airdrop hype?

Buying a token with no exchange listings, zero volume, and unclear purpose is highly risky. Wait for concrete development updates before allocating funds.

WILMAR MURIEL

When you look at the RBT listing on CoinMarketCap, the first thing that jumps out is the stark absence of any trading activity – a price of $0, zero volume, and a total supply that seems almost comical in its magnitude. This emptiness is a red flag that should prompt anyone to dig deeper before getting excited about a potential airdrop. The fact that the entry is marked as a "preview" tells us the project is still in a very early stage, likely pre‑launch, and therefore not ready to distribute tokens to a community. Without an official website, social media links, or a whitepaper, there is no way to verify the team’s identity or their roadmap. In the crypto world, transparency is the cornerstone of legitimacy; when it’s missing, skepticism is the only rational response. Moreover, the lack of a contract address means you cannot even confirm whether the token exists on a blockchain, let alone whether an airdrop contract is deployed. Scammers love to exploit exactly these gaps, creating fake claim forms that ask for fees or private keys under the guise of “verification.” The checklist included in the post – official announcements, contract transparency, no upfront fees, community verification, and domain matching – should be your north star in evaluating any claim. If a supposed RBT airdrop asks you to send even a tiny amount of ETH, that is a textbook phishing move. Additionally, remember that legitimate airdrops never require you to share your seed phrase; the only thing you ever need to provide is a wallet address you control. The proliferation of rabbit‑themed tokens, like RBTC and RAB, demonstrates that the cute branding can be a double‑edged sword: it attracts attention but also adds confusion, making it easier for impostors to ride on the coattails of a genuine project. Until the RBT team publishes a verified Twitter or Telegram post with a contract address, treat every airdrop rumor as unverified speculation. Finally, keep your crypto holdings insulated – use a non‑custodial wallet, enable hardware wallet protection if possible, and never click on suspicious links that lead you to .xyz or .tk domains. In short, the combination of zero market data, missing infrastructure, and high‑risk tactics makes the current RBT airdrop chatter more likely a scam than an opportunity.